Musk's Vision of a Future Without Mandatory Work Ignites Discussions on the Practicality of AI and Social Disparities

- Elon Musk predicts work will become optional in 10-20 years as AI/robotics render traditional labor obsolete, comparing future employment to leisure activities. - Tesla aims for 80% of its value to derive from Optimus robots, while economists question scalability challenges and decreasing returns in robotics adoption. - AI-driven sectors like Energy Management Systems are projected to grow rapidly, but face high costs and integration barriers for small businesses. - Critics warn Musk's vision risks exace

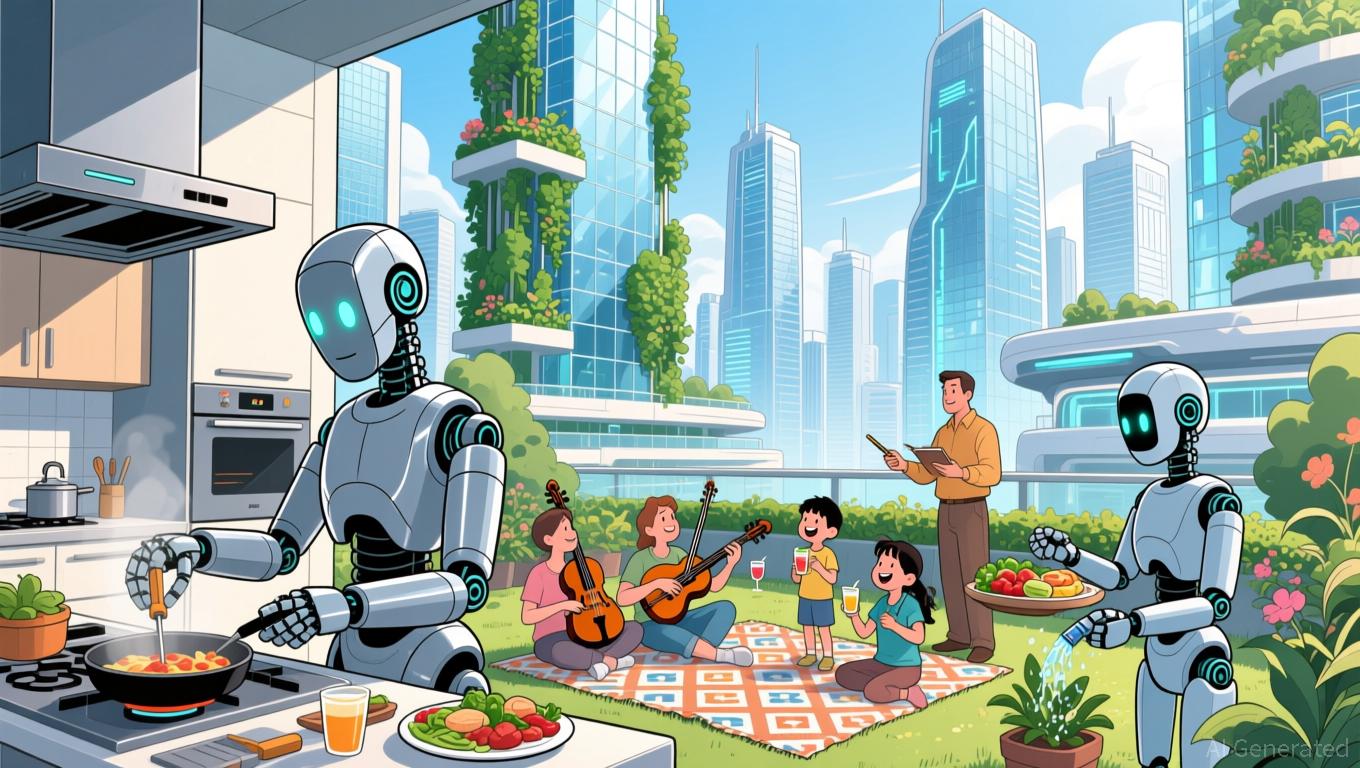

Elon Musk has forecasted that within the next decade or two, employment will become a matter of personal preference and financial concerns will diminish, all due to rapid progress in artificial intelligence (AI) and robotics. During his appearance at the U.S.-Saudi Investment Forum in Washington, D.C., the

Musk’s outlook is based on a world where countless robots take over physically demanding jobs, driving productivity so high that people can work for pleasure rather than for survival. His $470 billion company, Tesla,

The idea of a future where scarcity is eliminated and money becomes obsolete is inspired by science fiction writer Iain M. Banks’ Culture series, which

Major corporations are also evolving. C3.ai, a top provider of AI solutions for businesses,

Critics say Musk’s optimistic outlook ignores significant social and political barriers. Anton Korinek, an economist at the University of Virginia, cautions that a society where work is optional could disrupt social bonds,

As discussions about AI’s broader effects continue, Musk’s forecasts remain at the center of attention. Whether his vision of a society beyond work becomes reality will hinge not only on technological breakthroughs but also on tackling inequality and redefining human roles in an automated world

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: MSCI's Index Decision May Change MicroStrategy's Classification, Potentially Weakening Bitcoin's Integration into Mainstream Finance

- JPMorgan warns MSCI excluding MicroStrategy from indices could trigger $11.6B in outflows, threatening its Bitcoin-linked valuation. - Strategy's stock now trades at 0.90x Bitcoin holdings (vs. 2.7x last year), reflecting index exclusion concerns over its 56% BTC portfolio. - MSCI evaluates if firms with >50% digital assets should stay in benchmarks, with decision due Jan 15 that could reclassify Strategy as an investment fund. - Active managers face reputational risks if Strategy is delisted, while its

Ethereum News Update: Major Ethereum Holder Changes Strategy, Acquires $162 Million in ETH Amid Anticipated Fed Rate Reduction

- Ethereum whale accumulates $162M in ETH, boosting total holdings to 432,718 ETH ($1.36B), signaling potential market sentiment shift. - Strategy shifts from shorting to accumulating, with recent Aave V3 deposits and Binance transfers reflecting DeFi-driven liquidity tactics. - Actions align with Fed rate cut speculation (39.6% probability) and contrast with other whales' profit-taking from short positions. - Whale's 0.2% ETH market share highlights institutional crypto positioning diversity, as DeFi plat

Why these entrepreneurs swapped social media advertising for Taylor Swift shows and prison tablets