Bitcoin Slide Leaves Over 70% of Active capital in Losses as Sentiment Collapses

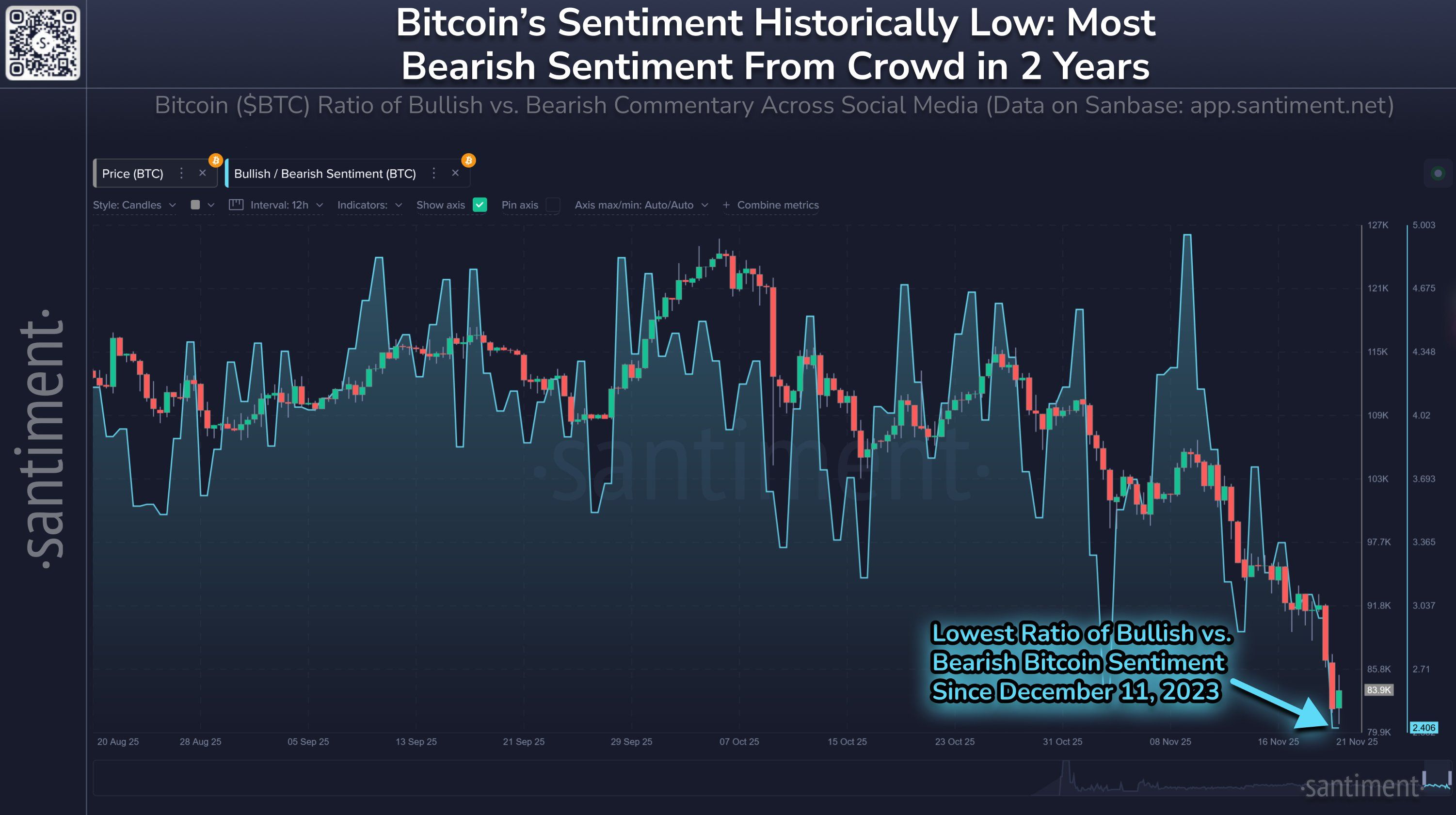

Social media data from shows that retail sentiment for Bitcoin has sunk to its lowest level since December 2023, with capitulation and panic selling reaching two-year highs.

Bitcoin’s recent drop toward $80,000 has driven most active capital in the asset into losses, signaling a shift in market conditions for the world’s largest cryptocurrency.

Bitcoin has erased nearly 35% from its October peak of about $126,000 after sinking to a seven-month low. As a result, it is now generating one of the largest waves of unrealized losses this cycle.

Over 70% of US Dollars Invested in Bitcoin is in Loss

According to data from on-chain analytics firm Checkonchain, the price rout has forced more than 70% of the capital allocated to Bitcoin underwater.

Bitcoin analyst James Check explains that 71.2% of the network’s realized capitalization carries a cost basis of at least $86,500. This metric prices each coin in the circulating supply at the value it last moved on-chain.

This chart shows the USD value of every coin in the Bitcoin supply priced when it last transacted onchain.Think of this as our collective invested cost basis.Over 70% of the USD invested in Bitcoin is now underwater.

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) November 21, 2025

Thus, it effectively represents the aggregate entry price for the market’s active investors.

So, with Bitcoin recently tumbling below that critical waterline, a flood of buyers who entered during the late-2024 and early-2025 rallies now face mounting losses. Many of these investors are effectively trapped in positions that no longer break even.

This heavy concentration of volume near the highs indicates that short-term holders are experiencing acute stress. It is forcing their Net Unrealized Profit and Loss metrics to collapse to cycle lows.

Bitcoin Market Sentiment Reaches 2-Year Low

Meanwhile, this fracture in the broader market structure is further corroborated by Glassnode data.

The firm’s Relative Unrealized Loss indicator, which tracks the dollar value of coins held below their acquisition price relative to total market capitalization, has spiked to 8.5%. In a typical, healthy bull market, this metric generally remains below 5%.

The Relative Unrealized Loss in the market is now trading at 8.5%. 📉

— glassnode (@glassnode) November 21, 2025

So, the current breach suggests that the drawdown represents a significant “market reset” of the asset’s ownership base rather than a standard volatility correction.

While prices have staged a modest recovery to the $84,543 level at press time, the psychological damage to the retail sector appears severe.

Social media sentiment has cratered to its lowest point since December 2023, according to blockchain analytics platform Santiment.

The firm said its analysis of social media commentary across X, Reddit, and Telegram shows that retail traders are capitulating and panic-selling at levels unseen in two years.

Bitcoin Social Media Sentiment. Source:

Santiment

Bitcoin Social Media Sentiment. Source:

Santiment

Historically, such extreme levels of bearishness often act as a contrarian signal, suggesting that the market may be clearing out weak hands in preparation for a local bottom.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ICP Caffeine AI Boom: Exploring How the Integration of AI and Blockchain is Transforming Early-Stage Investment Environments

- ICP Caffeine AI's token surged 45% to $5.20 in Nov 2025, driven by its decentralized AI platform enabling app creation from text/image/code prompts. - The platform reduces AI inference costs 20-40% via "chain-of-chains" architecture and reverse-gas model, challenging centralized cloud providers with scalable, censorship-resistant compute. - Despite $237B TVL growth in Q3 2025, 22.4% dApp activity decline highlights adoption challenges, while market fragmentation and sector volatility test its long-term v

Exodus Purchases W3C to Connect Cryptocurrency Assets with Daily Expenditures

- Exodus Movement Inc. agreed to acquire W3C Corp for $175M to integrate card/payment processing into its crypto wallet platform, enabling stablecoin transactions via Visa , Mastercard , and Discover. - The deal aims to create an end-to-end on-chain payment ecosystem by reducing third-party reliance and generating recurring revenue from interchange fees, supported by Exodus's Bitcoin-backed financing. - Projected to close in 2026 after U.S./U.K./EU regulatory approvals, the acquisition follows Exodus's sta

Fed Split Over December Rate Reduction: Employment Concerns Versus Inflation Targets

- Fed President Mary Daly advocates for a December rate cut to preempt sudden U.S. labor market deterioration, prioritizing job market risks over inflation. - Officials like Susan Collins and Christopher Waller show divided stances, with some favoring rate cuts as insurance against weakness while others urge caution to avoid limiting future flexibility. - The debate reflects broader FOMC tensions between stabilizing employment and curbing inflation, amid softer tariff-driven costs and a fragile "low-hiring

Bitcoin News Update: Institutional Giant's 20x Short Position on BTC—$24 Million Profit Hinges on $101,000 Liquidation Point

- A Hyperliquid institutional whale opened a 20x leveraged $113M BTC short, generating $24M in unrealized profits with a $101,641 liquidation threshold. - Bitcoin ETF flows show divergence: $523M BlackRock outflow on Nov 18 contrasted with $238M net inflows on Nov 21 as institutional buyers accumulate amid retail exits. - High-leverage shorts ($105M and $87.58M) risk forced liquidations if BTC rebounds, amplifying volatility risks seen during 2020's margin calls. - Market dynamics highlight tension between