Privacy Coins and Market Fluctuations: Uncovering the Factors Behind ZEC's Latest Price Jump

- Zcash (ZEC) surged 700% in late 2025 driven by institutional backing and network upgrades like the Zashi wallet. - Regulatory pressures and market fragmentation intensified as exchanges delisted privacy coins and liquidity shifted to decentralized platforms. - ZEC's volatility reflects macroeconomic tailwinds and speculative demand, but its long-term viability hinges on balancing privacy with regulatory compliance. - Institutional adoption of privacy coins accelerated in 2025, yet fragmented markets and

The State of Cryptocurrency in 2025: Privacy and Liquidity Challenges

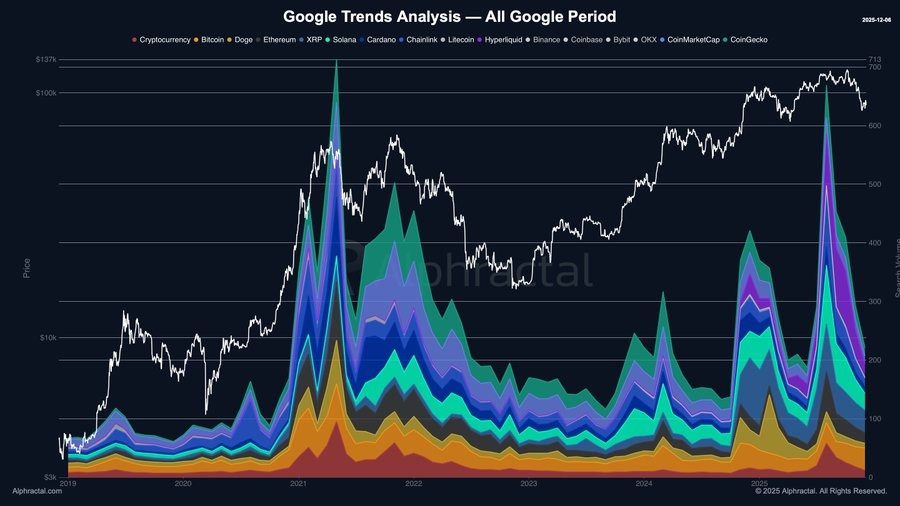

By 2025, the cryptocurrency sector has been shaped by two major trends: an intensified focus on privacy and the increasing dispersion of liquidity across various trading platforms. Among privacy-oriented digital assets, Zcash (ZEC) has taken center stage, experiencing an extraordinary 700% price increase since September 2025 before undergoing a sharp correction. This dramatic price movement highlights the intricate relationship between market sentiment, regulatory developments, and broader economic forces. To evaluate ZEC's position in this fragmented environment, it's essential to analyze the drivers behind its recent rally and consider whether its long-term value can surpass short-lived speculative gains.

Institutional Momentum and Technological Progress

ZEC's remarkable ascent in late 2025 was propelled by a combination of growing institutional participation and significant network improvements. The addition of ZEC to the Bitget exchange and the prospect of a Grayscale ZEC ETF signaled increased institutional confidence, drawing in professional investors interested in privacy-focused assets. At the same time, upgrades to the Zcash network—such as the introduction of the Zashi wallet—made private transactions more accessible, appealing to users concerned about surveillance in the digital economy.

These advancements occurred alongside a broader shift: privacy coins outperformed leading cryptocurrencies like Bitcoin by 71.6% in 2025, fueled by capital rotation and a surge in demand for confidential financial solutions.

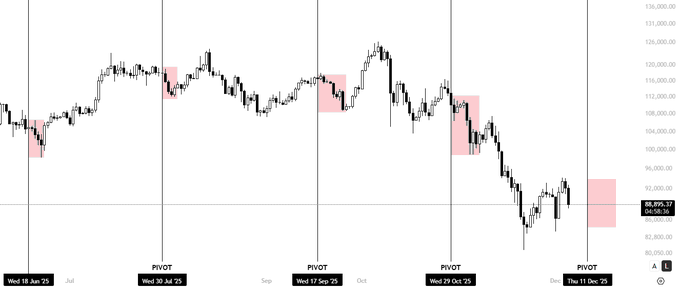

Nevertheless, warning signs accompanied the rally. Technical patterns, including a double-top formation at $740 and a subsequent "three black crows" bearish signal, pointed to looming volatility. Although ZEC briefly rebounded near $309, it struggled to regain crucial support levels, casting doubt on the strength of its upward momentum.

Regulatory Hurdles and Market Fragmentation

The privacy coin market faces a fundamental dilemma: maintaining user anonymity while meeting regulatory requirements. Zcash's model, which lets users choose between transparent and shielded transactions, makes it more acceptable to regulators compared to Monero (XMR), which automatically conceals all transaction details. Despite this, global regulatory sentiment remains largely unfavorable. The European Parliament's move to limit privacy coins on regional exchanges by 2027, along with U.S. proposals for stricter oversight of unhosted wallets, has fostered an atmosphere of uncertainty.

This regulatory scrutiny has deepened the fragmentation of the market. Centralized exchanges such as Poloniex have removed privacy coins, pushing liquidity toward decentralized platforms. ZEC's price swings reflect this instability: after soaring 1,300% from $44 to $660 in late 2025, it dropped 32% within a week, a decline triggered by concentrated long positions and rapid liquidations. Such volatility underscores the risks associated with assets that have limited liquidity and face regulatory ambiguity.

Macroeconomic Influences and Institutional Interest

Beyond regulatory challenges, macroeconomic trends have also boosted demand for privacy coins. In 2025, as inflation affected traditional markets like the S&P 500 and gold, institutional investors sought alternatives. The introduction of products such as the Grayscale Zcash Trust made it easier for accredited investors to gain exposure to ZEC without dealing with complex custody arrangements. This pattern mirrors Bitcoin's rise, where regulatory clarity and favorable economic conditions enhanced its legitimacy.

However, the broader economic landscape also brings risks. Zcash's price is highly responsive to overall market cycles, and its recent surge has been partly attributed to speculative "pump-and-dump" activity. While Zcash's use of zero-knowledge proofs (ZKPs) provides a technological advantage, adoption remains limited, restricting its appeal to mainstream investors.

Balancing Long-Term Potential and Short-Term Speculation

ZEC's future depends on its ability to manage both regulatory and market pressures. From a technical perspective, reclaiming the $375 support level could spark a rally toward $475, but falling below $260 would confirm a bearish outlook. Optimism for the long term is tempered by the reality that privacy coins represent a small, divided segment of the crypto market. Although Zcash's dual-address system offers regulatory flexibility, adoption of shielded transactions is progressing slowly, limited by user habits and compliance requirements worldwide.

The larger question is whether privacy will remain a specialized concern or become a mainstream financial necessity. As authorities enhance surveillance, demand for privacy-focused tools may persist, but institutional investors will need clearer regulatory guidance before increasing their involvement. For ZEC, the challenge lies in balancing innovation with compliance—a dynamic that will shape its prospects for years to come.

Summary

Zcash's recent rally reflects a mix of institutional interest, technical improvements, and supportive macroeconomic trends. Yet, its long-term success is closely tied to how regulatory issues are resolved and how the privacy coin ecosystem evolves. In a market marked by fragmentation, ZEC's flexible privacy model offers a competitive edge, but maintaining momentum will require adapting to changing compliance standards and economic conditions. For investors, the message is clear: while ZEC's price swings may offer speculative opportunities, its enduring value will depend on its ability to navigate the ongoing tension between privacy and regulation in the financial world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Bitcoin Price Is Down Today: The Unexpected Market Move No One Saw Coming

Crypto Market Panic Grows as Fear Index Hits Extreme Lows, Is Bitcoin Entering a Bear Market?

Algorand (ALGO) Gains 1.76% Over the Past Week Despite Market Fluctuations

- Algorand (ALGO) rose 1.76% weekly to $0.1326 but fell 60.33% annually amid broader crypto market declines. - ApeX Protocol's Dec 12 delisting of BABY/HOME tokens risks liquidity shocks, indirectly affecting ALGO market sentiment. - Other fintech/entertainment events had no direct impact on ALGO's price or trading dynamics. - Analysts highlight ALGO's long-term potential in DeFi despite bearish 1-month/1-year trends and macroeconomic uncertainties.

LUNA Value Jumps 20.24% as Rumors Swirl About Possible SBF Clemency

- Terra's LUNA token surged 20.24% in 24 hours, linked to speculation about a potential pardon for FTX founder Sam Bankman-Fried. - The 2022 UST depegging caused a $45B collapse, leading to legal actions against Terraform Labs' co-founder Do Kwon. - Rebranded LUNA (Terra 2.0) outperforms Luna Classic (LUNC), reflecting post-2022 restructuring efforts. - SBF's legal status fuels market volatility, with Kwon's December 2025 sentencing and regulatory scrutiny shaping crypto sentiment. - LUNA remains volatile