Australia Strikes a Balance Between Fostering Crypto Innovation and Safeguarding Investors with Updated Regulations

- Australia introduces 2025 Digital Assets Framework Bill to regulate crypto platforms under ASIC, creating "digital asset platform" and "tokenized custody platform" licenses. - The framework mandates custody standards, transparency requirements, and lighter regulations for small operators (<$5k per customer) to balance innovation with investor protection. - Global alignment with UAE and EU crypto regulations is emphasized, while addressing risks from past failures like FTX through stricter enforcement and

Australia Moves Forward with Comprehensive Crypto Regulation

Australia is introducing an extensive regulatory system for cryptocurrency platforms, aiming to place digital asset custodians and exchanges under the supervision of the Australian Securities and Investments Commission (ASIC) through the Corporations Amendment (Digital Assets Framework) Bill 2025. This initiative, put forth by Assistant Treasurer Daniel Mulino and Treasurer Jim Chalmers, is designed to close existing gaps in consumer protection and establish Australia as a leader in blockchain technology.

Under the proposed legislation, businesses operating in this space will need to secure an Australian Financial Services Licence (AFSL). The bill introduces two new licence categories: "digital asset platform" and "tokenized custody platform," recognizing the unique responsibilities of firms managing cryptocurrencies or tokenized assets such as real estate and commodities.

Key Requirements and Provisions

- Licensed platforms must comply with ASIC’s rules regarding asset custody, settlement processes, and transparency.

- Operators are required to provide detailed service guides outlining fees, potential risks, and asset management procedures.

- Smaller operators—those handling less than $5,000 per customer or with annual volumes below $10 million—will benefit from reduced regulatory requirements, encouraging innovation and supporting startups.

This regulatory approach is in line with international developments, such as the UAE’s recent approval of Ripple’s RLUSD stablecoin for institutional use and the European Union’s efforts to regulate decentralized finance (DeFi).

Economic Impact and Enforcement

Government projections indicate that integrating digital assets more efficiently could boost annual productivity by as much as $24 billion. However, the consequences for failing to comply are significant, with potential multimillion-dollar fines and a strong emphasis from ASIC on enforcing these new rules. The legislation also seeks to address vulnerabilities exposed by previous incidents like the FTX collapse, where insufficient safeguards resulted in substantial losses.

Industry Perspectives

- James Volpe from uCubed commended the bill for allowing early-stage projects to experiment without immediately requiring full licensing, making it easier for new ideas to be tested.

- Darcy Allen of RMIT University highlighted ongoing concerns about the costs and feasibility of implementing the new framework.

- The bill’s emphasis on regulating custodial services, rather than the underlying technology, is viewed as a flexible approach that can adapt as tokenization continues to develop.

Australia’s Place in Global Crypto Regulation

Australia joins countries like Singapore and the EU in strengthening oversight of the crypto industry. The move follows recent legislation in the UAE, which will require DeFi platforms to obtain licenses by 2026. Domestically, the bill is expected to pass the House of Representatives due to the ruling Labor Party’s majority, but may require negotiation in the Senate to secure broader support.

Balancing Innovation and Investor Protection

As the digital asset sector seeks greater regulatory certainty, Australia’s strategy aims to foster innovation while safeguarding investors. By integrating digital assets into established financial systems, the government hopes to attract investment, generate employment, and reinforce its standing in the global digital marketplace.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 5 Altcoins to Buy in December 2025

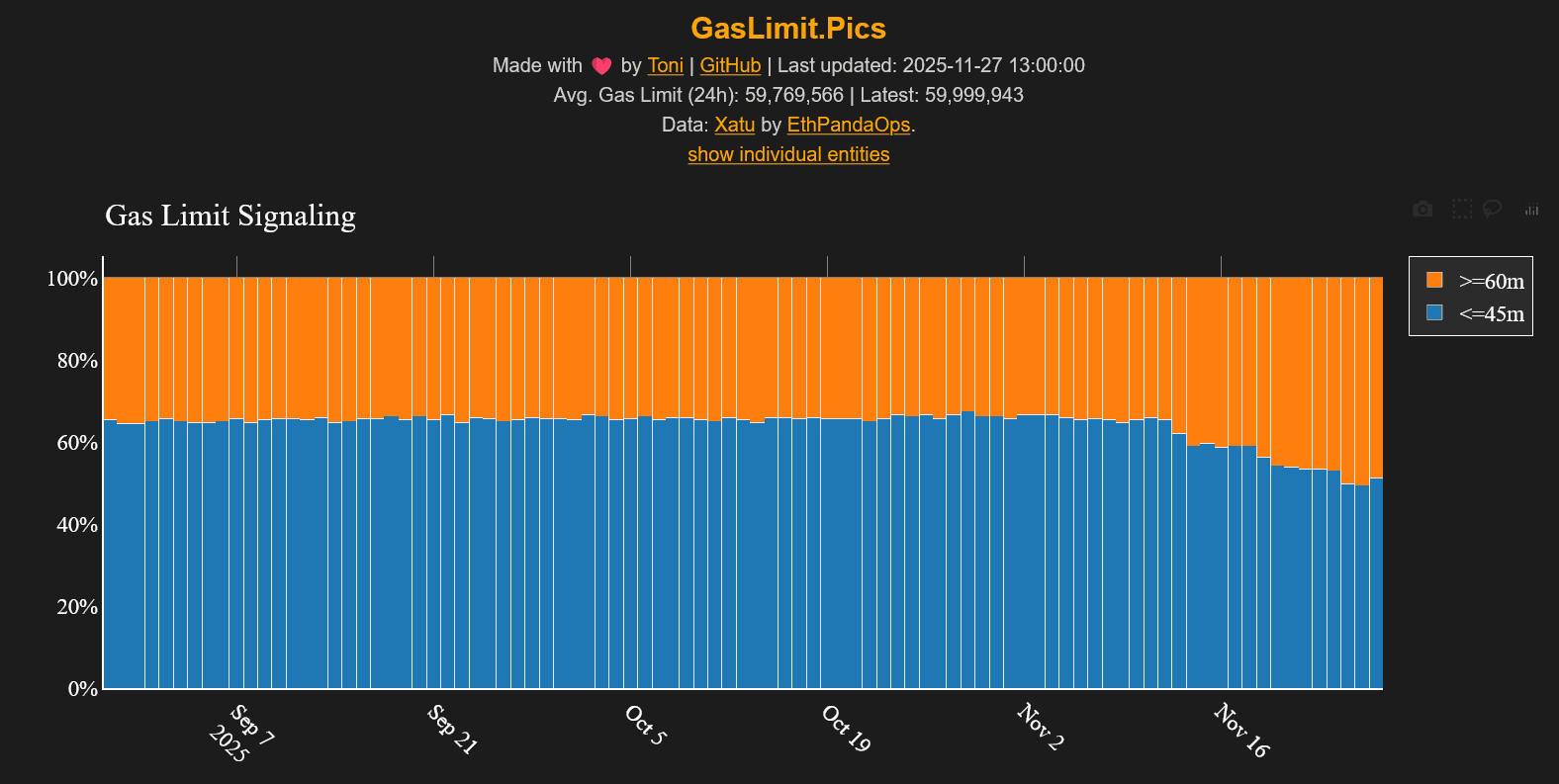

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v

Dogecoin Latest Updates: Crypto Winter Challenges DOGE ETFs While Technical Indicators Suggest a Potential 80% Surge

- Dogecoin (DOGE) could surge 80-90% as ETF launches approach, driven by a falling wedge pattern and institutional interest in Grayscale's GDOG and 21Shares' products. - Technical analysts compare DOGE's potential to XRP's 2025 ETF-driven rally, though broader crypto weakness and high interest rates pose risks to sustained gains. - While DOGE trades below key moving averages and faces $0.1495 resistance, a breakout above the wedge's trendline could push prices toward $0.27–$0.29. - Long-term projections su