Bitwise files ETF proposal focused on tokenization and stablecoins amid growing interest

Asset management firm Bitwise has put forward an exchange-traded fund proposal that focuses on tokenization, as interest in that sector surges.

The firm filed a prospectus on Tuesday for the Bitwise Stablecoin & Tokenization ETF, which, if approved by the U.S. Securities and Exchange Commission, would invest "provide exposure to assets poised to benefit from the growing adoption of stablecoins, tokenization and fundamental shifts in how financial assets are exchanged and settled," according to the filing.

Bitwise's filing is the latest proposal for a crypto ETF as more firms look to get the SEC's sign-off on dozens of similar funds. Just yesterday, the firm filed an S-1 for an ETF tracking AVAX, the native token for the Avalanche Layer 1 blockchain.

Bloomberg Senior ETF Analyst Eric Balchunas said Bitwise's ETF could launch around the end of November.

"Bitwise w a new filing for a Stablecoin & Tokenization ETF which will have sleeve of equities and crypto assets seen benefiting from those two trends," Balchunas said in a post on X. "40 Act so prob launch around Thanksgiving."

Some crypto firms, including Coinbase and Kraken, have shown interest in launching tokenized equities. If they get approval from the SEC, that could allow them to offer blockchain-based trading of traditional stocks and put them in direct competition with other, more traditional finance brokerages. And associations representing financial firms have pushed back.

SEC Chair Paul Atkins has said he plans to focus on tokenized securities and has asked agency staff to "provide relief where appropriate to assure that Americans are not left behind." This comes as the Federal Reserve has said it plans to hold a conference next month on stablecoin business models and the tokenization of financial products and services.

Bitwise nodded to the change in regulators' stance in its filing.

"The regulatory environment for tokenized assets is rapidly evolving and may lack clarity, which could impact the enforceability of ownership rights or the ability to transfer tokens," Bitwise said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

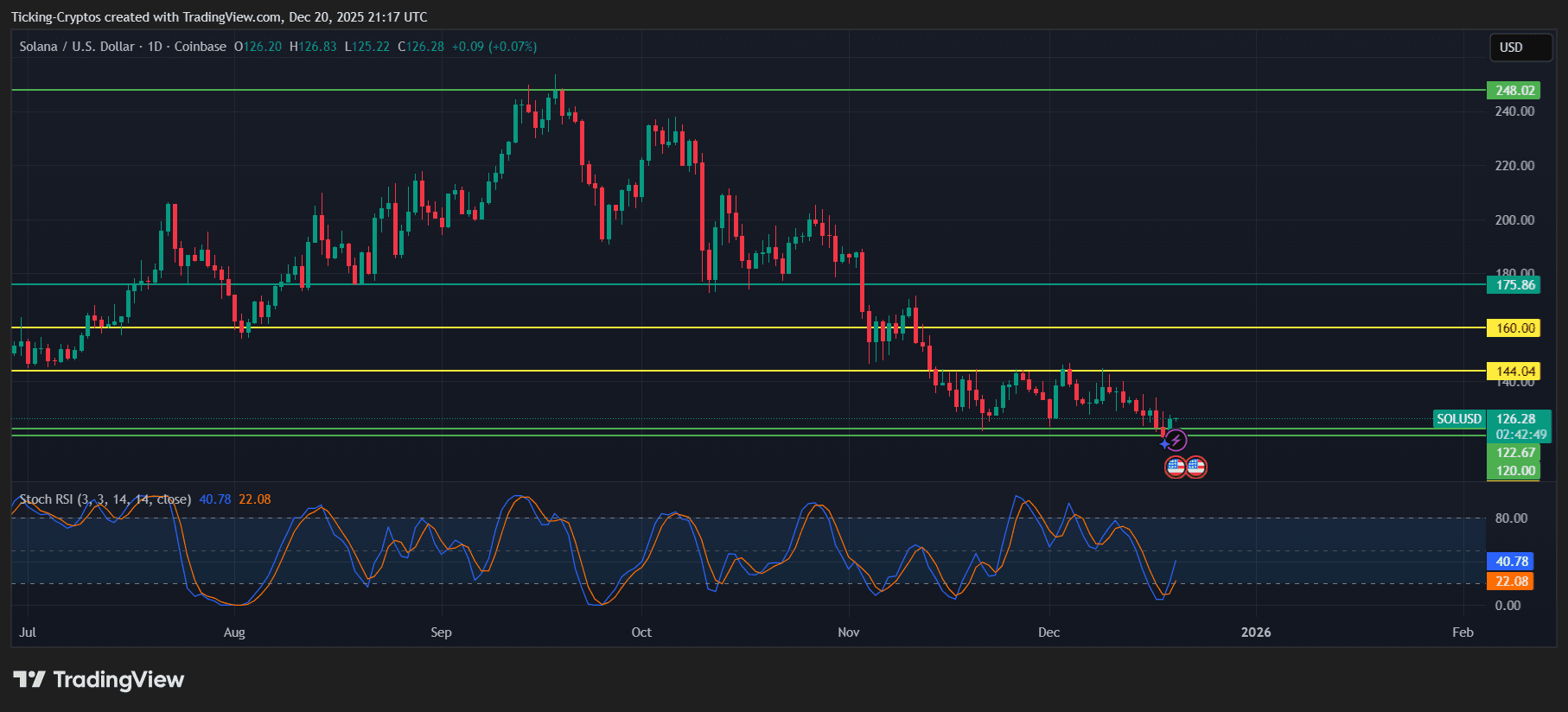

Solana (SOL) Still Under Market Pressure, Institutions Are Eyeing GeeFi (GEE) as Presale Raised Over $1.6M

Solana Price Depends On Existing SOL Holders, Here’s Why

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels

Banks Need XRP To Be Pricier—Here’s Why A Finance Expert Says So