Solana Considers Cutting $3 billion in SOL Emissions in its Biggest Economic Shift Yet

The proposed Solana disinflation plan would compress staking yields and could render up to 47 validators unprofitable, raising questions about future network consolidation.

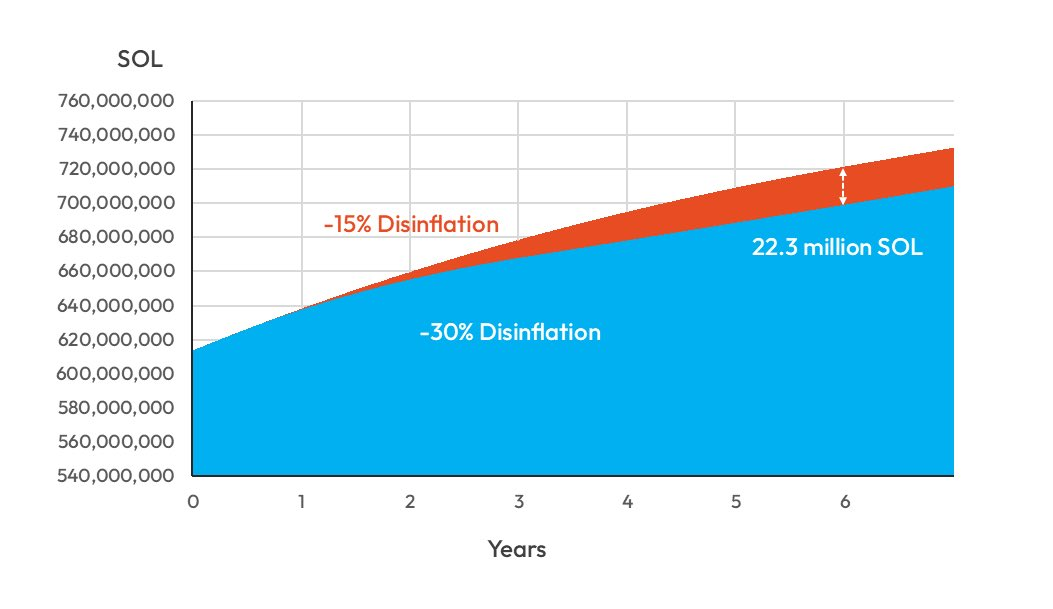

Solana is weighing a radical shift in its economic model that would eliminate approximately 22.3 million SOL ($2.9 billion) from projected emissions over the next six years.

As a result, the proposal would aggressively fast-track the transition of the blockchain to a low-inflation environment.

Solana’s Plan to Tighten Supply Risks Squeezing Nearly 50 Validators

The measure, formally titled SIMD-0411, proposes doubling the Solana network’s annual disinflation rate from 15% to 30%.

“Doubling the disinflation rate requires modifying a single parameter, making it the simplest possible protocol change that delivers a meaningful reduction in inflation. This adjustment will not consume core developer resources. It carries minimal risk of introducing bugs or unforeseen edge cases,” the authors argued.

If passed, Solana would hit its “terminal” inflation target of 1.5% in roughly three years, ie, by 2029. Notably, that milestone was originally scheduled for 2032.

Proponents describe the current emissions schedule as a “leaky bucket” that continually dilutes holders and creates persistent sell pressure.

By tightening supply, the network hopes to emulate the scarcity mechanics that have historically benefited Bitcoin and Ethereum.

“Our modeling indicates that, over the next 6 years, total supply would be approximately 3.2% lower (a reduction of 22.3 million SOL) than under the current inflation schedule. At today’s SOL price, this equates to roughly $2.9 billion in reduced emissions. Excessive emissions create persistent downward price pressure, distorting market signals and hindering fair price comparison,” they wrote.

Solana’s Disinflation Proposal. Source: Solana Floor

Solana’s Disinflation Proposal. Source: Solana Floor

Beyond price support, the plan seeks to overhaul the incentive structure for decentralized finance (DeFi).

Moreover, the proposal argues that high inflation mirrors high interest rates in traditional finance, raising the “risk-free” benchmark and discouraging borrowing.

Considering this, Solana aims to push capital out of passive validation and into active liquidity provision by compressing nominal staking yields. Those yields are projected to fall from 6.41% to 2.42% by the third year.

Solana’s Staking Reward and Inflation Rate. Source:

Staking Rewards

Solana’s Staking Reward and Inflation Rate. Source:

Staking Rewards

However, this “hard money” pivot carries operational risks.

The reduction in subsidies will inevitably squeeze validator margins.

The proposal estimates that up to 47 validators could become unprofitable within three years as rewards dry up. However, the authors describe this level of churn as minimal.

Still, it raises questions about whether the network will consolidate around larger, better-capitalized operators that can survive on transaction fees alone.

Despite these concerns, early backing from key ecosystem players suggests Solana is prepared to trade subsidized growth for greater stability. The shift reflects a move toward positioning the network as a more mature, scarcity-driven asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Kite’s Initial Public Offering Debut and Subsequent Price Fluctuations: Evaluating Immediate Risks and Future Growth Opportunities for Long-Term Investors

- Zerodha Kite's unconfirmed 2025 IPO status raises investor uncertainty amid mixed FY25 financial results showing 22.9% profit decline but strong liquidity reserves. - Brokerage revenue dropped 40% Q2 2025 due to industry-wide slowdown, highlighting Zerodha's vulnerability to macroeconomic shifts and regulatory pressures. - Crypto market volatility (e.g., MSTR's 60% share drop) underscores indirect risks for Zerodha if expanding into crypto trading or facing regulatory scrutiny in this space. - Long-term

Why the Crypto Crash on Oct 10 Was No Accident...

Bitcoin News Today: Solo Miner Beats 1-in-180M Odds to Win $265K Bitcoin Jackpot

- A hobbyist Bitcoin miner using a 6 TH/s setup defied 1-in-180 million odds to earn $265,000 via CKpool's solo mining platform. - The win marked CKpool's 308th solo block since 2014, with the miner's hash rate representing 0.0000007% of Bitcoin's 855 EH/s network. - The achievement highlights Bitcoin's decentralization, as solo miners maintain security despite industrial dominance and bear market conditions. - CKpool's 2% fee model allows solo miners to retain nearly full block rewards, contrasting with t

Bitcoin Updates: Major Investors Adjust Holdings Amid $2.1 Billion Outflow from Bitcoin ETFs

- BlackRock's IBIT Bitcoin ETF recorded a $523M single-day outflow on Nov 19, marking its fifth consecutive day of redemptions totaling $2.1B this month. - Bitcoin fell below $90,000 (-30% from October peak) as ETF outflows and macroeconomic uncertainty triggered institutional risk mitigation strategies. - Analysts cite profit-taking, Fed policy uncertainty, and weak macro signals as drivers, with Bitcoin ETFs accounting for 70% of $3.79B in U.S. crypto ETF outflows. - While Ethereum and altcoins like Sola