What Crypto Whales Are Buying During the Early December Market Dip

Crypto whales have turned active during the early December market dip, and their buying patterns reveal a split across three very different tokens. One is pushing through every major price extension with aggressive whale demand. Another is playing a steady reversal setup after days of pressure. And a third is showing early signs that heavy

Crypto whales have turned active during the early December market dip, and their buying patterns reveal a split across three very different tokens.

One is pushing through every major price extension with aggressive whale demand. Another is playing a steady reversal setup after days of pressure. And a third is showing early signs that heavy selling may finally be easing. Together, these moves outline where big buyers expect the next leg of rebounds and rally continuations.

Fartcoin (FARTCOIN)

Fartcoin is the first surprising entry on the list. The token is up more than 23% in the past 24 hours, outperforming the December 1 dip. Even with this jump, the broader trend is still soft, with a 3.4% monthly drop showing that the larger structure has not fully recovered. But crypto whales clearly see opportunity here.

Over the past 24 hours, standard whales increased their holdings by 0.79%, lifting their stash to 111.55 million tokens. Mega whales (top 100 holders) added 4.76%, raising their total to 700.8 million tokens. Together, whales picked up 32.43 million FARTCOIN, worth roughly $10.70 million at the current price near $0.33. That is a strong show of conviction during a volatile week.

Fartcoin Whales:

Fartcoin Whales:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

The chart helps explain why. RSI (Relative Strength Index), which measures momentum on a 0–100 scale, flashed a standard bullish divergence between November 4 and November 22. Price made a lower low while RSI made a higher low. This pattern is tied to reversal setups, and it triggered the bounce from $0.17.

Fartcoin Price Analysis:

Fartcoin Price Analysis:

If this reversal setup continues to hold, Fartcoin needs a clean break above $0.33. Clearing that level can extend the move toward $0.42, which is about a 32% push from current prices. But if the setup weakens, the first key support sits at $0.23, and losing it exposes a deeper retest of $0.17.

Uniswap (UNI)

Uniswap sits on the more stable end of this list, and crypto whale behavior reflects that. Over the past 48 hours, large holders increased their supply from 665.56 million UNI to 666.36 million UNI, a pickup of 0.80 million UNI worth about $4.98 million at the current price. For a DeFi token that moves with broader market liquidity, this quiet accumulation stands out.

Crypto Whales Buying UNI:

Crypto Whales Buying UNI:

Uniswap has been falling since November 11. The chart shows steady selling, but that pressure may be easing now. The Wyckoff volume bars help explain this. In this system, red bars show sellers in control, yellow shows sellers gaining control, blue shows buyers gaining control, and green shows buyers in full control.

Over the past 24 hours, the yellow bars have thinned out. The last time this pattern appeared — between November 7 and 8 — buyers stepped in quickly, and UNI rallied 77.7% in the next few sessions. If yellow fades again and the bars turn blue, it could hint at a similar shift.

For a rebound to develop, UNI must protect $5.40, the key support. A move above $5.90 would show early strength. Real momentum returns only if UNI clears $6.80, the 0.618 Fibonacci level, and one of its strongest technical checkpoints.

UNI Price Analysis:

UNI Price Analysis:

If that breakout happens, the recovery path opens toward the $8.10 zone.

If UNI loses $5.40, the structure weakens, and the price could drop toward $4.70, which risks cancelling the rebound setup entirely.

Pippin (PIPPIN)

Pippin has been one of the strongest performers during the early December dip. The token is up close to 30% in the last 24 hours and has followed every extension level since October 10, when the upmove started. This steady climb has drawn the attention of crypto whales, who are buying into strength.

Over the last 24 hours, standard whales increased their holdings by 5.16%. After this change, they now hold 274.63 million Pippin tokens, which means they added about 13.45 million tokens. Top 100 addresses added 3.28% and now hold 851.89 million, which means an additional 27 million tokens. Together, whales added almost 40.45 million Pippin tokens, worth about $7.28 million. This is one of the strongest whale accumulation clusters seen in this meme-coin group this month.

PIPPIN Whales:

PIPPIN Whales:

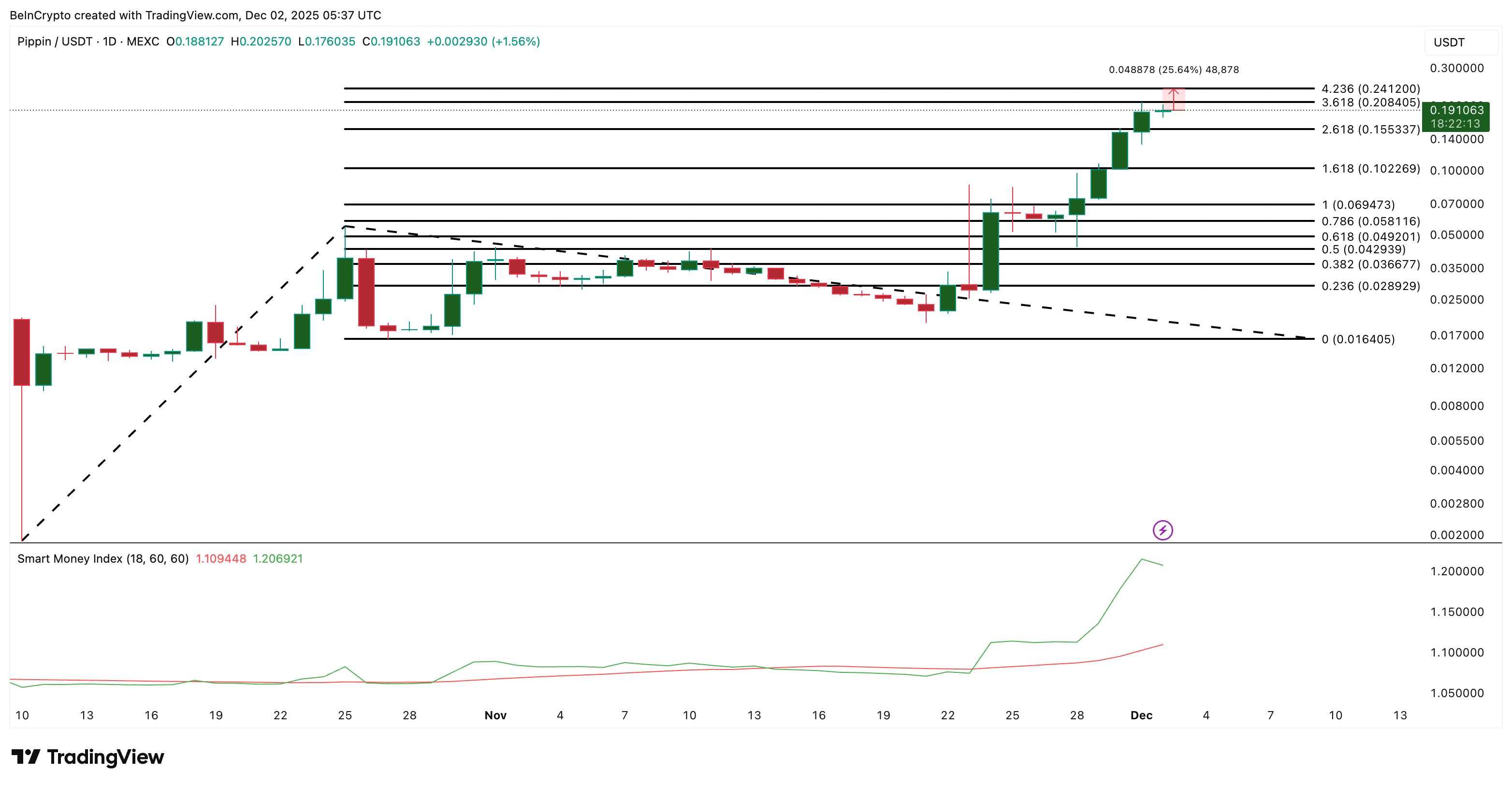

PIPPIN’s price chart supports this conviction. Since October 10, the token has moved through every Fibonacci extension on the chart and is now trading above the 3.618 extension. If the same momentum continues, the next major target sits near $0.24, which would be roughly a 25% move from this zone. A daily close above $0.24 could push Pippin higher.

Smart Money Index also backs this strength. This metric tracks whether informed and early traders are becoming more active. The index has formed higher highs over the last week, showing these traders are still backing the uptrend. When smart money expands along with whale accumulation, the setup often supports further rallies.

PIPPIN Price Analysis:

PIPPIN Price Analysis:

A clean move under $0.10 would weaken the structure and could pull the PIPPIN back toward lower levels. Until then, momentum, whales, and smart money all point in the same direction: the uptrend remains in control.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid’s Growing Influence in Crypto Trading: Enhancing Investor Access and Entry Methods in an Evolving Market

- Hyperliquid dominates 2025 crypto market with 73% DEX perpetual trading share via fee cuts, stablecoin integration, and institutional partnerships. - USDH stablecoin (backed by USD/Treasury) and HyperEVM infrastructure position it as "AWS of liquidity" for on-chain finance developers. - 78% user growth and 1.75M HYPE token unlock resilience highlight its scalability, though stablecoin regulations and market volatility pose risks.

PENGU Token Price Rally: Examining Brief Upward Trends and Institutional Indicators Towards the End of 2025

- PENGU token surged past $0.0100 in late 2025, driven by Bitcoin's rebound and institutional inflows totaling $430,000. - Technical indicators show conflicting signals: overbought RSI (73.76) vs. positive MACD/OBV, with critical support at $0.009. - $66.6M team wallet outflows contrast with institutional accumulation, raising sustainability concerns despite short-term bullish momentum. - Macroeconomic factors like Fed policy and Bitcoin correlation amplify PENGU's volatility, complicating long-term price

LUNA Rises 1.13% Amid Progress on U.S. Lawmaker’s Stock Trading Ban

- LUNA rose 1.13% in 24 hours amid U.S. political pressure to ban congressional stock trading, despite an 82.66% annual decline. - Rep. Anna Paulina Luna advanced the bipartisan Restore Trust in Congress Act, which would prohibit lawmakers and families from trading individual stocks. - The bill faces bipartisan opposition over financial flexibility concerns but has 100+ supporters, including conservatives and progressives, seeking to close ethics loopholes. - Critics argue the 2012 STOCK Act lacks sufficie

BCH Rises 9.13% Over 24 Hours as Overall Market Trends Upward

- Bitcoin Cash (BCH) surged 9.13% in 24 hours, with 10.08% monthly and 37.01% annual gains, signaling sustained bullish momentum. - Analysts attribute the rise to BCH's utility in cross-border payments, low fees, and institutional interest as a Bitcoin layer-2 solution. - No immediate catalysts (regulatory shifts, partnerships) were identified, suggesting market sentiment and macro trends drive the rally. - Experts highlight BCH's structural strengths and active development, positioning it to outperform br