Will Cardano Explode Soon?

Cardano price has spent weeks in a tight range, leaving traders wondering if the worst is finally over. With the Federal Reserve poised to make a key rate cut next week and inflation data showing early signs of cooling, the macro backdrop could be shifting in ADA price favor. The question now is simple— can Cardano price turn this moment into the start of a real recovery, or will it stay trapped in its sideways drift near $0.41?

Cardano Price prediction: Market Overview

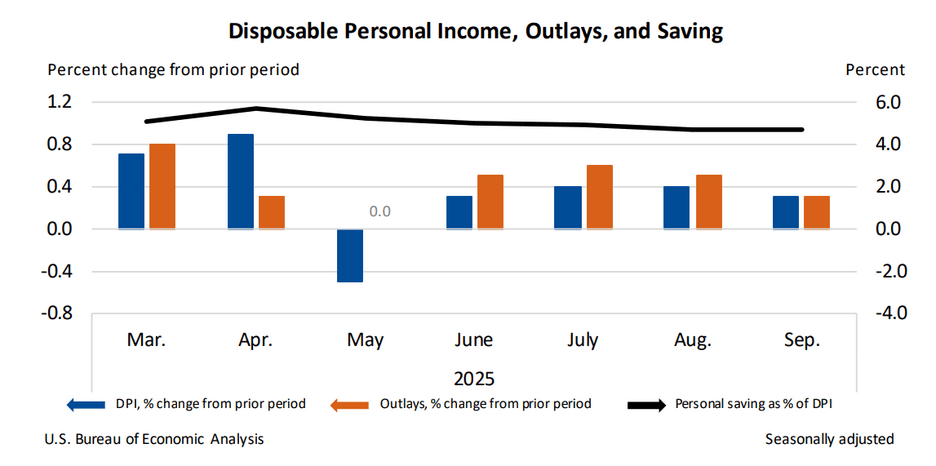

Cardano (ADA) price has been moving sideways near the $0.41 mark, struggling to break above key resistance as broader market sentiment hangs on upcoming Federal Reserve decisions. The latest inflation report confirmed that the U.S. economy remains hotter than the Fed would like, yet the central bank is widely expected to cut interest rates next week—a shift that could inject fresh liquidity into risk assets like cryptocurrencies.

If the Fed follows through, it could act as a short-term bullish trigger for ADA and the broader market, reversing the sluggish performance seen over the past month.

Cardano Price Prediction: Still in Recovery Mode

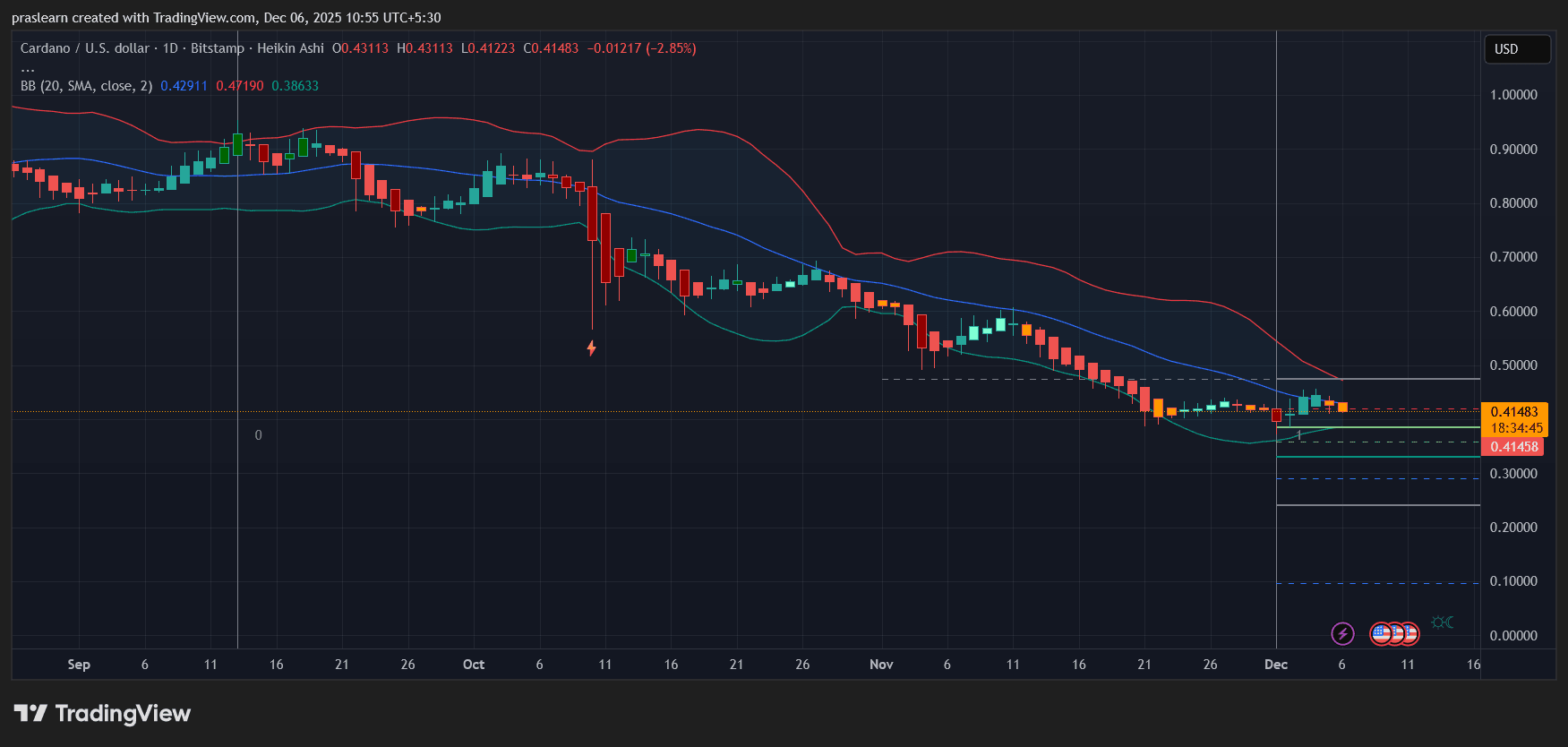

ADA/USD Daily Chart- TradingView

ADA/USD Daily Chart- TradingView

On the daily chart, Cardano price trades around $0.414, slightly below its 20-day moving average (blue line), which now serves as resistance near $0.43. The Bollinger Bands are tightening, signaling reduced volatility and hinting at a possible breakout phase ahead. However, price candles remain clustered just above the lower band, suggesting that buyers have not yet regained full control.

The recent consolidation zone between $0.38 and $0.43 shows that ADA has built a temporary base after weeks of steady decline. The previous downtrend began from the $0.70 zone in late September, breaking below the mid-Bollinger level and dragging the coin into a long corrective stretch. If ADA price sustains above $0.40, a rebound toward the upper Bollinger limit near $0.47 becomes likely. A daily close above that could open the way to $0.50–$0.52, which aligns with the next visible resistance range.

Macro Impact: Why Fed Policy Matters for ADA

The Fed’s upcoming rate decision is the wild card. A rate cut typically boosts liquidity and investor appetite for riskier assets, especially in crypto markets. Since ADA is highly correlated with Bitcoin and the overall risk environment, any dovish tone from the Fed could push ADA price into a short-term rally.

The key point here is that core inflation easing slightly gives the Fed room to prioritize economic stability. If markets interpret this as the start of a broader easing cycle, Cardano price and other altcoins could benefit from renewed capital inflows.

Short-Term Outlook: Watch for Confirmation

ADA’s immediate support lies around $0.38 , a critical zone that has held through multiple tests. If this level breaks, the next downside targets sit at $0.34 and $0.30, as shown by historical chart lows. On the upside, a decisive breakout above $0.47 could signal the start of a trend reversal, confirming a move toward the $0.50–$0.55 region.

Volume remains subdued, indicating that most traders are waiting for confirmation from the Fed before taking new positions. The Heikin Ashi candles show mixed momentum, with smaller bodies and fading red color—early signs of exhaustion in the selling trend.

Cardano’s chart suggests the worst of its recent downtrend may be behind it, but momentum is still fragile. The macro backdrop—cooling core inflation and a potential Fed rate cut—offers $ADA a much-needed window for recovery.

If the Fed confirms its dovish stance and Bitcoin reacts positively, $Cardano price could climb toward the $0.47–$0.50 zone in the short term. Failure to hold $0.38, however, would invalidate the bullish setup and risk a slide back to $0.30.

For now, ADA price sits at a pivotal level—quiet before the potential storm of Fed-driven volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Dynamics and Investment Prospects: The Role of CFTC-Approved Platforms in Facilitating Institutional Participation

- CFTC-approved platforms like CleanTrade are transforming clean energy markets by standardizing derivatives and centralizing trading infrastructure, boosting institutional liquidity and transparency. - CleanTrade’s SEF designation in September 2025 enabled $16B in notional trades within two months, converting illiquid assets like RECs into tradable commodities with ESG-aligned risk management tools. - Institutional demand surged as 70% of large asset owners integrated climate goals, with IRA-driven clean

The Growing Significance of Financial Well-Being in Planning for Lasting Wealth

- Financial wellness is redefining long-term wealth planning by integrating personal well-being with financial outcomes. - Intentional habits and AI-driven tools boost resilience, reducing behavioral underperformance by 2.5% annually. - Debt management via sustainable finance mitigates risks, especially in developing economies with robust policies. - Early financial education and four-quadrant frameworks balance objective metrics with subjective well-being. - Technology and financial therapy bridge gaps, e

The Rise of Liquid Clean Energy Markets and Their Impact on Investment Opportunities

- Global energy transition accelerates liquid clean energy markets, reshaping institutional investment strategies with ESG-aligned assets. - U.S. DOE and private firms advance infrastructure, including fusion and hydrogen projects, addressing scalability and reliability. - RESurety’s CFTC-approved CleanTrade platform boosts transparency and liquidity in clean energy derivatives, enabling $16B in trading. - Institutional investors diversify portfolios with clean energy derivatives, leveraging ESG compliance

Anthropology-Inspired Advancements in Higher Education: The Impact of Cross-Disciplinary Research on Student Success and Institutional Worth

- Farmingdale State College integrates anthropology with STEM/edtech to cultivate critical thinking and cross-disciplinary skills, aligning with evolving workforce demands. - Its Anthropology Minor (15 credits) and STS program emphasize cultural context, societal implications of technology, and data-driven problem-solving for STEM-aligned careers. - Partnerships like the $1.75M Estée Lauder collaboration and $75M Computer Sciences Center demonstrate how interdisciplinary approaches attract investment and a