3 Altcoins Offering Massive Black Friday Discounts

Black Friday falls on November 29, and several major altcoins are now trading at steep markdowns. These altcoins offering Black Friday discounts are not just cheap — they each have a setup that could turn the discount into a recovery if market conditions improve. Or even worsen! One has an attainable path back toward its

Black Friday falls on November 29, and several major altcoins are now trading at steep markdowns. These altcoins offering Black Friday discounts are not just cheap — they each have a setup that could turn the discount into a recovery if market conditions improve. Or even worsen!

One has an attainable path back toward its highs, one carries a deep reversal setup, and another sits inside a strong cycle narrative with heavy long-term discounting. All three offer different types of discount narratives.

BNB (BNB)

BNB is one of the few large-cap tokens that have maintained strong long-term performance. While Bitcoin is down about 6% year-on-year and Ethereum is down nearly 15%, BNB remains up around 35%. That strength makes the current pullback a more meaningful Black Friday discount rather than a symptom of weakness.

Its current discount? BNB is 37.1% below its all-time high, which was set roughly a month ago. That makes the markdown more relevant.

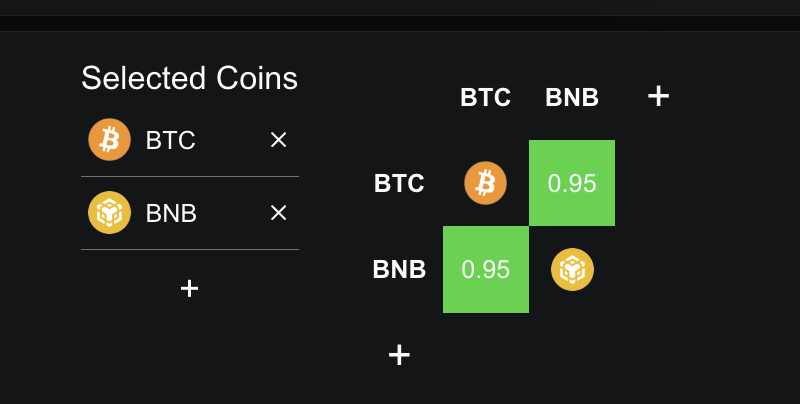

BNB is also closely tied to the broader market. Its +0.95 one-month correlation with Bitcoin shows it moves almost in sync with BTC. So, if the market turns, the BNB price tends to respond quickly.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BNB-BTC Correlation:

BNB-BTC Correlation

BNB-BTC Correlation:

BNB-BTC Correlation

On the chart, BNB shows a clear continuation structure.

Between June 21 and November 21, the price formed a higher low, while the Relative Strength Index (RSI) made a lower low. RSI measures momentum, and this pattern — price rising while RSI falls — hints that selling pressure is fading. A similar setup appeared earlier between June 22 and November 4, but the move stalled at the same ceiling BNB faces now. That ceiling is $1,016.

BNB needs a clean daily close above this level to confirm momentum. If it breaks:

- $1,183 becomes the next target

- Above that sits $1,375, very close to its all-time high and realistic if market sentiment shifts.

BNB Price Analysis:

BNB Price Analysis

BNB Price Analysis:

BNB Price Analysis

On the downside, losing $791 exposes $730, but the broader uptrend remains intact.

BNB earns its place on the Black Friday discount list because:

- Its discount is recent and not structural

- Its RSI divergence hints that the pullback may be ending

- Its path back to the highs is short and achievable if Bitcoin stabilizes

Sei (SEI)

Sei also fits the list of altcoins offering Black Friday discounts because its markdown is deep, fresh, and supported by a clean reversal setup. And the DeFi-narrative could also be a strong driver.

Its discount is one of the steepest on this list. Sei is down 54% in the past three months and 88% below its all-time high, which was set in March 2024. That makes the markdown meaningful: the top isn’t from five or six years ago, so retesting higher zones isn’t unrealistic if conditions improve.

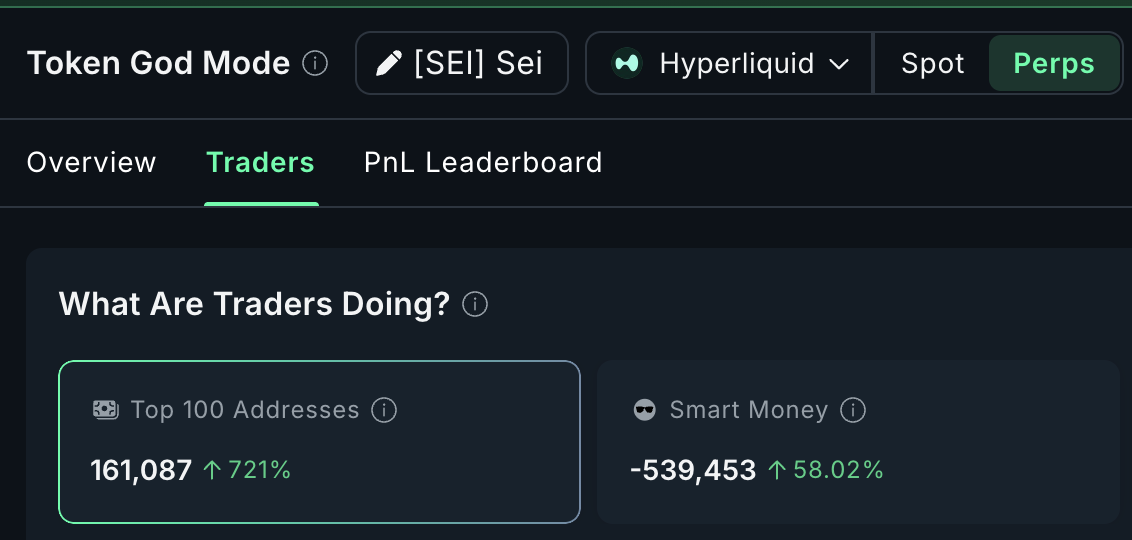

Perp traders are also turning more active. Top 100 addresses increased long exposure by 721%, signaling renewed interest.

Smart Money is still net-negative (short), but even here, positioning improved by 58.02%, showing that the most efficient traders are slowly easing off bearish bets.

Long-Biased Setup:

Long-Biased Setup

Long-Biased Setup:

Long-Biased Setup

The chart sends the clearest signal. Between October 10 and November 21, the price made a lower low, while the Relative Strength Index (RSI) made a higher low. This is a classical bullish divergence and a possible reversal catalyst.

A similar structure formed between October 10 and November 4, when SEI bounced sharply before getting rejected at key resistance.

That creates the next set of levels. Sei must break $0.169 to confirm a real reversal. If it clears this, the path opens toward $0.195 (previous rejection level), and above that sits the heavier ceiling at $0.240.

SEI Price Analysis:

SEI Price Analysis

SEI Price Analysis:

SEI Price Analysis

The downside is straightforward. Losing $0.127 weakens the reversal and exposes a clean breakdown, especially if broader conditions remain soft.

Sei earns its place on this Black Friday list because:

- Its discount is deep but recent enough to be meaningful

- A clear RSI reversal setup is active

- Early perp-side optimism supports the idea that the decline may be ending

Dash (DASH)

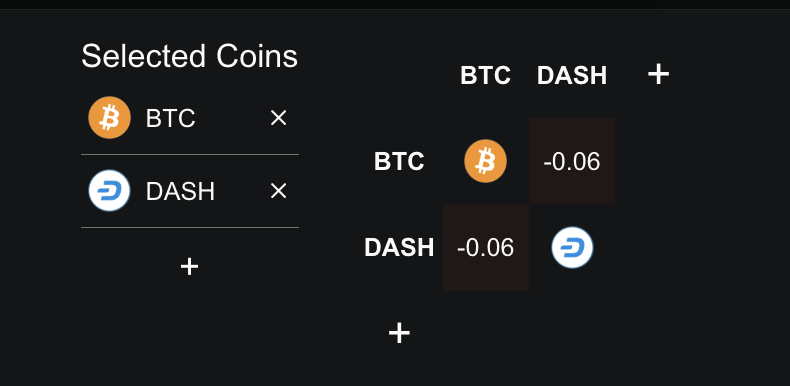

Dash fits a very different part of the altcoins offering Black Friday discounts theme because it sits inside the privacy token narrative, one of the few segments that have outperformed in this uneven cycle. Its one-year correlation with Bitcoin is –0.06, which means it can move the opposite way when the broader market falls.

DASH-BTC Correlation:

DASH-BTC Correlation

DASH-BTC Correlation:

DASH-BTC Correlation

The long-term markdown here is huge. DASH is still down more than 96% from its all-time high. The near-term pullback adds another layer to the discount.

DASH has dropped 26% over the past seven days, so buyers are still getting a marked-down entry even after the strong run earlier this quarter.

The chart now signals that this pullback may be fading. Between October 30 and November 25, the price made a higher low while the Relative Strength Index (RSI) made a lower low. This is a continuation setup (hidden bullish divergence), and it often appears when a broader uptrend pauses before resuming.

For Dash, trend-based Fibonacci extension levels help map the path ahead. The first barrier is $78. A clean break above this level clears the way toward $107 and higher. These targets are well within reach if the cycle narrative stays strong.

DASH Price Analysis:

DASH Price Analysis

DASH Price Analysis:

DASH Price Analysis

A drop under $52 breaks the continuation structure and puts $41 back on the chart. This is the level that acted as the floor during the early-November surge.

Here is why this discount narrative works:

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP ETFs Draw $600M in Investments, Yet Price Remains Stuck Under $2.20 Barrier

- XRP ETFs approved by NYSE, including Franklin Templeton's XRPZ and Grayscale's GXRP , attracted $600M in combined inflows as institutional demand grows for Ripple's token. - Regulatory milestone enables structured institutional access to XRP, with Franklin Templeton's $62.59M and Grayscale's $67.36M inflows highlighting traditional asset managers' crypto appetite. - XRP price remains trapped below $2.20 resistance at $2.13 despite ETF inflows, with technical analysts noting a rising wedge pattern and cri

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti

Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to