New ETF Proposal Targets Bitcoin’s Overnight Returns as Outflows Hit Record Levels

Tidal Trust II has filed with the US Securities and Exchange Commission (SEC) for a Bitcoin exchange-traded fund (ETF) designed to provide exposure when US markets are closed. The filing comes as spot BTC ETFs posted their weakest month on record, marked by heavy outflows and rising concerns about potential price manipulation during the US

Tidal Trust II has filed with the US Securities and Exchange Commission (SEC) for a Bitcoin exchange-traded fund (ETF) designed to provide exposure when US markets are closed.

The filing comes as spot BTC ETFs posted their weakest month on record, marked by heavy outflows and rising concerns about potential price manipulation during the US market open.

SEC Filing Reveals ETF That Seeks to Bet on Bitcoin After Hours

The Form N-1A, submitted on Tuesday, proposes to add two ETFs to the existing fund. These include Nicholas Bitcoin and Treasuries AfterDark ETF and Nicholas Bitcoin Tail ETF.

According to the registration statement, the AfterDark ETF will not hold BTC directly. Instead, it will gain exposure through investments in Bitcoin futures, Bitcoin options, and Bitcoin ETFs or ETPs listed in the US.

It may utilize a Cayman Islands subsidiary to manage its positions. The objective is to pursue long-term capital appreciation through a systematic approach that targets Bitcoin’s overnight return profile. Meanwhile, the fund will hold short-term US Treasuries and cash equivalents during the daytime trading period.

“When utilizing Bitcoin Futures, the Fund trades these instruments during US overnight hours and closes them out shortly after the US market opens each trading day. When utilizing Bitcoin Underlying Funds, the Fund purchases a security at US market close, and then sells the position around US market open….When utilizing Bitcoin Options, the Fund typically enters into options positions that establish a synthetic long bitcoin position near the close of regular US trading hours. These positions are typically closed or unwound near the following market open, however, the Fund may hold these synthetic long positions longer term and offset them during US daytime trading hours by entering into a synthetic short position,,” the document reads.

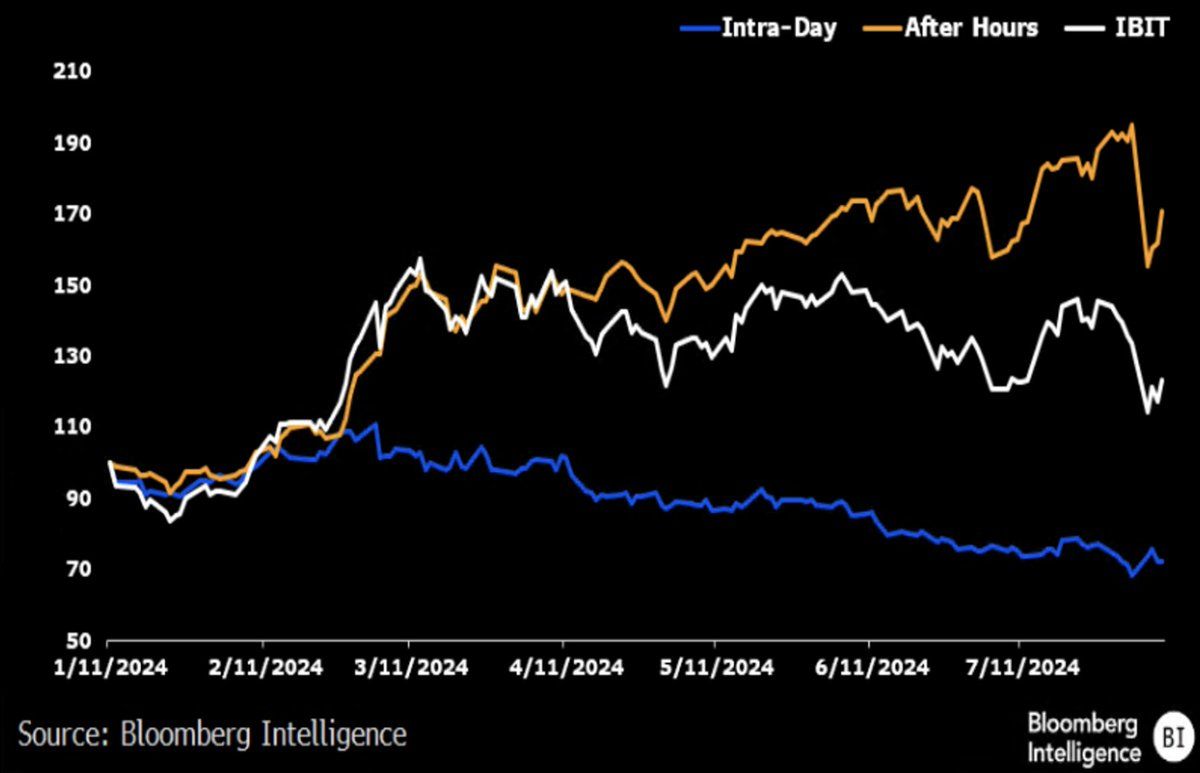

Bloomberg senior ETF analyst Eric Balchunas discussed the strategy in a recent X (formerly Twitter) post. He noted that internal research conducted last year showed a significant share of Bitcoin’s gains occurring during after-hours trading.

“Doesn’t mean the ETFs aren’t having impact. Some of this is positioning bc of the ETFs etc or derivatives based on flows etc etc. But yeah, bitcoin After Dark ETF could put up better returns, we’ll see tho,” Balchunas wrote.

Bitcoin After-Hours Returns. Source:

Bitcoin After-Hours Returns. Source:

This filing appears as industry watchers highlight alleged price manipulation during US daytime trading hours. Analysts have identified a recurring pattern of Bitcoin price drops around the market’s opening.

Bitcoin ETF Flows and Investor Sentiment Shift

Meanwhile, spot Bitcoin ETFs have been under significant pressure in the fourth quarter. Data from SoSoValue showed that monthly outflows reached a record $3.48 billion in November. BlackRock’s iShares Bitcoin ETF accounted for the largest share, recording $2.34 billion in outflows.

The heavy withdrawals coincided with a steep decline in Bitcoin’s price, which fell 17.4% in November, its worst monthly performance of the year. This has impacted investor confidence and contributed to renewed caution across digital asset markets.

Outflows extended into December, with another $87.77 million leaving spot Bitcoin ETFs in the first week of the month. Still, the trend showed some signs of stabilizing. On December 9, the funds posted a notable rebound, drawing $151.74 million in inflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Prospects in EdTech and Advancements in STEM Career Training

- Global EdTech market to grow from $277B to $907B by 2034, driven by AI, cybersecurity, and engineering education. - U.S. universities expand AI programs (114% growth since 2024) while states integrate AI into K-12 curricula to address 750K cybersecurity job shortage. - Federal and corporate investments ($18.5B U.S. AI Action Plan, IBM's 2M-trainee goal) create innovation ecosystems aligning education with AI-driven workforce needs. - Mentorship programs and federal grants (e.g., Cybersecurity Talent Init

Wellness-Driven Industries: A Profitable Intersection of Individual Health and Economic Wellbeing

- The global wellness industry, valued at $2 trillion, is reshaping healthcare , tech, and education through holistic well-being integration. - Younger generations drive 41% of U.S. wellness spending, prioritizing mental resilience and financial stability alongside physical health. - AI and wearables bridge health and financial wellness, with startups like Akasa and Meru Health leveraging tech for personalized solutions. - Education institutions adopt wellness programs, supported by public-private partners

Financial Well-being and Investment Choices: The Impact of Individual Financial Stability on Market Involvement and Building Lasting Wealth

- Financial wellness, combining objective health and subjective well-being, directly influences market participation and investment success according to 2025 studies. - Four financial wellness quadrants reveal systemic gaps: only 38% achieve high health and well-being, while millennials show mixed confidence amid rising debt and stagnant wages. - Behavioral biases affect all investors: 84% of high-net-worth individuals seek education to counter overconfidence, while young investors rely on social media for

The Growing Impact of Artificial Intelligence on Learning and Professional Development

- Global AI in education market to grow from $7.57B in 2025 to $32.27B by 2030 (31.2% CAGR), driven by classroom AI adoption and workforce training. - Asia-Pacific leads growth (35.3% CAGR), with 60% U.S. teachers and 86% global students using AI for personalized learning and content summarization. - Institutions like Farmingdale State College pioneer AI integration through interdisciplinary programs and NSF-funded ethical AI research initiatives. - Strategic partnerships (e.g., IBM-Pearson) and platforms