BCH has surged by 35.79% since the beginning of the year, reflecting the overall positive sentiment in the market.

- Bitcoin Cash (BCH) fell 0.1% in 24 hours but rose 35.79% year-to-date, outperforming peers. - Sustained 7-day (7.55%) and 1-month (9.1%) gains highlight growing institutional and retail confidence. - Market adoption in DeFi and low-cost transactions, plus macroeconomic optimism, drive BCH's long-term appeal. - Analysts predict continued growth as BCH's ecosystem matures and on-chain activity rises.

Bitcoin Cash Shows Steady Growth Despite Brief Dip

As of December 3, 2025, Bitcoin Cash (BCH) experienced a slight decrease of 0.1% over the past day, settling at $589.6. However, the cryptocurrency has posted notable gains in other timeframes: a 7.55% rise over the previous week, a 9.1% increase in the last month, and a significant 35.79% surge over the past year.

Consistent Upward Momentum Over the Past Year

Although BCH saw a minor pullback in the last 24 hours, its performance throughout the year has been robust. The impressive 35.79% annual growth highlights strong confidence from both individual and institutional investors, positioning Bitcoin Cash as a prominent contender in the digital asset space. These results have allowed BCH to outperform many other cryptocurrencies in the same period.

Shorter-term gains—7.55% in seven days and 9.1% over the last month—further underscore the asset’s ability to sustain positive momentum, even amid short-term market shifts.

Favorable Market Conditions Support BCH’s Growth

Bitcoin Cash’s upward trend is being bolstered by a supportive market environment. Factors such as improved economic outlooks and broader adoption across various sectors have enhanced its attractiveness. Many investors are choosing to hold and accumulate BCH, signaling a move toward longer-term strategies rather than short-term speculation.

Additionally, BCH’s ongoing relevance in payment systems and decentralized finance (DeFi) continues to drive its adoption. Its reputation for enabling scalable and cost-effective transactions makes it an appealing choice for both developers and users, aligning with the push for mainstream cryptocurrency use.

Analysts Remain Optimistic About Future Prospects

Market experts point to Bitcoin Cash’s strong performance over the past year as evidence of its potential for further growth. While the recent daily decline is seen as a routine fluctuation, it does not overshadow the broader upward trend. Both retail and institutional interest are expected to remain strong as the BCH ecosystem matures and expands.

The asset’s ability to withstand minor corrections reflects solid demand and growing confidence in its practical applications. Analysts maintain a positive long-term outlook for BCH, especially as on-chain activity increases and new real-world uses emerge.

Outlook: Positioned for Continued Success

Bitcoin Cash’s achievements so far this year are the result of rising demand, ongoing technical progress, and expanding industry adoption. While short-term price changes are to be expected, the overall direction remains positive. As the cryptocurrency landscape develops, BCH is well-placed to sustain its growth and deliver ongoing value to its supporters and investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Eyes $2.75 Breakout as BTC Dominance Dips – Bullish Setup Loading

Quick Take Summary is AI generated, newsroom reviewed. XRP closes with a strong bullish daily candle, reinforcing upward momentum. Analysts project a move toward the $2.75 resistance if Bitcoin continues rising. XRP trades around $2.15–$2.20, reflecting a 6% rebound that supports bullish continuation. Lower-timeframe charts show scalp setups forming, though confirmation remains essential.References X Post Reference

ETH Traders Turn Bold as $6,500 Calls Take Over Deribit

Quick Take Summary is AI generated, newsroom reviewed. Traders push $6,500 ETH calls to $380M in open interest Strong clusters form at $4K, $5.5K, and $6K call strikes Market confidence rises despite a 26% quarterly ETH drop ETH price outlook strengthens as crypto market sentiment turns bullishReferences 🚨DERIBIT TRADERS CALL FOR $6,500 ETH! The $6.5K strike leads with $380 MILLION in open interest, with $4K, $5.5K and $6K calls also active. Despite a 26% quarterly drop, BIG REBOUND bets are in

Crypto Market Ignites as Bitcoin and SUI Drive Massive Trading Activity

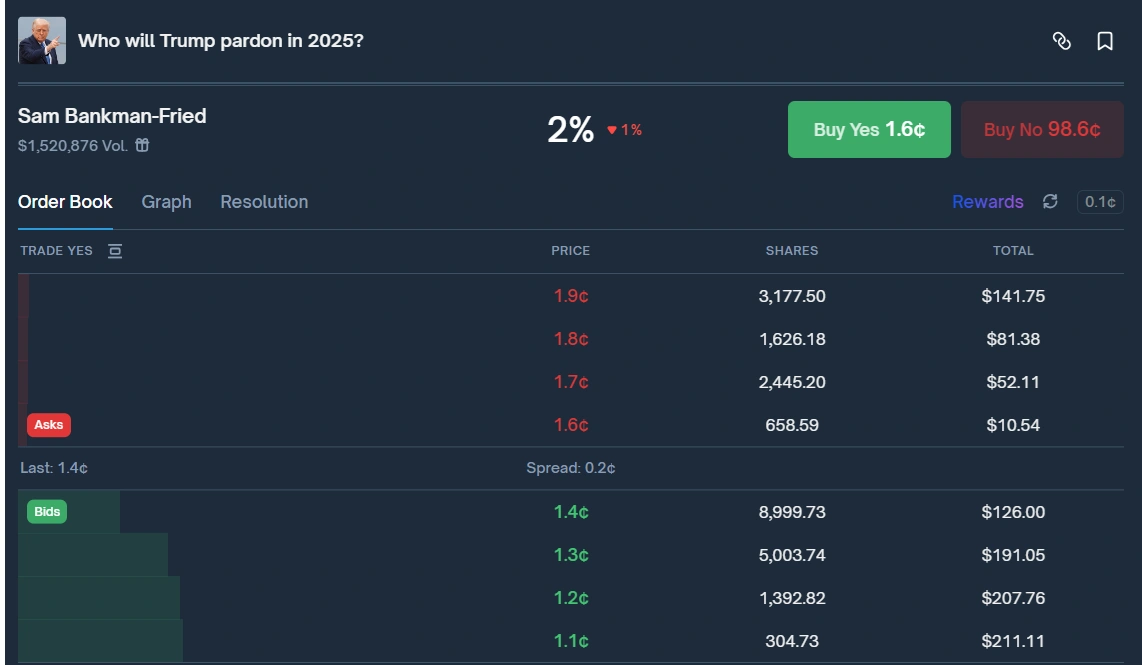

Trump continues to overlook SBF as president issues fresh pardons