The Biggest Zcash Strength Is Now a Weakness as Buying Collapses 97% —Breakdown Next?

Zcash price has turned sharply lower even as the wider market rises more than 6% today. Bitcoin, Ethereum, and most large caps have bounced, but ZEC remains one of the biggest laggards, falling more than 4% in the last 24 hours and over 40% in the past week. This contrast raises a clear question: why

Zcash price has turned sharply lower even as the wider market rises more than 6% today. Bitcoin, Ethereum, and most large caps have bounced, but ZEC remains one of the biggest laggards, falling more than 4% in the last 24 hours and over 40% in the past week. This contrast raises a clear question: why is Zcash weakening when the rest of the market is recovering?

The answer begins with the same factor that helped Zcash outperform for months.

Zcash’s Biggest Strength Is Now Becoming Its Weakness

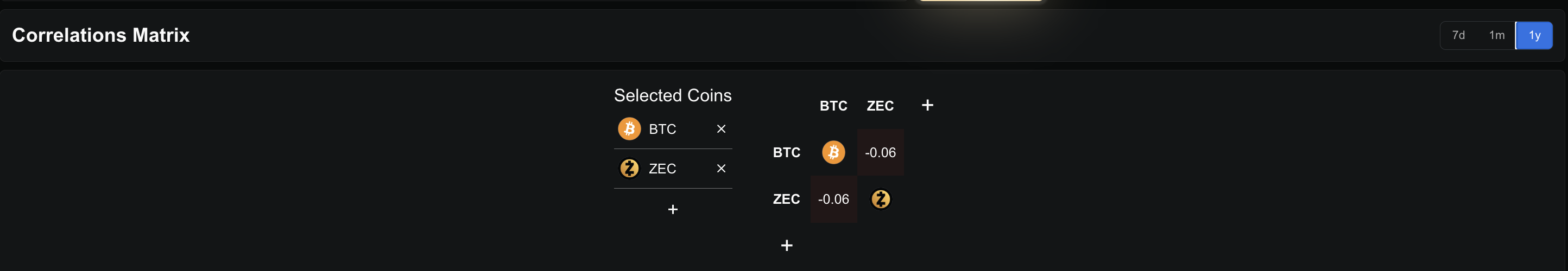

For most of the year, Zcash carried a negative correlation with Bitcoin. The one-year Pearson correlation coefficient, which measures how two assets move together or apart, sits near –0.06 for ZEC.

ZEC-BTC Correlation:

ZEC-BTC Correlation:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

A negative value means ZEC often moves in the opposite direction of BTC. This was its biggest strength during late October and November, when Bitcoin struggled while ZEC surged more than 650% in the 3-month horizon.

Now that Bitcoin is rising, this same negative link is working against Zcash.

And the chart confirms the pressure.

The 20-day exponential moving average (EMA), which tracks short-term momentum by giving more weight to recent prices, is closing in on the 50-day EMA. If the 20-day crosses below the 50-day, it would confirm a loss of strength and could extend the Zcash decline beyond the current 40% weekly slide.

Looming EMA Cross:

Looming EMA Cross:

The trend that once protected ZEC during Bitcoin weakness has now flipped into a structural disadvantage.

Buying Pressure Collapses 97%, But Selling Pressure Begins to Ease

The biggest red flag appeared between December 1 and December 2. Exchange outflows — a proxy for buying demand — fell from $61.06 million to just $1.74 million.

Dip In Buying Pressure:

Dip In Buying Pressure:

When comparing the scale of outflows, this reflects roughly a 97% collapse in buying pressure within a single day. This drop signals that traders who had been accumulating aggressively through the October–November rally have suddenly stepped back.

But one element still keeps the chart from turning fully bearish.

Wyckoff volume colors show that selling pressure has begun to soften in the last two sessions. Yellow bars, which indicate sellers gaining control, have gradually weakened.

Zcash Sellers Might Be Losing Strength:

Zcash Sellers Might Be Losing Strength:

A similar pattern appeared between October 23 and 25. Soon after, buyers regained control with blue bars surfacing, and ZEC rallied more than 230%. So while buying pressure has collapsed, selling pressure is also reducing since yesterday, leaving the Zcash price at a conflicted but important turning point.

On the flipside, weakening buying and selling activity can eventually lead to a range-bound ZEC price movement.

Key Zcash Price Levels to Watch: Breakdown or Stabilization?

ZEC’s ability to avoid a deeper breakdown depends on holding a few major levels.

The first support sits near $299. Losing this zone would expose the next region around $210, where previous reactions formed a temporary base. A further slip could drag Zcash toward $124, a level seen during early-cycle resets.

For any recovery to develop, ZEC must reclaim $426, which would be a 34% bounce from current levels and mark the start of a reversal attempt. If buyers sustain momentum above that zone, the next major ceiling remains $736, a barrier ZEC has failed to break since early November.

Zcash Price Analysis:

Zcash Price Analysis:

Right now, Zcash price sits at a crossroads: its biggest historical strength — moving opposite to Bitcoin — has turned into a weight on its price, buying pressure has collapsed by 97%, and the bearish EMA setup is nearing. Only easing sell pressure and a reclaim of $426 keep the path to stabilization open.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster DEX and the Next Phase of Decentralized Finance (DeFi): Assessing Entry Points for Individual Investors in the Changing DeFi Environment

- Aster DEX bridges retail-institutional DeFi gaps via zero-knowledge proofs and MiCA-compliant custody solutions, enhancing privacy and regulatory alignment. - Its Aster Chain Layer 1 blockchain enables fast, scalable trading while reducing reliance on external chains, addressing retail onboarding barriers through integrated fiat gateways. - Despite advancements, DeFi on-ramps remain fragmented, with institutional liquidity pools controlling 85% of assets, limiting retail influence and exposing compliance

Investor Interest Grows as GeekStake Highlights Its 2025 Staking Features

Vitalik Buterin Backs ZKsync: Accelerating the Evolution of Ethereum’s Layer 2 Solutions

- Vitalik Buterin endorsed ZKsync, highlighting its ZK rollup role in Ethereum's scalability and security. - ZKsync's Atlas upgrade achieved 30,000 TPS with Ethereum compatibility, driving ZK token's 120% surge to $0.74. - Institutional adoption grew with $3.3B TVL, 27M monthly transactions, and partnerships with Deutsche Bank/Sony. - ZKsync leads ZK rollups with $3.3B TVL vs. $1.2B (StarkNet), leveraging EVM compatibility and low fees. - Investors face opportunities in ZKsync's network effects and deflati

ZK Atlas Enhancement and Its Impact on Blockchain Scalability

- ZKsync's October 6, 2025 Atlas Upgrade introduces modular architecture with 15,000–43,000 TPS and $0.0001 ZK proof costs, enhancing blockchain scalability and EVM compatibility. - Deutsche Bank and UBS adopt the upgrade for cross-chain settlements, leveraging its cryptographic finality and real-time RWA tokenization capabilities. - Bitget projects 60.7% CAGR for ZK-based Layer-2 solutions, reaching $90B by 2031, driven by institutional demand for interoperable, compliant blockchain infrastructure. - Modu