SEC Begins Privacy Debate With Zcash-Led Roundtable

Industry voices say the SEC's privacy session signals a rare opportunity to shape oversight while preserving civil-liberty protections.

The US Securities and Exchange Commission (SEC) will hold its delayed roundtable on financial surveillance and privacy on December 15.

This sets the stage for one of the agency’s most direct engagements yet with the builders of privacy-focused crypto systems.

SEC Opens Door to Privacy Tech

The SEC said the session will examine how privacy-preserving technologies work. It will also explore how those tools intersect with existing surveillance expectations in financial markets.

The SEC's Crypto Task Force is holding a roundtable on financial surveillance and privacy on Dec. 15.See agenda, panelists, and registration details:

— U.S. Securities and Exchange Commission (@SECGov)

Zooko Wilcox, founder of Zcash, is expected to present at the event. Other participants include Aleo Network Foundation CEO Alex Pruden, Predicate CEO Nikhil Raghuveera, and SpruceID founder Wayne Chang.

Meanwhile, their involvement underscores the agency’s attempt to gather input from teams building zero-knowledge proofs, identity systems, and private computation frameworks.

Moreover, Hester Peirce, who leads the SEC’s crypto task force, said the agency wants a clearer view of the tools that shape modern digital transactions. She added that fresh insight could help the financial agency rethink its oversight approach without constraining civil liberties.

“New technologies give us a fresh opportunity to recalibrate financial surveillance measures to ensure the protection of our nation and the liberties that make America unique,” she stated.

Her comments mark one of the clearest signals that the agency is weighing how privacy infrastructure fits into broader digital-asset policy.

Interest in Privacy Token Spikes

Craig Salm, Chief Legal Officer at Grayscale, said the roundtable is also an opportunity for the industry to demonstrate that privacy protocols can coexist with regulatory goals.

Salm said active engagement with policymakers is essential for teams that worry about existential regulatory risk. He added that this type of forum gives real meaning to the long-standing call for crypto firms to “come in and talk to us.”

Interest in privacy tools has surged this year as regulators in multiple regions expand monitoring requirements. The trend has prompted many crypto users to adopt systems that conceal transaction details or restrict data exposure.

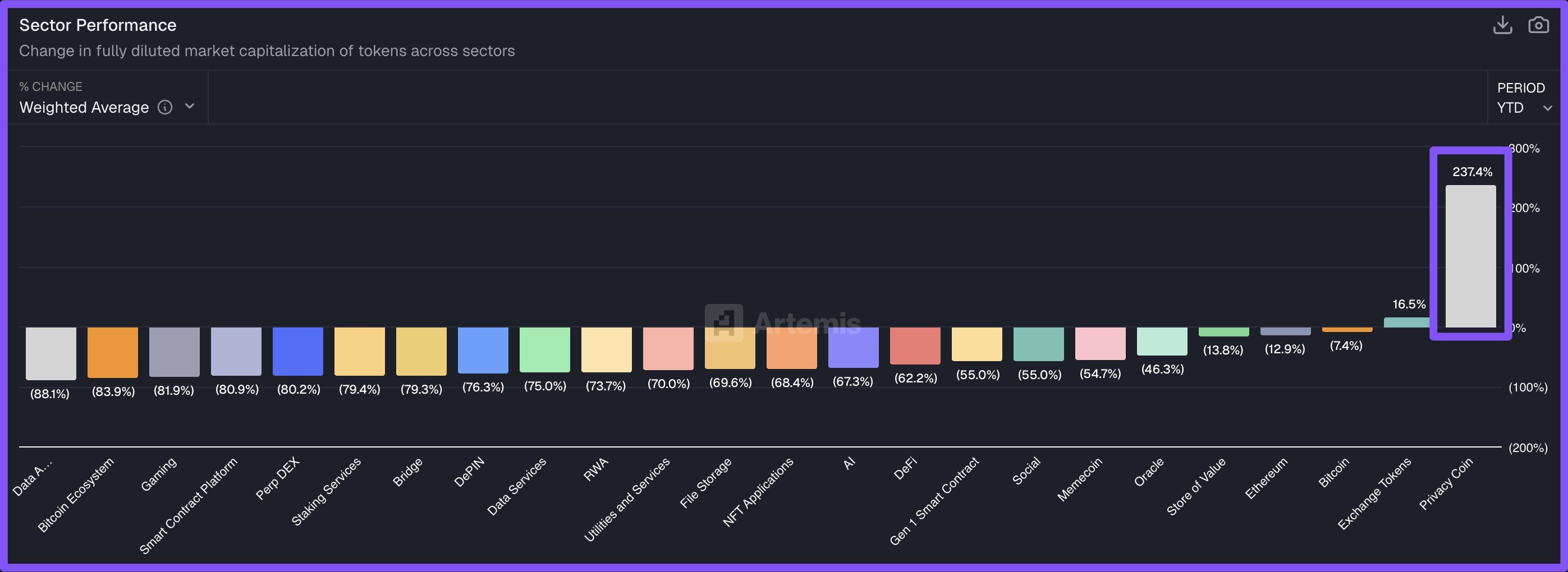

That shift is visible in market performance.

Artemis data shows that privacy-focused tokens have climbed more than 237% in 2025. The gains are driven in part by strong rallies in Zcash, Monero, and other projects at the center of the debate.

Privacy Tokens Outperform Crypto Market. Source:

Privacy Tokens Outperform Crypto Market. Source:

The roundtable signals that the SEC now recognizes privacy technologies as a central part of the crypto market structure. It also shows that policy decisions made today will shape how those systems scale in the years ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ASTR Price Rally: Can Astar Achieve Sustainable Expansion by 2025?

- Astar (ASTR) navigates 2025's volatile crypto market with strategic upgrades and deflationary tokenomics. - Institutional investments and cross-chain innovations boost ASTR's enterprise adoption and DeFi growth. - Partnerships with Sony , Toyota , and NTT Docomo expand ASTR's real-world utility in logistics and digital identity. - Analysts project long-term price growth, though short-term volatility and market sentiment remain risks.

Green Energy Implementation and Urban Dispersal in Developing Economies

- Global investment in sustainable infrastructure is accelerating in emerging markets through electric transit, decentralized energy, and shared mobility solutions. - India leads with 9,714 electric buses (2024) under government schemes, reducing fossil fuel dependence and urban pollution in decentralized networks. - African and South Asian DRE projects, backed by $16M U.S. funding and $495M guarantees, address energy poverty while enabling industrial resilience. - Shared electric mobility in Hanoi, Jakart

Solana Pushes DeFi Forward as RockawayX Launches RWA Vaults

Quick Take Summary is AI generated, newsroom reviewed. RockawayX launches RWA vaults on Solana. Kamino, Exponent Finance, and Midas RWA power the vault infrastructure. The vaults offer tokenized yield from assets like treasuries and home equity loans. Solana’s low fees and fast execution enable scalable RWA products.References X Ref

XRP Spot ETFs Add $20M in One Day as Total Inflows Hit $213M

Quick Take Summary is AI generated, newsroom reviewed. U.S.-listed XRP spot ETFs had a net inflow of $20.17 million on December 12, raising total cumulative inflows to $213 million. Total net assets across the funds reached $1.18 billion, accounting for almost 1% of XRP's total market capitalization. Franklin's XRP ETF led the daily inflows, adding $8.7 million, followed by Bitwise with $7.85 million. The steady accumulation trend suggests long-term demand from institutional investors focused on regulated