Litecoin Is Being Ignored by Retail — While Institutions Quietly Accumulate 3.7 Million LTC

Litecoin (LTC) has not escaped the shadow of its long downtrend since 2021. Its weak price performance has caused many retail investors to overlook this “legacy” altcoin. However, new reports reveal quietly growing positive signals. These signals form the basis for analysts to predict that the price may soon break above $100. Institutions Accumulate 3.7

Litecoin (LTC) has not escaped the shadow of its long downtrend since 2021. Its weak price performance has caused many retail investors to overlook this “legacy” altcoin.

However, new reports reveal quietly growing positive signals. These signals form the basis for analysts to predict that the price may soon break above $100.

Institutions Accumulate 3.7 Million LTC Despite Falling Prices

This year, as companies and institutions expand their digital-asset reserves and launch crypto ETFs, Litecoin has also joined this trend.

According to data from Litecoin Register, by the end of 2025, Treasuries and ETFs held nearly 3.7 million LTC. The total value exceeded $296 million.

Total Treasury & ETF Holdings (LTC). Source:

Litecoin Register

Total Treasury & ETF Holdings (LTC). Source:

Litecoin Register

“There are now over 3.7 million Litecoin being held in 10 public companies and investment funds. An increase of one million LTC since August 2025,” the Litecoin Foundation commented.

The chart illustrates a persistent accumulation over the past year. This trend continued even though LTC has not set a new high in 2025.

Notable holders include Grayscale, Lite Strategy, and Luxxfolio Holdings. Luxxfolio Holdings aims to accumulate 1 million LTC by 2026.

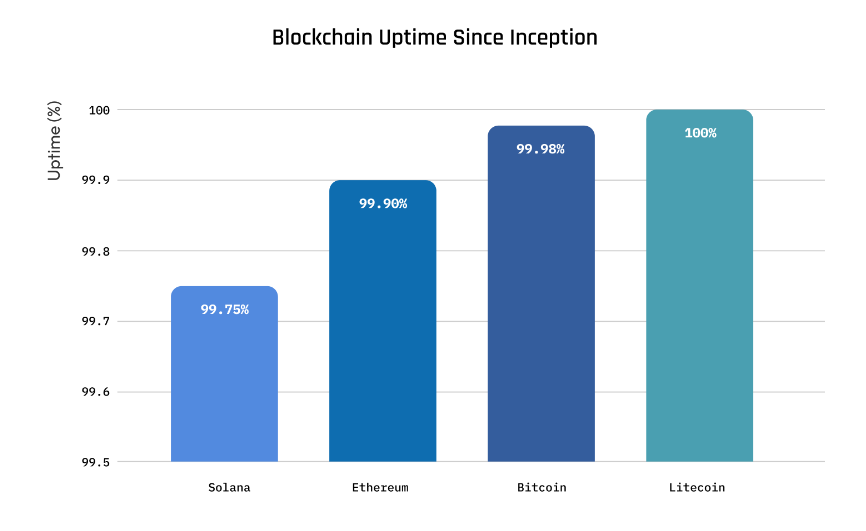

In addition, the “Silver Standard” report from LitVM highlights Litecoin as the blockchain with the highest uptime among legacy networks. It has maintained 100% uptime for the past 12 years.

Blockchain Uptime Since Inception. Source:

LitVM

Blockchain Uptime Since Inception. Source:

LitVM

Uptime measures the duration of a network’s continuous operation without interruption. A blockchain with high uptime demonstrates system stability, security, and reliability in processing transactions without technical failures.

“Institutions want sound money. They want LTC’s 12-year reliability,” investor Creed stated.

Fundamental data does not always create an immediate short-term impact. However, the short-term outlook from derivatives markets appears highly positive.

Binance top traders are rapidly increasing their $LTC long positions.

— CW (@CW8900) December 12, 2025

Top traders on Binance rapidly increased long LTC positions in the second week of December. Their behavior signals strong bullish expectations.

These factors may explain why several long-time investors continue to trust LTC. A crypto investor active since 2015, Lucky, believes that LTC will recover soon.

“I don’t see $LTC staying below $100 for much longer,” Lucky predicted.

Litecoin price recovery scenario. Source:

Lucky

Litecoin price recovery scenario. Source:

Lucky

LTC’s situation resembles that of several altcoins with strong fundamentals but slow price action, such as XRP, XLM, LINK, and INJ.

Experts also argue that only altcoins supported by liquidity from DATs and ETFs can survive and grow sustainably in the new phase of the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Dynamics and Investment Prospects: The Role of CFTC-Approved Platforms in Facilitating Institutional Participation

- CFTC-approved platforms like CleanTrade are transforming clean energy markets by standardizing derivatives and centralizing trading infrastructure, boosting institutional liquidity and transparency. - CleanTrade’s SEF designation in September 2025 enabled $16B in notional trades within two months, converting illiquid assets like RECs into tradable commodities with ESG-aligned risk management tools. - Institutional demand surged as 70% of large asset owners integrated climate goals, with IRA-driven clean

The Growing Significance of Financial Well-Being in Planning for Lasting Wealth

- Financial wellness is redefining long-term wealth planning by integrating personal well-being with financial outcomes. - Intentional habits and AI-driven tools boost resilience, reducing behavioral underperformance by 2.5% annually. - Debt management via sustainable finance mitigates risks, especially in developing economies with robust policies. - Early financial education and four-quadrant frameworks balance objective metrics with subjective well-being. - Technology and financial therapy bridge gaps, e

The Rise of Liquid Clean Energy Markets and Their Impact on Investment Opportunities

- Global energy transition accelerates liquid clean energy markets, reshaping institutional investment strategies with ESG-aligned assets. - U.S. DOE and private firms advance infrastructure, including fusion and hydrogen projects, addressing scalability and reliability. - RESurety’s CFTC-approved CleanTrade platform boosts transparency and liquidity in clean energy derivatives, enabling $16B in trading. - Institutional investors diversify portfolios with clean energy derivatives, leveraging ESG compliance

Anthropology-Inspired Advancements in Higher Education: The Impact of Cross-Disciplinary Research on Student Success and Institutional Worth

- Farmingdale State College integrates anthropology with STEM/edtech to cultivate critical thinking and cross-disciplinary skills, aligning with evolving workforce demands. - Its Anthropology Minor (15 credits) and STS program emphasize cultural context, societal implications of technology, and data-driven problem-solving for STEM-aligned careers. - Partnerships like the $1.75M Estée Lauder collaboration and $75M Computer Sciences Center demonstrate how interdisciplinary approaches attract investment and a