Zcash (ZEC) Rips While Bitcoin Dips — Can This Privacy Coin Run 49% Higher

ZEC is gaining momentum as privacy demand grows and liquidation pressure builds for short sellers. Traders now eye a push toward $1,000.

Zcash has seen a strong surge in recent weeks as demand for privacy coins grows across the market. ZEC’s rise stands out due to its limited correlation with Bitcoin, allowing it to perform independently during periods of volatility.

This unique behavior has fueled renewed interest and helped strengthen ZEC’s upward momentum.

Zcash Is Independent

Zcash’s correlation with Bitcoin currently sits at -0.78, signaling a strong negative relationship. This means ZEC is moving in the opposite direction of BTC, which is highly beneficial at a time when Bitcoin is trading near $90,000 after several days of decline. ZEC’s ability to decouple from BTC enables it to avoid broader market pullbacks.

This negative correlation has remained intact since early November, reinforcing ZEC’s resilience. As long as the correlation stays below zero, Zcash will be less vulnerable to Bitcoin-driven sell-offs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

ZEC Correlation With Bitcoin. Source:

TradingView

ZEC Correlation With Bitcoin. Source:

TradingView

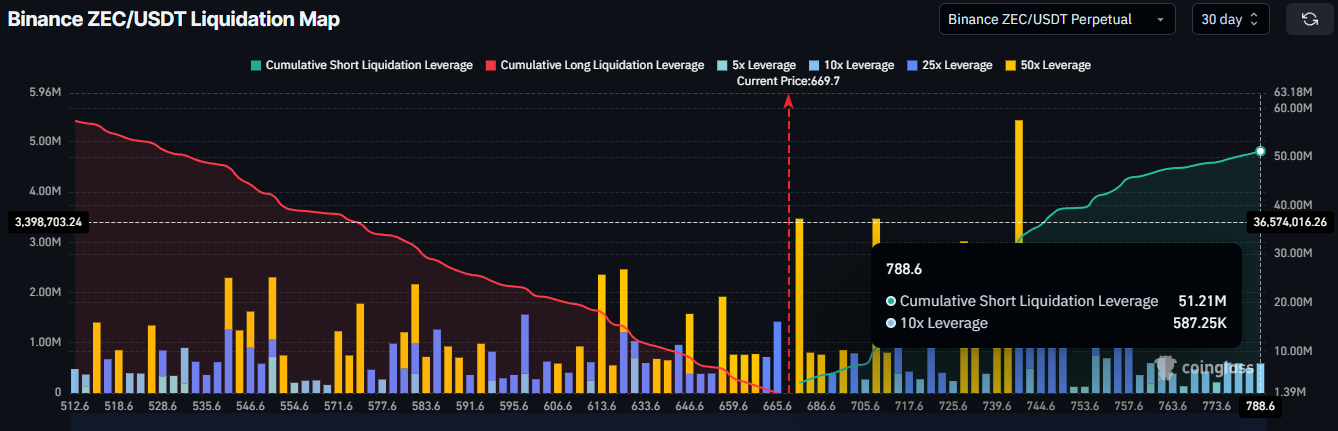

Macro indicators also suggest favorable conditions. Zcash’s liquidation map reveals that short sellers should approach the market with caution. If ZEC climbs to $788, roughly $51 million worth of short positions could be liquidated. This creates an additional incentive for traders to avoid bearish strategies.

Large liquidation clusters often discourage short positions and can fuel further upside as forced liquidations amplify price movement. For ZEC, reaching these levels would disrupt bearish sentiment and provide additional support for continued appreciation.

Zcash Liquidation Map. Source:

Coinglass

Zcash Liquidation Map. Source:

Coinglass

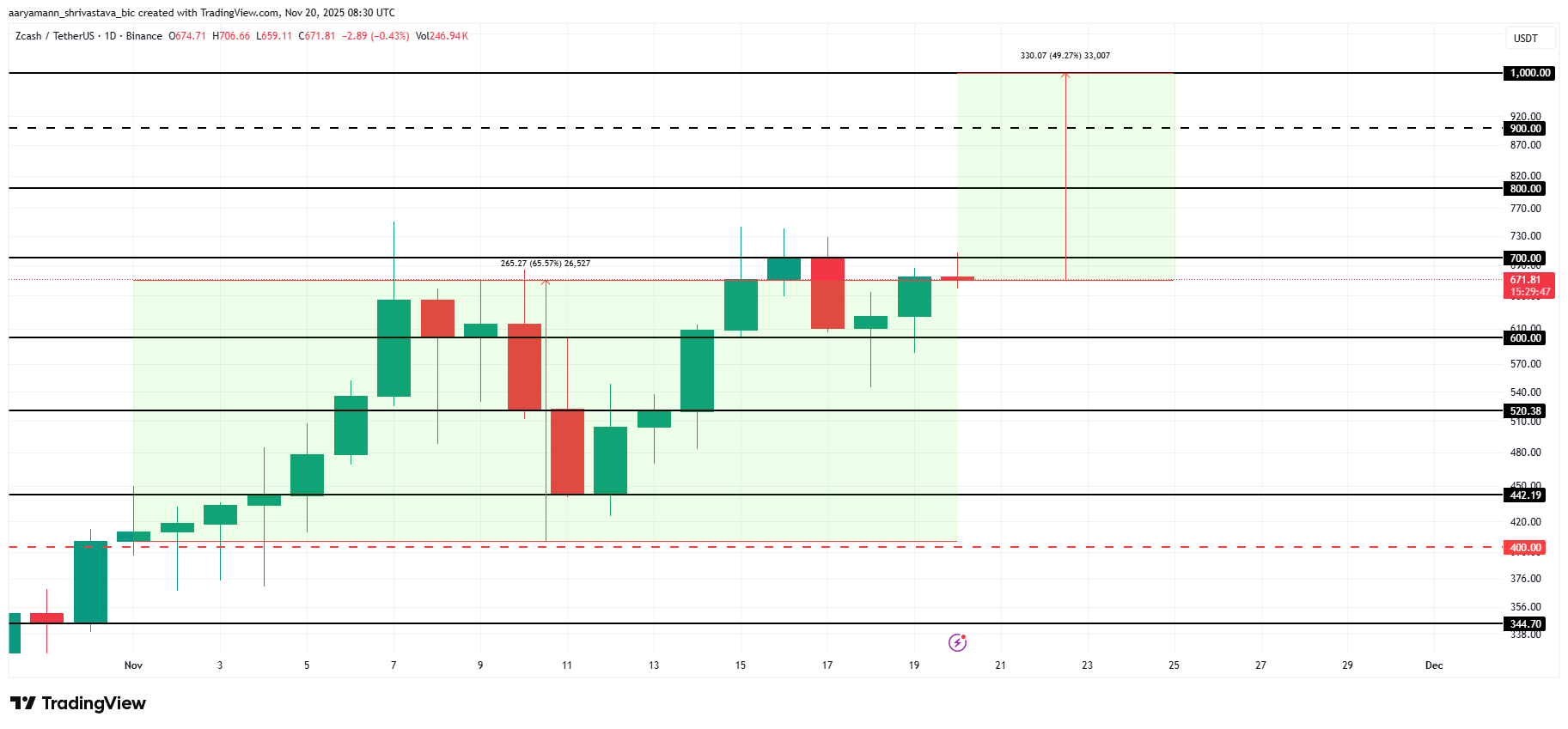

ZEC Price Has A Lot Of Room To Grow

Zcash trades at $671, sitting just below the $700 resistance level. The altcoin has gained 65.5% since the start of the month. This reflects strong market participation and growing interest from both retail and institutional traders.

If momentum continues, ZEC could rise toward $1,000, which sits 49% above current levels. Achieving this target within 10 days is possible if investor support remains consistent. To reach $1,000, ZEC must first break through and convert the $700, $800, and $900 levels into support.

ZEC Price Analysis. Source:

TradingView

ZEC Price Analysis. Source:

TradingView

However, if selling pressure increases, ZEC could lose momentum and fall to $600. A deeper correction may push the price toward $520, invalidating the current bullish thesis, leaving the altcoin vulnerable to a crash.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Faces Dilemma Balancing Inflation Management and Job Market Stability Ahead of December Decision

- The Fed faces divided views on December rate cuts amid 39.6% odds of a 25-basis-point reduction versus 60.4% no-change probability. - Officials weigh inflation (3% vs 2% target) against resilient labor market (119,000 September jobs), complicating dual mandate balancing. - Bitcoin volatility ($81,629) and equity market jitters reflect uncertainty, with leveraged crypto positions facing margin pressures. - Corporate debt issuance for AI infrastructure and delayed economic reports heighten borrowing cost r

Bitcoin News Update: Major Investors Balance the Opportunities and Risks of Cryptocurrency

- BlackRock and institutional investors cautiously navigate Bitcoin/stablecoin adoption, balancing innovation with regulatory and volatility risks. - Stablecoins processed $9 trillion in 2025 payments, driven by cross-border efficiency and U.S. Treasury's GENIUS Act regulatory framework. - BlackRock manages Circle's $200B stablecoin reserves while enabling U.S. banks to hold crypto under OCC guidelines for controlled experimentation. - Hybrid financial systems emerge as Deutsche Börse and JPMorgan integrat

Kite’s Initial Public Offering Debut and Subsequent Price Fluctuations: Evaluating Immediate Risks and Future Growth Opportunities for Long-Term Investors

- Zerodha Kite's unconfirmed 2025 IPO status raises investor uncertainty amid mixed FY25 financial results showing 22.9% profit decline but strong liquidity reserves. - Brokerage revenue dropped 40% Q2 2025 due to industry-wide slowdown, highlighting Zerodha's vulnerability to macroeconomic shifts and regulatory pressures. - Crypto market volatility (e.g., MSTR's 60% share drop) underscores indirect risks for Zerodha if expanding into crypto trading or facing regulatory scrutiny in this space. - Long-term

Why the Crypto Crash on Oct 10 Was No Accident...