Zcash (ZEC) Price Faces Uphill Battle to Close Gap With November Peak

Zcash price is struggling to regain its bullish momentum after a steep decline that pushed the altcoin below $350 earlier this week. While ZEC has shown minor signs of stabilization, its broader trend remains weak, and the distance from November’s highs leaves a significant recovery challenge ahead. Zcash Is Lacking On All Fronts The RSI

Zcash price is struggling to regain its bullish momentum after a steep decline that pushed the altcoin below $350 earlier this week.

While ZEC has shown minor signs of stabilization, its broader trend remains weak, and the distance from November’s highs leaves a significant recovery challenge ahead.

Zcash Is Lacking On All Fronts

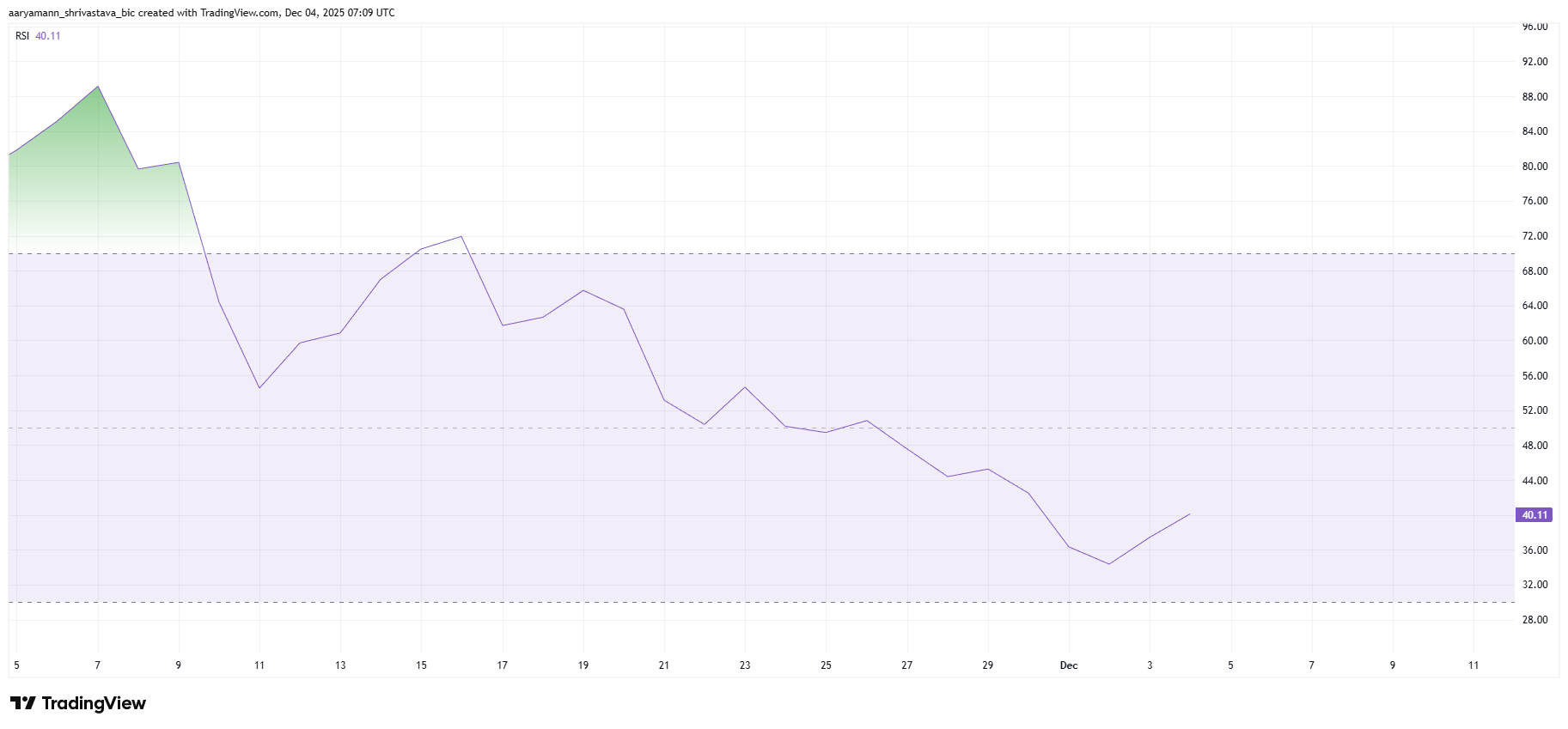

The RSI indicates that Zcash continues to face persistent bearish pressure. The indicator remains in the negative zone, reflecting a lack of upward momentum and highlighting that buyers are not yet regaining control. This signals that broader market conditions are not aligned with a meaningful rebound.

Unless the RSI improves, ZEC may struggle to attract fresh demand.

The bearish sentiment is reinforced by declining participation across the market, with risk appetite remaining low. ZEC’s failure to push back toward key resistance levels in recent sessions suggests traders are prioritizing safer assets while waiting for clearer signals.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

ZEC RSI. Source:

TradingView

ZEC RSI. Source:

TradingView

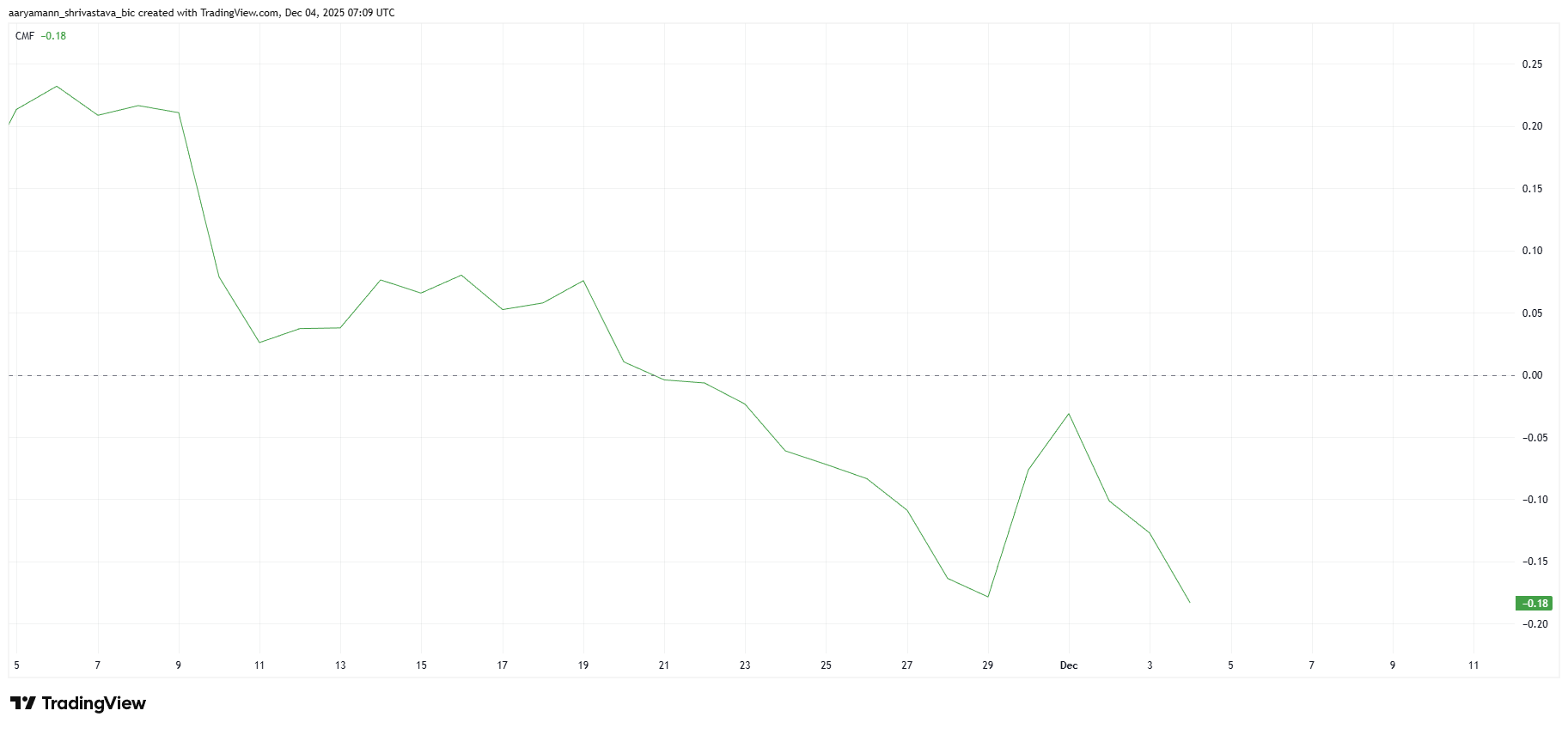

The CMF shows persistent outflows, highlighting a decline in investor confidence. Capital continues leaving ZEC, and the indicator remains firmly in the negative zone. This pattern is concerning because Zcash is already lacking broader market support, and sustained outflows could prevent any meaningful rally. For ZEC to regain strength, inflows must return.

Given the current macro backdrop, ZEC’s path to recovery appears challenging. Market volatility remains high, and investors are cautious amid fear-driven activity. Without a shift in sentiment, ZEC may find it difficult to build the momentum required to revisit higher levels.

ZEC CMF. Source:

TradingView

ZEC CMF. Source:

TradingView

ZEC Price Has A Long Way To Go

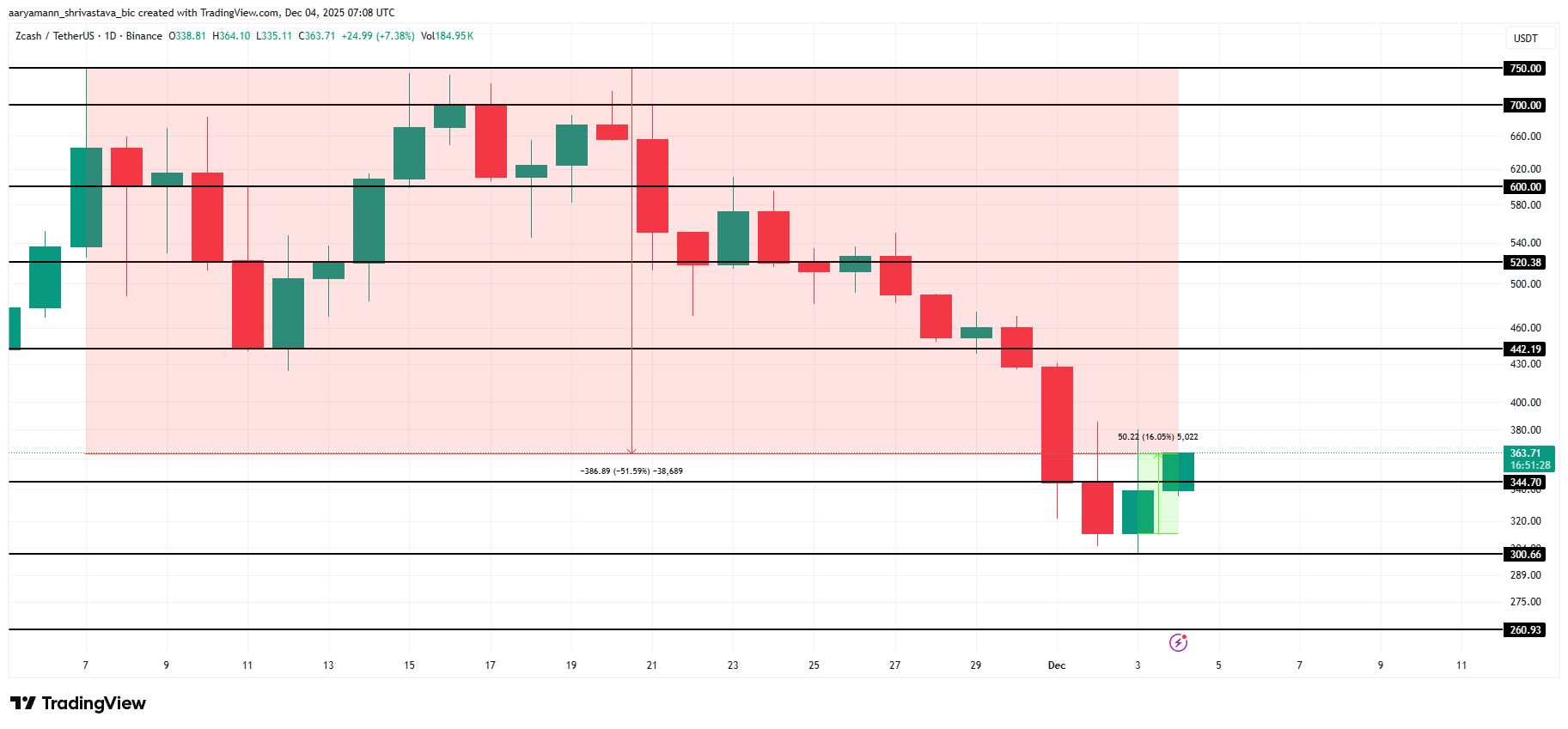

ZEC is trading at $363 at the time of writing, sitting just above the $344 support level. Holding this support is essential for any near-term recovery attempt toward $442. However, revisiting November’s highs remains a distant objective.

If bearish conditions persist, ZEC could fail to hold its support, potentially falling below $344 again and sliding to $300 or even $260. Such a move would extend the current downtrend and deepen investor concerns.

ZEC Price Analysis. Source:

TradingView

ZEC Price Analysis. Source:

TradingView

Conversely, a shift in investor sentiment could support a recovery. Yet even in that scenario, ZEC would need to rally by 101% to reclaim its November peak near $750. That would require flipping $442 into support and climbing toward $520, which remains a substantial challenge for the altcoin’s current momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Abrupt Price Swings in Late 2025: Macroeconomic Triggers and the Actions of Institutional Investors

- Bitcoin's 2025 crash from $126,000 to $80,553 stemmed from macroeconomic shocks, institutional leverage risks, and regulatory shifts. - Trump's 100% China tariffs and Fed rate uncertainty triggered $19B in crypto liquidations, linking Bitcoin to equity market volatility. - Leveraged offshore trading platforms and de-pegged stablecoins exposed crypto's structural vulnerabilities during cascading margin calls. - U.S. Bitcoin ETF approval and EU MiCA regulation boosted institutional adoption, but post-crash

Bitcoin Leverage Liquidation Spike: An Urgent Reminder for Enhanced Risk Controls in Cryptocurrency Trading

- Bitcoin's late 2025 price drop below $86,000 triggered $2B in leveraged liquidations, exposing systemic risks in over-leveraged retail trading. - Major exchanges reported $160M+ forced unwinds, with 90% losses from long positions and a $36.78M single liquidation highlighting concentrated risk. - Regulatory scrutiny intensified as U.S. SEC capped ETF leverage and CFTC examined stablecoin reserves, signaling growing focus on crypto market stability. - Retail traders showed emerging maturity through risk ca

Bitcoin’s Latest Downturn: Key Factors for Investors to Monitor in the Weeks Ahead

- Bitcoin fell below $100,000 in 2025 amid geopolitical tensions, U.S. trade tariffs, and regulatory shifts, raising concerns over market stability. - The Trump administration's pro-crypto policies, including the GENIUS Act and CFTC reforms, aim to boost adoption but face criticism over fraud risks. - Global regulatory divergence, from EU's MiCAR to UAE's innovation-friendly rules, highlights fragmented oversight and cross-border coordination challenges. - Central bank actions, including Fed rate hikes and