8 Million MONAD Sold By Whales In 24 Hours, Could Price Suffer?

Monad is facing renewed pressure after a sharp dip in price triggered by broader market weakness led by Bitcoin. The pullback has shaken investor confidence, resulting in notable selling activity across key cohorts. As sentiment shifts, the question now is whether MONAD can stabilize or whether deeper losses are ahead. Monad Whales Turn To Selling

Monad is facing renewed pressure after a sharp dip in price triggered by broader market weakness led by Bitcoin. The pullback has shaken investor confidence, resulting in notable selling activity across key cohorts.

As sentiment shifts, the question now is whether MONAD can stabilize or whether deeper losses are ahead.

Monad Whales Turn To Selling

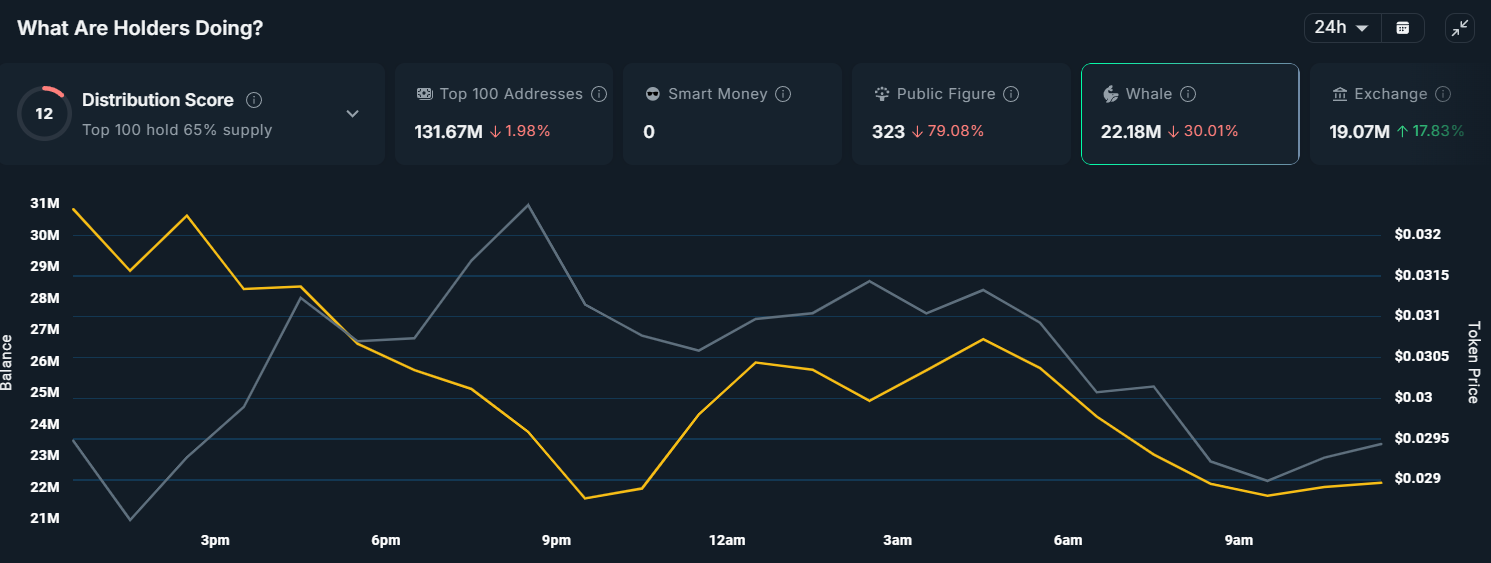

Whale activity has become a major concern for MONAD holders this week. On-chain data shows that large wallets holding more than $1 million worth of MONAD — excluding exchanges — sold over 8 million tokens in just 24 hours. This scale of distribution signals a clear decline in confidence among influential holders, who often drive major price movements.

Their exit from the asset could create additional downward pressure if the trend accelerates.

Such aggressive whale selling typically reflects expectations of further decline or a desire to reduce exposure during periods of volatility. Since these wallets hold a significant supply, their collective moves can sway price direction sharply.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Monad Whale Activity. Source:

Monad network analytics

Monad Whale Activity. Source:

Monad network analytics

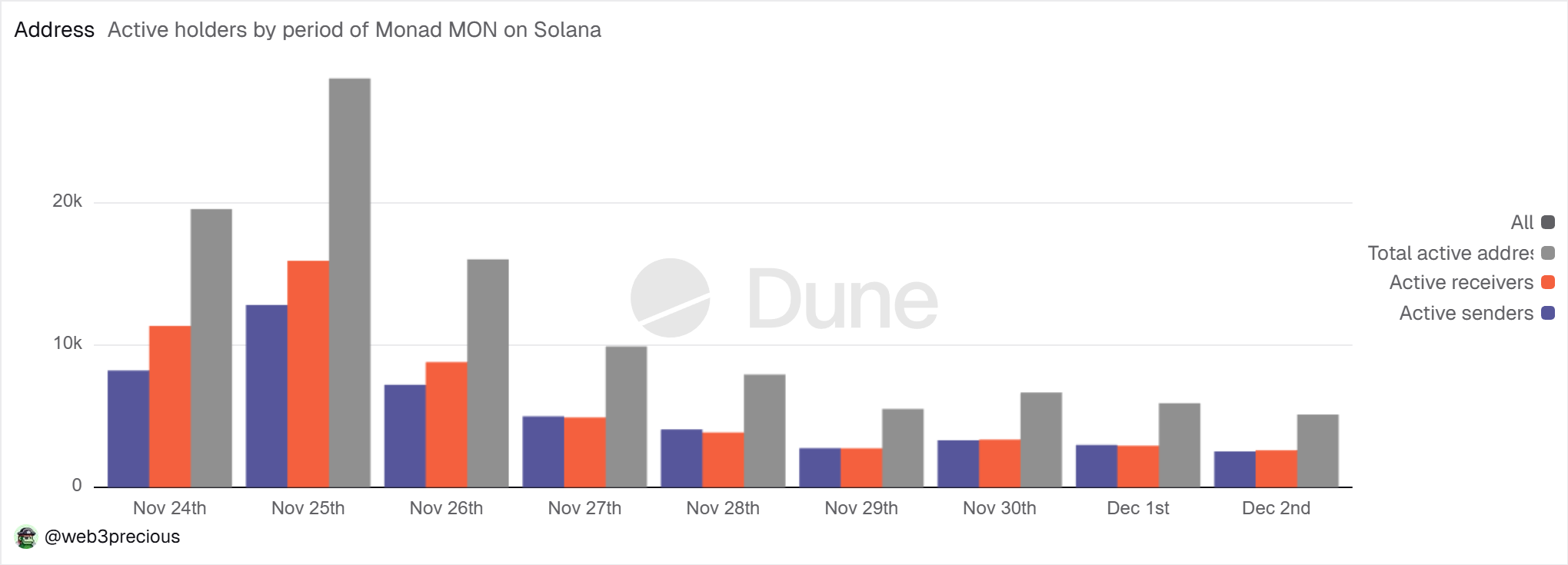

The broader activity on the Monad network also paints a cautious picture. Active addresses have been steadily falling over the past week, with activity nearly flatlining in the last few days. Active addresses represent users interacting with the chain, whether through sending, receiving, or executing transactions.

This drop in activity reflects uncertainty among MONAD holders. As long as market conditions remain unfavorable, user engagement may stay muted, limiting the organic demand needed to support price recovery. A revival in active addresses is essential for regaining momentum.

Monad Active Addresses. Source:

Monad network analytics

Monad Active Addresses. Source:

Monad network analytics

MONAD Price Might See Decline

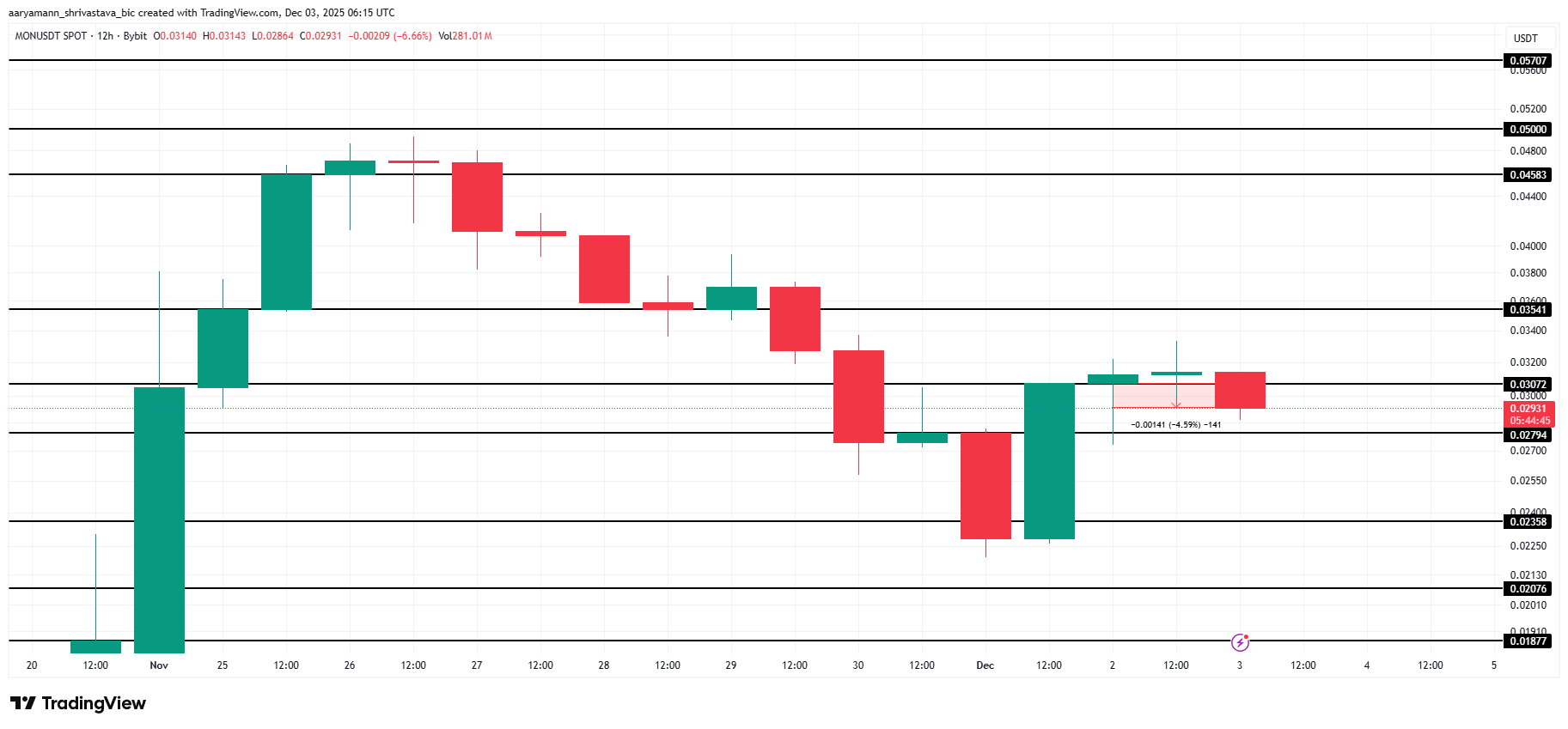

Monad’s price is down 5% in the past 24 hours, trading at $0.029 at the time of writing. The altcoin is attempting to establish short-term support within the $0.027 to $0.030 range as it searches for stability.

However, the pressures highlighted above suggest further downside risk. If whale selling continues and network participation weakens further, MONAD could fall toward the key support at $0.023, deepening losses for holders.

Monad Price Analysis. Source:

Price analytics

Monad Price Analysis. Source:

Price analytics

On the positive side, if bullish momentum returns and whales pause their distribution, MONAD could recover. A bounce from $0.030 would allow the token to target $0.035, with a potential extension to $0.045. A move into this zone would invalidate the bearish outlook and restore investor confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Abrupt Price Swings in Late 2025: Macroeconomic Triggers and the Actions of Institutional Investors

- Bitcoin's 2025 crash from $126,000 to $80,553 stemmed from macroeconomic shocks, institutional leverage risks, and regulatory shifts. - Trump's 100% China tariffs and Fed rate uncertainty triggered $19B in crypto liquidations, linking Bitcoin to equity market volatility. - Leveraged offshore trading platforms and de-pegged stablecoins exposed crypto's structural vulnerabilities during cascading margin calls. - U.S. Bitcoin ETF approval and EU MiCA regulation boosted institutional adoption, but post-crash

Bitcoin Leverage Liquidation Spike: An Urgent Reminder for Enhanced Risk Controls in Cryptocurrency Trading

- Bitcoin's late 2025 price drop below $86,000 triggered $2B in leveraged liquidations, exposing systemic risks in over-leveraged retail trading. - Major exchanges reported $160M+ forced unwinds, with 90% losses from long positions and a $36.78M single liquidation highlighting concentrated risk. - Regulatory scrutiny intensified as U.S. SEC capped ETF leverage and CFTC examined stablecoin reserves, signaling growing focus on crypto market stability. - Retail traders showed emerging maturity through risk ca

Bitcoin’s Latest Downturn: Key Factors for Investors to Monitor in the Weeks Ahead

- Bitcoin fell below $100,000 in 2025 amid geopolitical tensions, U.S. trade tariffs, and regulatory shifts, raising concerns over market stability. - The Trump administration's pro-crypto policies, including the GENIUS Act and CFTC reforms, aim to boost adoption but face criticism over fraud risks. - Global regulatory divergence, from EU's MiCAR to UAE's innovation-friendly rules, highlights fragmented oversight and cross-border coordination challenges. - Central bank actions, including Fed rate hikes and