Whales Are Going All-In on Ethereum — But Record Leverage Puts Their Longs at Risk

After the FED announced interest rate cuts, major whale wallets began pouring capital into long positions on Ethereum (ETH). These moves signal strong confidence in ETH’s upside. They also increase overall risk. Several factors suggest that their long positions may face liquidation soon without effective risk management. How Confident Are Whales in Their Ethereum Long

After the FED announced interest rate cuts, major whale wallets began pouring capital into long positions on Ethereum (ETH). These moves signal strong confidence in ETH’s upside. They also increase overall risk.

Several factors suggest that their long positions may face liquidation soon without effective risk management.

How Confident Are Whales in Their Ethereum Long Positions?

Whale behavior offers a clear view of current sentiment.

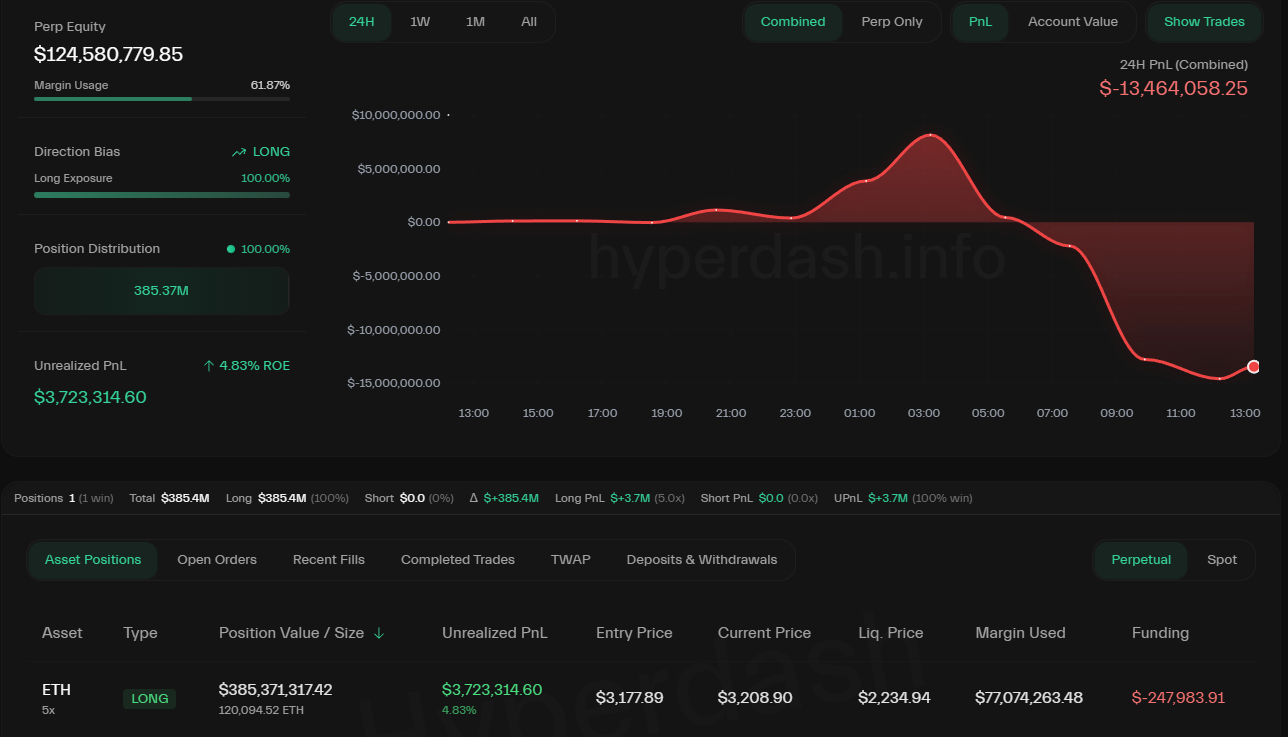

On-chain tracking account Lookonchain reported that a well-known whale, considered a Bitcoin OG, recently expanded a long position on Hyperliquid to 120,094 ETH. The liquidation price sits at only $2,234.

This position is currently showing a 24-hour PnL loss of more than $13.5 million.

A Whale’s Long ETH Position on Hyperliquid. Source:

HyperDash

A Whale’s Long ETH Position on Hyperliquid. Source:

HyperDash

Similarly, another well-known trader, Machi Big Brother, is maintaining a long position worth 6,000 ETH with a liquidation price of $3,152.

Additionally, on-chain data platform Arkham reported that the Chinese whale trader who called the 10/10 market crash is now holding a $300 million ETH long position on Hyperliquid.

Whale activity in ETH long positions reflects their expectation of a near-term price increase. However, behind this optimism lies a significant risk stemming from Ethereum’s leverage levels.

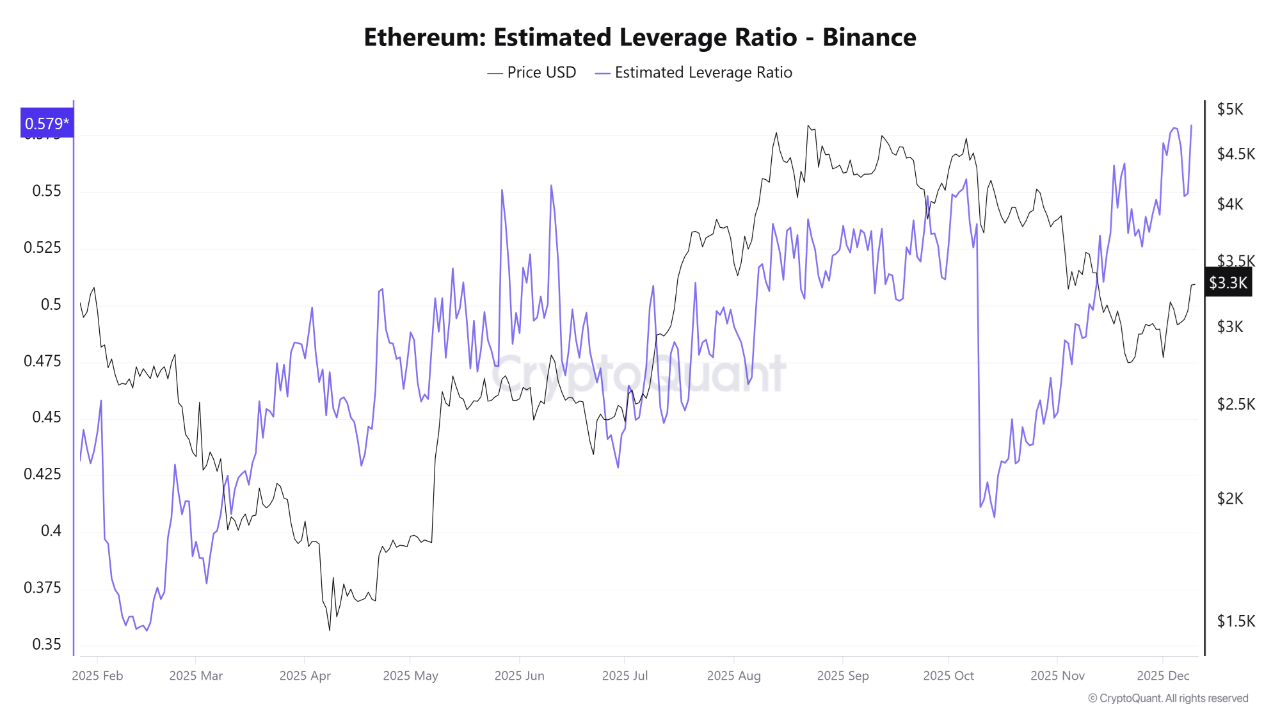

ETH Leverage Is Reaching Dangerous Highs

CryptoQuant data shows that ETH’s estimated leverage ratio on Binance has reached 0.579 — the highest in history. This level indicates extremely aggressive leverage usage. Even a small price swing could trigger a domino effect.

Ethereum Estimated Leverage Ratio – Binance. Source:

CryptoQuant

Ethereum Estimated Leverage Ratio – Binance. Source:

CryptoQuant

“Such a high leverage ratio means that the volume of open contracts financed by leverage is rising faster than the volume of actual assets on the platform. When this occurs, the market becomes more vulnerable to sudden price movements, as traders are more susceptible to liquidation—whether in an upward or downward trend,” analyst Arab Chain said.

Historical data indicate that similar peaks typically coincide with periods of intense price pressure and often signal local market tops.

Spot Market Weakness Adds More Risk

The spot market is also showing clear signs of weakening. Crypto market watcher Wu Blockchain reported that spot trading volume on major exchanges dropped 28% in November 2025 compared to October.

November Exchange Data Report: Spot trading volume of major exchanges in November 2025 fell 28% compared with October. The top three exchanges by change rate were Bitfinex +17%, Coinbase -8%, and KuCoin -17%. The bottom three were Bitget -62%, Gate -44%, and MEXC -34%.…

— Wu Blockchain (@WuBlockchain) December 10, 2025

Another report from BeInCrypto highlighted that stablecoin inflows into exchanges have declined by 50%, falling from $158 billion in August to $ 78 billion as of today.

Combined, low spot buying power, high leverage, and shrinking stablecoin reserves reduce ETH’s ability to recover. These conditions could put whale long positions at significant risk of liquidation.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aligning Universities with Emerging Industries: The Critical Need for STEM Investment

- Global industries demand AI, renewable energy, and biotech skills faster than traditional education systems can supply, creating a critical skills gap. - Universities like MIT and Stanford are embedding AI across STEM curricula while industry partnerships accelerate hands-on training in automation and biomanufacturing. - Renewable energy programs with apprenticeships and public-private funding are addressing talent shortages as $386B global investments outpace workforce readiness. - Biotech's fragmented

PENGU Token Value Soars: Blockchain Data and Institutional Interest Indicate Optimal Timing for Investment

- PENGU ranks #81 with $706.5M market cap, showing rising institutional interest and whale accumulation. - The pending Canary PENGU ETF, if approved, could unlock institutional capital by including NFTs in a U.S. ETF. - Mixed on-chain signals (RSI 38.7, OBV growth) and 2B tokens moved from team wallets highlight uncertainty. - Partnerships with Care Bears and Lufthansa, plus Bitso collaboration, expand utility but face regulatory risks. - Recent 8.55% price rebound and 2.6% gain post-BNB listing suggest ca

Evaluating How the COAI Token Scandal Influences Cryptocurrency Regulatory Policies

- COAI Token's 88% price crash and $116.8M loss exposed systemic risks in centralized AI-DeFi projects with opaque governance. - Global regulators responded with stricter frameworks, including EU's MiCA and Singapore's asset freezes, to address jurisdictional gaps. - Institutional investors now prioritize compliance, with 55% of hedge funds allocating to digital assets via tokenized structures in 2025. - Emerging solutions include AI-driven risk platforms and anthropological governance models to enhance tr

Higher-Timeframe Support Holds Strong—5 Altcoins Set for a Possible 30%–55% Surge Once 20-Day MA Breaks