Bitcoin News Update: Aave's ETHLend 2.0 Disrupts DeFi's Dependence on Wrapped Tokens by Introducing Native Bitcoin

- Aave founder Stani Kulechov announced ETHLend 2.0's 2026 relaunch using native Bitcoin as collateral, diverging from wrapped tokens. - The hybrid P2P-liquidity pool model aims to enhance DeFi efficiency while reducing synthetic asset reliance through cross-chain BTC integration. - This revival aligns with growing institutional demand for non-wrapped BTC and could restore utility for the legacy LEND token. - Despite bearish market conditions, the move signals confidence in Bitcoin's foundational role for

Stani Kulechov, the founder of Aave, has announced that ETHLend—the project’s original peer-to-peer lending platform—will be revived in 2026 with a major update:

ETHLend, which became known as

The DeFi sector has responded with both nostalgia and intrigue. Old screenshots of ETHLend’s 2018 interface have resurfaced on social media, showcasing the project’s journey from a small-scale P2P initiative to a major DeFi ecosystem.

Although the focus is on ETHLend’s return, the overall crypto market remains in a downturn.

This revival highlights Aave’s intention to move beyond just liquidity pools and broaden its product lineup. While it’s still uncertain whether ETHLend 2.0 will be a standalone platform or integrated with Aave, the renewed focus on P2P lending suggests it will complement Aave’s current offerings. This could appeal to users who prefer direct counterparty relationships, a need not fully met by automated market makers.

As DeFi continues to develop, bringing back ETHLend with native Bitcoin support puts Aave in a strong position to attract both long-time users and new institutional participants. With 2026 approaching, the industry will be watching closely to see how this hybrid approach balances fresh innovation with the efficiency that made Aave a leader in the space.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: VanEck Issues Bitcoin an Ultimatum—Adopt Quantum-Resistant Privacy or Face Withdrawal

- VanEck CEO warns firm may exit Bitcoin if quantum computing threatens its encryption and privacy model. - Privacy coins like Zcash gain traction as alternatives, using zero-knowledge proofs to address Bitcoin's transparency risks. - Quantum-resistant crypto market grows rapidly, with IBM-Cisco quantum internet project and PQC sector projected to reach $2.84B by 2030. - Regulatory shifts and institutional investments in altcoins signal evolving crypto landscape amid security and privacy challenges.

Bitcoin Updates: Stimulus Fails to Curb Crypto Fluctuations; Uncertainty Over Hedging Function

- Japan's $135B stimulus package failed to curb Bitcoin's decline below $85,500 amid heightened market volatility. - Analysts debate crypto's role as an inflation hedge, with Fundstrat's Tom Lee framing it as a leading indicator for U.S. stocks. - Brazilian firm Rental Coins' $370M BTC collapse highlights sector fragility, filing Chapter 15 bankruptcy to recover assets. - Security threats persist in DeFi, with Aerodrome Finance's front-end attack and Coinbase's routine wallet migrations underscoring risks.

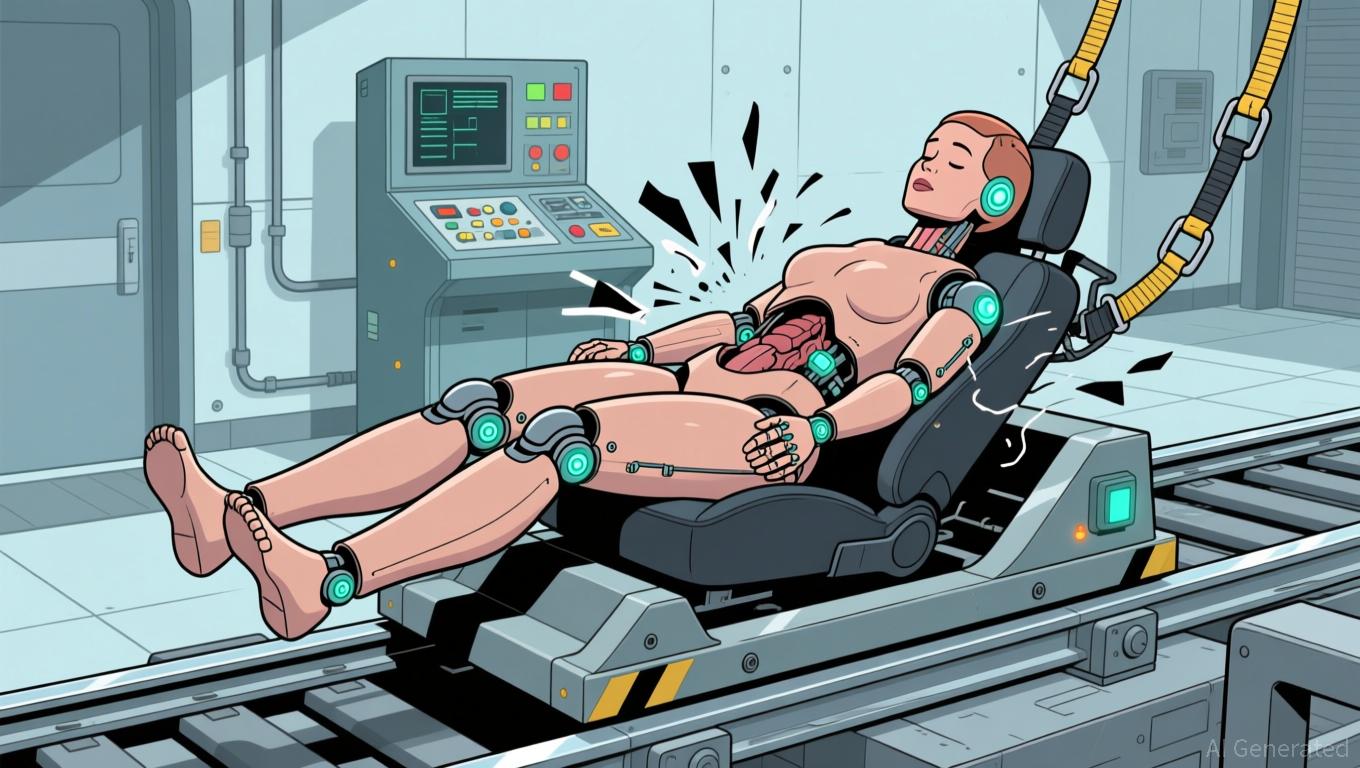

Polkadot News Today: "U.S. Requires Female Crash-Test Dummies to Tackle Longstanding Gender Inequality in Safety Engineering"

- U.S. DOT mandates female crash-test dummies in federal safety testing by 2027-2028 to address gender bias in vehicle design. - THOR-05F, representing average adult women, replaces outdated 1970s models that left women 73% more likely to suffer serious injuries in crashes. - NHTSA emphasizes scientific validation for the 150-sensor dummy, while automakers and IIHS express skepticism about current safety standards. - Advocacy groups praise the move as critical for closing safety gaps, but activists warn de

Assessing the Factors Behind COAI's Significant Price Drop in Late November 2025 and Its Long-Term Impact on Investment

- COAI's 88% year-to-date plunge in late 2025 exposed systemic risks in AI/crypto markets, driven by governance failures, regulatory ambiguity, and overvaluation. - C3.ai's $116.8M loss, leadership turmoil, and lawsuits triggered panic, while the CLARITY Act's vague oversight deepened institutional investor caution. - The selloff highlighted a stark divide between foundational AI tech and speculative crypto assets, with analysts warning against conflating sector-wide risks with isolated failures. - Long-te