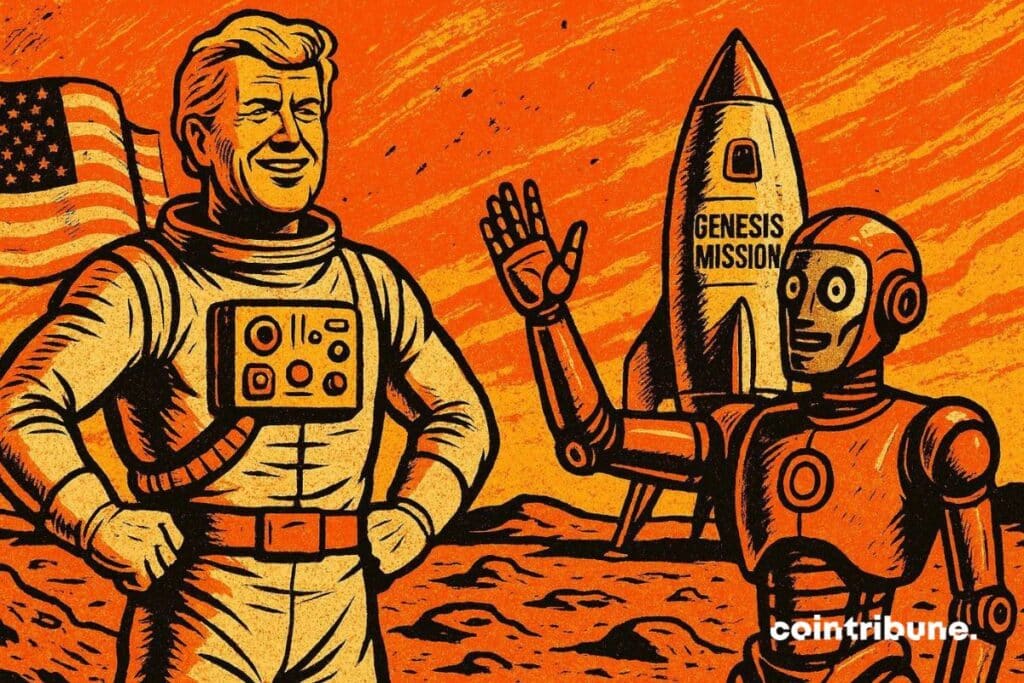

Trump Signs "Genesis Mission" Order to Boost AI Innovation in the United States

On November 24, 2025, Donald Trump signed an executive order launching the “Genesis Mission“, an ambitious federal project to accelerate research in artificial intelligence (AI). Compared to the Apollo program, this initiative aims to position the United States as the global leader in technological innovation. What are its objectives, key players, and implications for the future?

In brief

- Donald Trump signs the “Genesis Mission” executive order to accelerate AI research in the United States.

- The Genesis Mission relies on public-private partnerships with companies such as Nvidia, AMD, and AWS.

- The initiative could indirectly benefit AI-related cryptocurrencies, while creating new challenges for Bitcoin.

The “Genesis Mission“: a federal revolution for AI by Trump

The “Genesis Mission” is a federal initiative aiming to centralize American scientific resources to stimulate advances in artificial intelligence (AI). Led by the Department of Energy, the decree signed by Donald Trump foresees the creation of a digital platform integrating:

- supercomputers;

- federal data sets;

- research infrastructures.

The objective is clear: accelerate discoveries in strategic fields such as energy, national security, and semiconductors.

To achieve this, the Trump administration relies on partnerships with tech giants. Nvidia, AMD, and AWS have already announced massive investments, such as Amazon’s $50 billion commitment for AI-dedicated data centers. This public-private collaboration recalls great federal programs of the past, like the Manhattan Project or the space race.

The platform, named “American Science and Security Platform“, must demonstrate operational capability within nine months. It will allow researchers to access advanced modeling tools and unprecedented computing resources. All this while ensuring the protection of sensitive data.

AI and crypto: a winning duo for the US economy?

The alliance between AI and blockchain could become a pillar of technological innovation in the United States. Indeed, the “Genesis Mission” decree signed by Donald Trump emphasizes areas where blockchain can play a key role. Notably, data security and process automation. Smart contracts, for example, could optimize energy resource management, while decentralized ledgers would ensure research traceability.

For the crypto sector, this synergy represents an opportunity. Projects integrating AI tools, such as Fetch.ai or SingularityNET, could benefit from increased visibility and federal support. Growing AI adoption in government infrastructures could also encourage more favorable regulation for cryptocurrencies, strengthening their legitimacy. However, this dynamic will depend on the crypto players’ ability to meet federal requirements, especially regarding cybersecurity and compliance.

The dangers of the “Genesis Mission”: is Trump turning his back on bitcoin?

The “ Genesis Mission ” could propel AI cryptos to the forefront, relegating bitcoin to a secondary role. Projects combining blockchain and artificial intelligence align better with federal priorities than BTC, which is often seen as a simple store of value. Massive investments in AI, like those by AWS, could marginalize the crypto queen, less integrated into government initiatives.

However, bitcoin retains major assets: its status as a safe haven asset and increasing adoption by institutions (ETFs, state reserves) could limit its decline. Lastly, this initiative raises questions about the centralization of infrastructures, contrary to the decentralized ethos of cryptos, and about the environmental impact of data centers.

Donald Trump’s “Genesis Mission” could redefine technological and economic balances in the United States. While it offers unprecedented opportunities for AI cryptos, it also poses challenges in terms of regulation and environmental impact… A ticking time bomb for the climate . In your opinion, will this strategy manage to reconcile innovation and decentralized principles?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TWT's Updated Tokenomics Framework: Key Changes and Market Impact for 2025

- TWT faces potential tokenomics shifts in 2025, inferred from industry trends toward buybacks and utility diversification. - Projects like Treehouse DAO and XRP Tundra highlight growing emphasis on deflationary mechanics and transactional utility. - TWT's long-term success depends on aligning with these trends through governance upgrades or cross-chain integration. - Investor sentiment remains cautious due to lack of official TWT announcements, despite broader market demand for sustainable token models.

Bitcoin Updates: Bitcoin ETF Withdrawals Underscore Rising Altcoin Momentum Amid Changing Crypto Focus

- BlackRock's IBIT Bitcoin ETF saw $3.79B in November outflows, marking its worst month since launch amid Bitcoin's 13% weekly price drop below $80,000. - Analysts link redemptions to profit-taking after October's $126,000 peak and macro concerns like delayed Fed rate cuts, creating a self-reinforcing price decline cycle. - Institutional buyers see Bitcoin's $90,000 level as a buying opportunity, while altcoin ETFs like Solana's BSOL attract $660M inflows with competitive staking yields. - Citigroup warns

Bitcoin News Today: Bitcoin Faces $80K Turning Point: Will a Short Squeeze Ignite or Is a Further Decline Ahead?

- Bitcoin fell below $80,000 in November 2025, triggering debates over short-squeeze rebounds vs. deeper bear markets amid macroeconomic fears and ETF outflows. - A "death cross" technical signal and $800M in on-chain losses highlight market fragility, with $1T wiped from crypto since October. - Analysts remain divided: bullish targets ($200K) clash with bearish warnings of $74,500 retests, while institutions like Harvard buy dips. - Negative funding rates suggest short-covering potential, but $20B in liqu

Astar 2.0: Transforming Blockchain Scalability and Pioneering DeFi Advancements

- Astar 2.0 tackles blockchain scalability via ZK Rollups, zkEVM, and LayerZero interoperability, enabling cross-chain liquidity and Ethereum compatibility. - Hybrid AMM-CEX models reduce slippage while AI-powered security attracts institutions, with TVL reaching $1.4B and 20% QoQ institutional wallet growth. - Tokenomics 3.0 caps ASTR supply at 10.5B tokens, paired with Burndrop PoC to create scarcity, while governance shifts to community councils by mid-2026. - Startale App (2026) and Polkadot Plaza inte