Bitcoin Four-Year Cycle Now Driven by Politics and Liquidity

Bitcoin’s well-known four-year cycle is still intact, but its drivers have shifted. According to Markus Thielen, head of 10x Research, political events and liquidity now play a bigger role than halving events. Historically, the cryptocurrency’s market peaks have begun to align more closely with US election cycles.

From Halving to Politics

Bitcoin’s four-year cycle was once mainly influenced by halving events. Halving reduces the rewards miners receive, which historically caused supply shocks and price increases. However, Thielen says that halving no longer drives market peaks as strongly as it used to.

Instead, political developments, government policies, and liquidity conditions now shape Bitcoin’s price movement. Elections, fiscal stimulus, and interest rate changes affect investor sentiment and cash flow, which in turn influence crypto markets.

Why US Elections Matter

Thielen points out that Bitcoin’s historical highs often coincide with US election years. Investors pay close attention to fiscal and monetary policies during elections. Decisions about taxation, regulation, and financial stimulus can directly affect market liquidity.

For example, periods of political uncertainty or large stimulus packages have historically led to higher trading volumes and price volatility in Bitcoin. As a result, US elections have become a key timing factor for market peaks.

Liquidity and Bitcoin Behavior

Liquidity now plays a critical role in Bitcoin’s four-year cycle. When cash flow in the system increases, investors often allocate more funds to high-risk assets like cryptocurrencies. Conversely, tighter liquidity can slow market momentum.

Thielen emphasizes that this change reflects Bitcoin’s maturation. The market now reacts more to macroeconomic trends than to purely technical supply events. In other words, Bitcoin has evolved from being a scarcity-driven asset to one influenced by the broader financial environment.

Understanding Bitcoin’s Evolving Four-Year Cycle

Investors should consider political calendars and liquidity conditions when analyzing Bitcoin cycles. While halving events still have symbolic and technical significance, broader market forces are increasingly important.

Thielen’s insights suggest that Bitcoin’s four-year cycle remains a useful guide, but it now requires a more nuanced understanding of external factors. Traders and long-term investors may benefit from combining traditional cycle analysis with macroeconomic and political awareness.

As Bitcoin continues to integrate into mainstream finance, cycles driven by politics and liquidity could become the new norm. Awareness of these patterns may help investors anticipate market peaks more accurately than relying on halving events alone.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

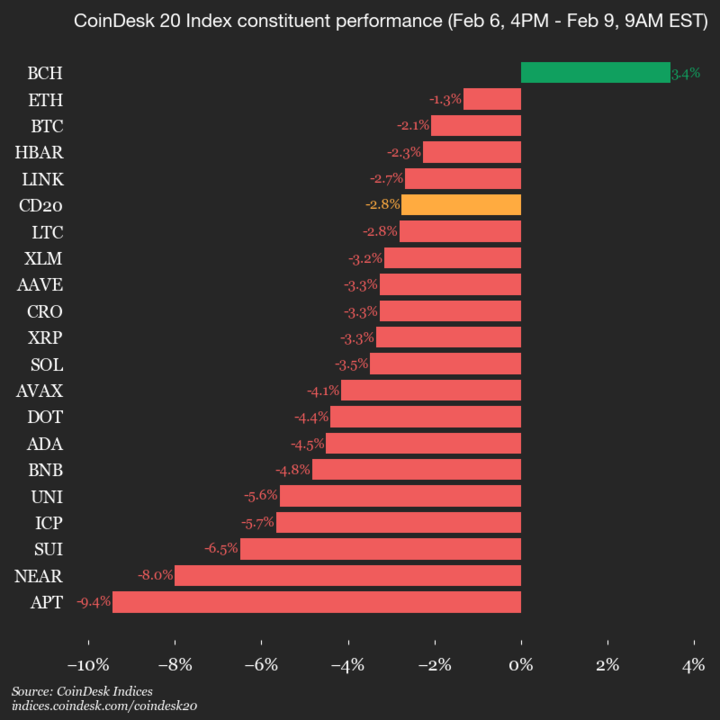

CoinDesk 20 performance update: Bitcoin Cash (BCH) stands out as the sole winner, rising by 3.4%

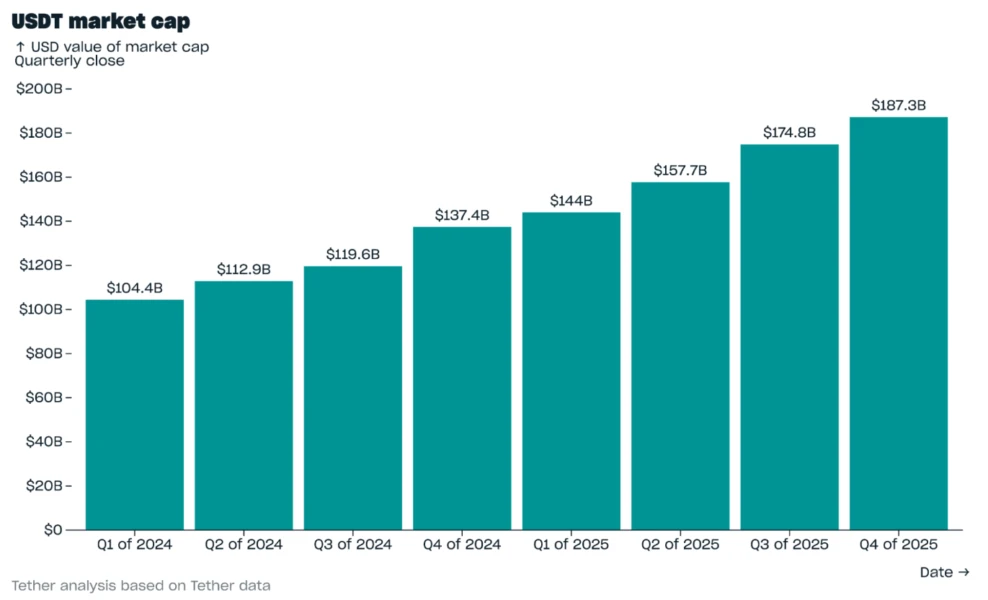

Tether USDT Expands Across Key Metrics as Rival Stablecoins Stall in Q4 2025

US job market outlook sees modest improvement; near-term inflation expectations ease

Ripple RLUSD Powers Bitso’s XRP Payments, Unlocking Near-Instant US-LATAM Flows