Bitcoin Updates: The Crypto Market Splits—Bitcoin ETFs See Outflows While Altcoin Enthusiasts Seek Returns and New Developments

- Bitcoin ETFs lost $3B in November, with BlackRock’s IBIT seeing $523M outflow as prices fell below $90K. - Bitwise’s Solana and XRP ETFs gained $580M and $420M inflows, offering staking rewards and cross-border payment exposure. - Institutional investors repositioned capital, shorting 53% of Bitcoin while Ethereum retained 55% long positions. - Analysts highlight altcoin ETFs’ yield advantages, but warn of Bitcoin’s liquidity risks and XRP’s weak derivatives market. - Market divergence reflects crypto-na

The cryptocurrency sector is currently experiencing a sharp divide in trends as

BlackRock's

In contrast, Bitwise’s

This divergence in fund flows signals a broader shift among sophisticated investors. Large holders, or "whales," are increasingly betting against Bitcoin, with 53% of their positions now short, while

Experts attribute the popularity of altcoin ETFs to their distinctive advantages. Bitwise’s Solana ETF combines staking rewards with price exposure, providing investors with a product that enhances yield.

However, risks remain. Bitcoin’s recent dip below $90,000 has raised concerns about liquidity,

With the end of the year approaching,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: VanEck Issues Bitcoin an Ultimatum—Adopt Quantum-Resistant Privacy or Face Withdrawal

- VanEck CEO warns firm may exit Bitcoin if quantum computing threatens its encryption and privacy model. - Privacy coins like Zcash gain traction as alternatives, using zero-knowledge proofs to address Bitcoin's transparency risks. - Quantum-resistant crypto market grows rapidly, with IBM-Cisco quantum internet project and PQC sector projected to reach $2.84B by 2030. - Regulatory shifts and institutional investments in altcoins signal evolving crypto landscape amid security and privacy challenges.

Bitcoin Updates: Stimulus Fails to Curb Crypto Fluctuations; Uncertainty Over Hedging Function

- Japan's $135B stimulus package failed to curb Bitcoin's decline below $85,500 amid heightened market volatility. - Analysts debate crypto's role as an inflation hedge, with Fundstrat's Tom Lee framing it as a leading indicator for U.S. stocks. - Brazilian firm Rental Coins' $370M BTC collapse highlights sector fragility, filing Chapter 15 bankruptcy to recover assets. - Security threats persist in DeFi, with Aerodrome Finance's front-end attack and Coinbase's routine wallet migrations underscoring risks.

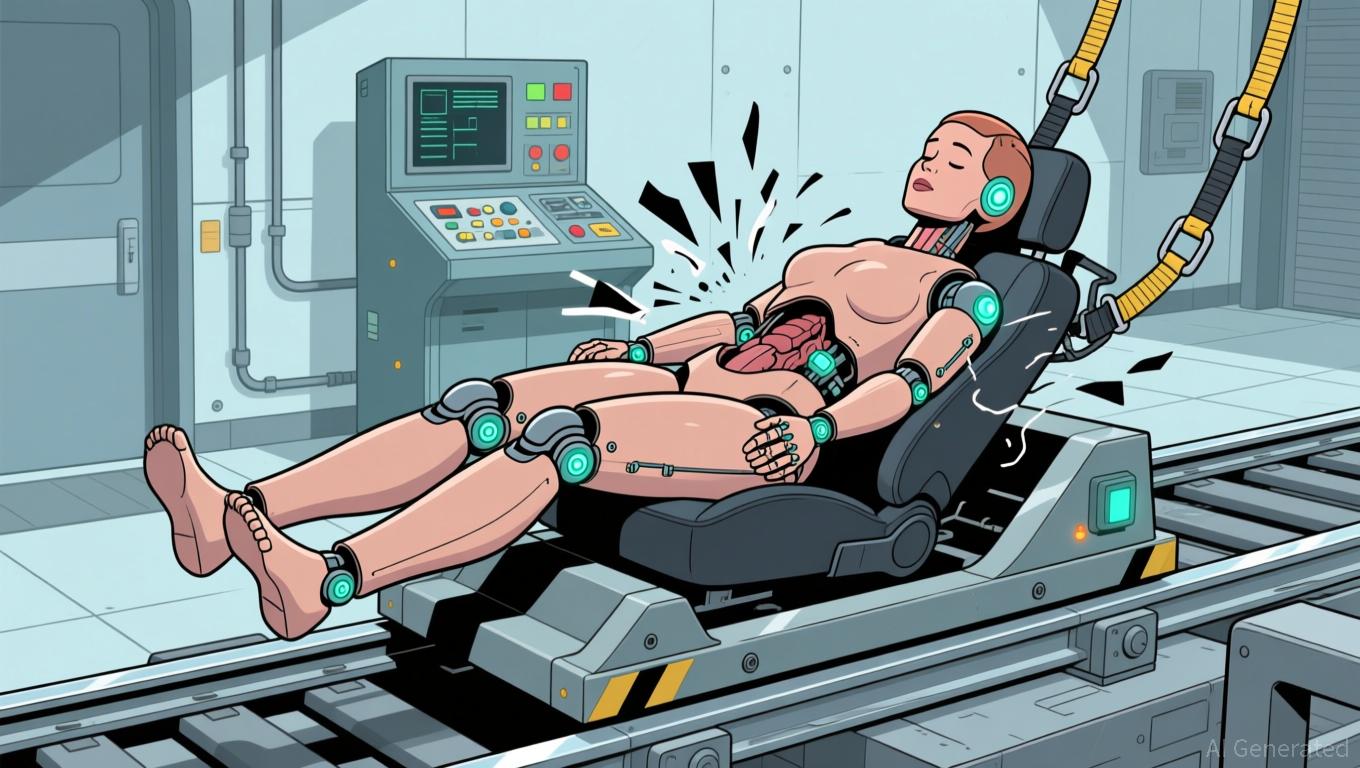

Polkadot News Today: "U.S. Requires Female Crash-Test Dummies to Tackle Longstanding Gender Inequality in Safety Engineering"

- U.S. DOT mandates female crash-test dummies in federal safety testing by 2027-2028 to address gender bias in vehicle design. - THOR-05F, representing average adult women, replaces outdated 1970s models that left women 73% more likely to suffer serious injuries in crashes. - NHTSA emphasizes scientific validation for the 150-sensor dummy, while automakers and IIHS express skepticism about current safety standards. - Advocacy groups praise the move as critical for closing safety gaps, but activists warn de

Assessing the Factors Behind COAI's Significant Price Drop in Late November 2025 and Its Long-Term Impact on Investment

- COAI's 88% year-to-date plunge in late 2025 exposed systemic risks in AI/crypto markets, driven by governance failures, regulatory ambiguity, and overvaluation. - C3.ai's $116.8M loss, leadership turmoil, and lawsuits triggered panic, while the CLARITY Act's vague oversight deepened institutional investor caution. - The selloff highlighted a stark divide between foundational AI tech and speculative crypto assets, with analysts warning against conflating sector-wide risks with isolated failures. - Long-te