3 Token Unlocks to Watch in the Final Week of November 2025

The crypto market will welcome tokens worth more than $566 million in the final week of November 2025. Several major projects, including Hyperliquid (HYPE), Plasma (XPL), and Jupiter (JUP), will release significant new token supplies. These unlocks might lead to market volatility and influence price movements in the short term. Here’s a breakdown of what

The crypto market will welcome tokens worth more than $566 million in the final week of November 2025. Several major projects, including Hyperliquid (HYPE), Plasma (XPL), and Jupiter (JUP), will release significant new token supplies.

These unlocks might lead to market volatility and influence price movements in the short term. Here’s a breakdown of what to watch for each project.

1. Hyperliquid (HYPE)

- Unlock Date: November 29

- Number of Tokens to be Unlocked: 9.92 million HYPE (0.992% of Total Supply)

- Current Circulating Supply: 270.77 million HYPE

- Total supply: 1 billion HYPE

Hyperliquid is a leading decentralized perpetual futures exchange built on its own Layer-1 blockchain. It offers high-performance trading with low latency, on-chain order books, and also sub-second transaction finality.

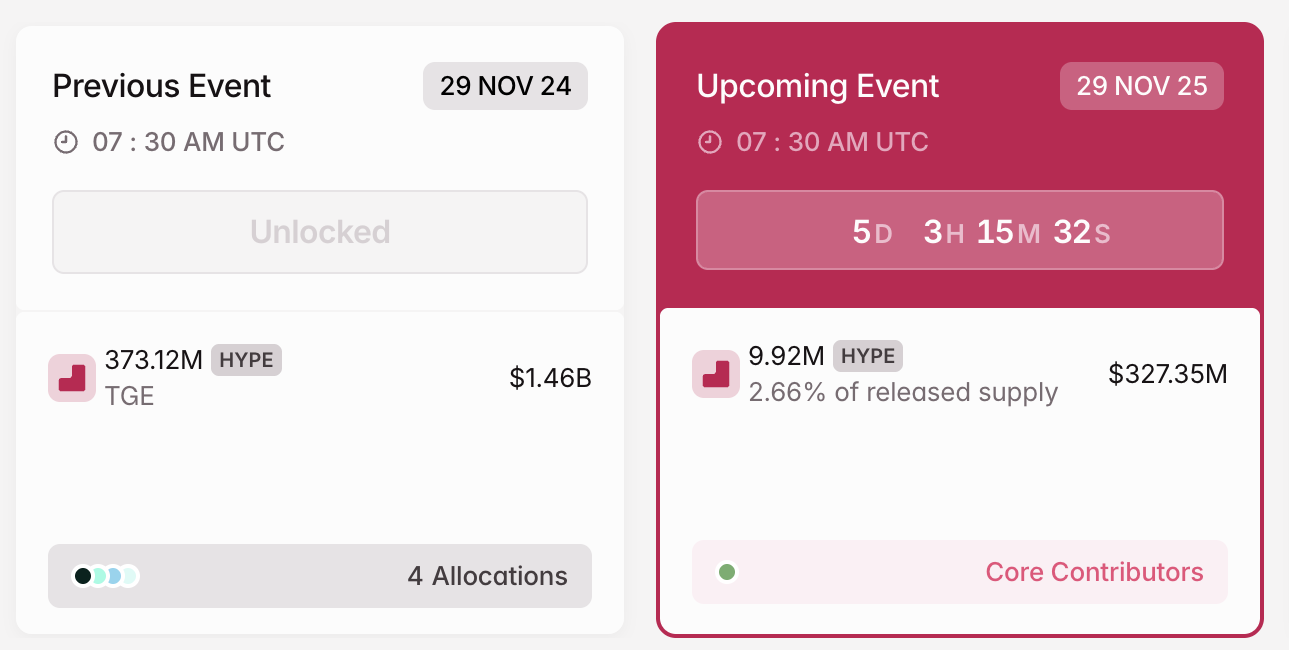

On November 29, the project will release 9.92 million tokens valued at approximately $327.35 million. This accounts for 2.66% of the current released supply.

HYPE Crypto Token Unlock in November. Source:

Tokenomist

HYPE Crypto Token Unlock in November. Source:

Tokenomist

Hyperliquid will distribute all the unlocked tokens among core contributors.

2. Plasma (XPL)

- Unlock Date: November 25

- Number of Tokens to be Unlocked: 88.89 million XPL (0.89% of Total Supply)

- Current Circulating Supply: 1.88 billion XPL

- Total supply: 10 billion XPL

Plasma is a Layer 1 blockchain platform built to enhance the efficiency and scalability of stablecoin transactions. It enables zero-fee USDT transfers, allows the use of custom gas tokens, supports confidential payments, and delivers the throughput required for global-scale adoption.

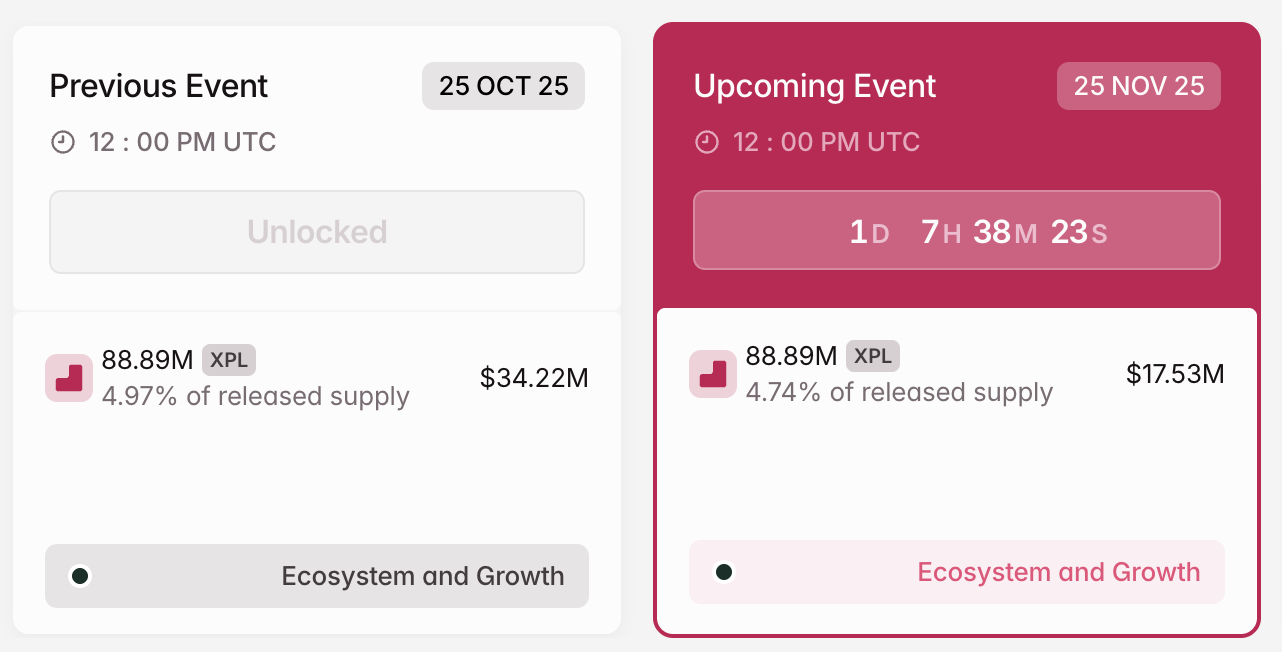

Plasma will unlock 88.89 million XPL on November 25. The tokens are worth $17.53 million. Moreover, they account for 4.74% of the current circulating supply.

XPL Crypto Token Unlock in November. Source:

Tokenomist

XPL Crypto Token Unlock in November. Source:

Tokenomist

The team will direct all of the 88.89 million XPL to the ecosystem and growth.

3. Jupiter (JUP)

- Unlock Date: November 28

- Number of Tokens to be Unlocked: 53.47 million JUP (0.53% of Total Supply)

- Current Circulating Supply: 3.2 billion JUP

- Total supply: 10 billion JUP

Jupiter is a decentralized liquidity aggregator on the Solana (SOL) blockchain. It optimizes trade routes across multiple decentralized exchanges (DEXs) to provide users with the best prices for token swaps with minimal slippage.

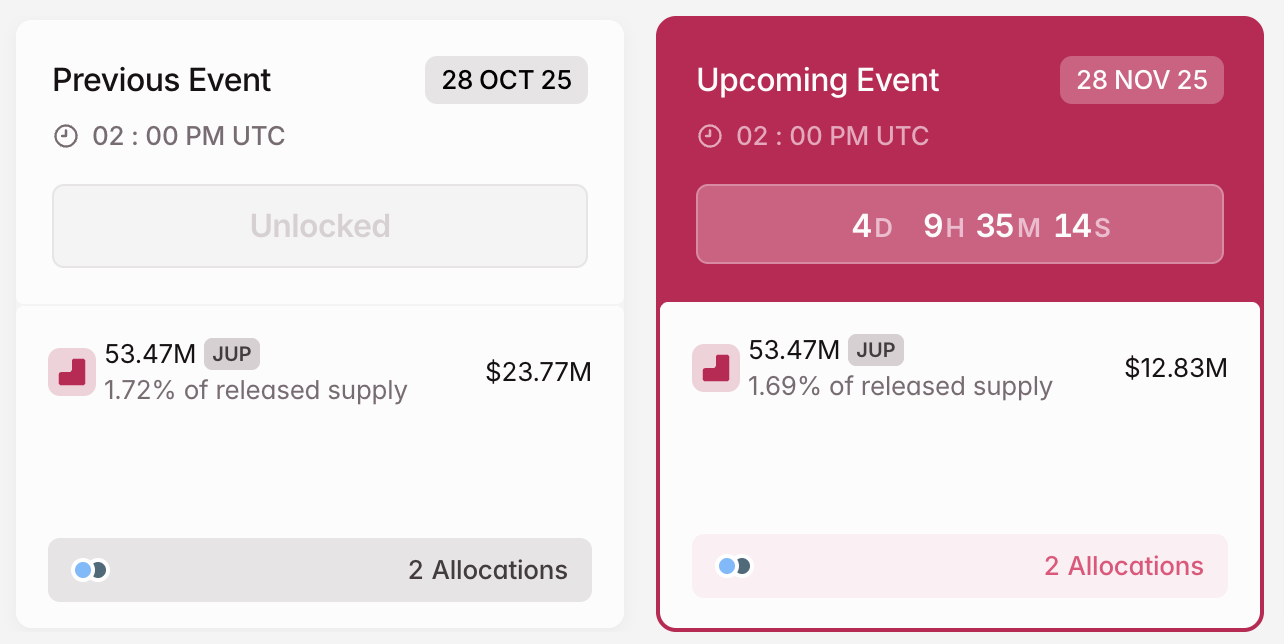

On November 28, Jupiter will unlock 53.47 million JUP tokens. The supply is worth approximately $12.83 million, representing 1.69% of its circulating supply. Furthermore, this unlock follows a monthly cliff vesting schedule.

JUP Crypto Token Unlock in November. Source:

Tokenomist

JUP Crypto Token Unlock in November. Source:

Tokenomist

Jupiter has allocated the tokens primarily to the team, who will get 38.89 million JUP. Furthermore, Mercurial stakeholders will receive 14.58 million JUP altcoins.

In addition to these, other prominent unlocks that investors can look out for in the final week of November include Artificial Superintelligence Alliance (FET), Aerodrome Finance (AERO), IOTA (IOTA), and various altcoins, contributing to the overall market-wide releases.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Upbit's Plans for Nasdaq Listing Encounter Regulatory Challenges Amid South Korea's Stricter Crypto Regulations

- Upbit and Naver merge to form a $13.8B fintech group, aiming for a Nasdaq IPO with potential $34B valuation. - South Korea's FIU intensifies crypto regulation, fining Upbit's Dunamu $25.7M for AML/KYC violations and targeting rivals. - Regulatory scrutiny delays Bithumb's IPO plans as exchanges face strict compliance demands and surprise inspections. - Stricter crypto rules aim to align with traditional finance standards, balancing innovation with institutional trust requirements.

MemeX's Creator Buybacks: Could Community Incentives Bring Order to Meme Coin Chaos?

- MemeX introduces a 2.5% trading fee buyback model to redistribute value to meme coin creators and active traders. - The platform's Creator Rewards Program aims to stabilize volatile markets by linking liquidity provision with creator incentives. - With 2.5 million users and retroactive rewards planned, MemeX challenges traditional fee-capture models in crypto ecosystems. - Critics question if community-driven buybacks can counteract inherent meme coin volatility and speculative trading patterns. - Succes

Ethereum News Update: ECB Focuses on Stability Rather Than Regulation When Evaluating Stablecoin Risks

- ECB maintains stablecoin risks in eurozone remain low despite rising digital asset interest, emphasizing systemic risk management over preemptive regulation. - Lagarde advocates shifting Europe's export-driven model to internal resilience, citing vulnerabilities in supply chains and critical technology dependencies. - ECB's 2026 rate stability stance aligns with Japan's 21.3T yen stimulus, stabilizing EUR/JPY at 181.40 while monitoring crypto market volatility. - Ethereum faces short-term headwinds but r

Ethereum Updates Today: BitMine's Digital Currency Dilemma: Could This Be a Bretton Woods Turning Point for U.S. Financial Markets?

- BitMine Immersion (BMNR) challenges Coinbase's crypto dominance with $11.2B reserves and 3.63M Ethereum holdings. - Regulatory shifts like GENIUS Act and SEC's Project Crypto create competitive frameworks, paralleling 1971 Bretton Woods reforms. - BMNR's $1.6B 5-day trading volume and Wynn Las Vegas shareholder meeting signal growing market influence. - Global stablecoin expansion (QCAD, Bitkub) and Ethereum staking strategies intensify competition for U.S. crypto leadership.