Explore the volatile nature of Bitcoin's price trends during Christmas from 2013 to 2017 and its impact on the financial market.

Bitcoin prices on Christmas Day from 2013 to 2017 fluctuated significantly, highlighting the cryptocurrency’s early volatility, with prices ranging from $319 to near $900.

This period illustrates historical Bitcoin boom-bust cycles and influences on investment sentiment, despite the absence of governance, DeFi, or altcoin implications at that time.

Bitcoin’s Volatile Christmas Price Trends

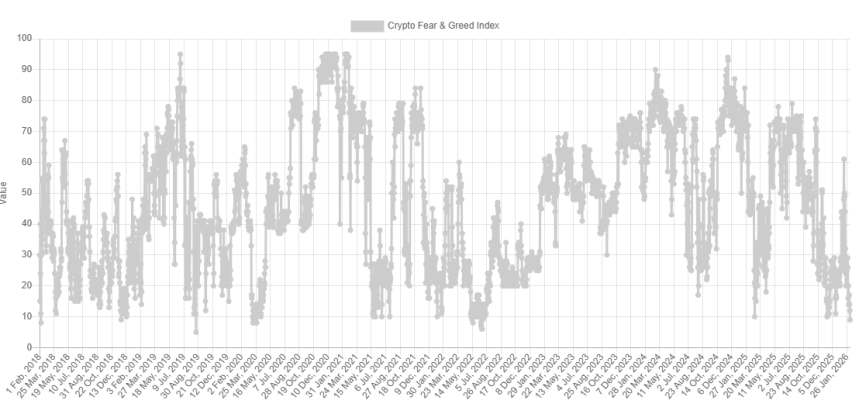

Bitcoin’s price trends during Christmas from 2013 to 2017 highlight its volatile nature. Bitcoin’s Christmas Price Volatility fluctuated significantly, ranging from $319 in 2014 to above $19,000 in 2017. This underlines Bitcoin’s dynamic price shifts across the years.

These price fluctuations reflect Bitcoin’s impact on the broader financial market. High volatility often attracts investors seeking rapid returns, yet includes risks due to unpredictable trends. Bitcoin’s relevance as a financial asset continues to draw attention globally.

Historical Price Analysis and Predictions

Based on the details provided, there are no notable quotes from key players or leadership figures directly related to Bitcoin prices on Christmas for the years 2013 to 2017. Bitcoin’s decentralized nature means it lacks a formal leadership structure or consistently quoted experts related to specific prices on those dates. However, I can summarize the relevant Bitcoin price data and contextual significance without quoting individuals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

+700,000,000 Shiba Inu Recorded Inflows in 24 Hours as Major Funds Turn to Crypto Market Acceleration

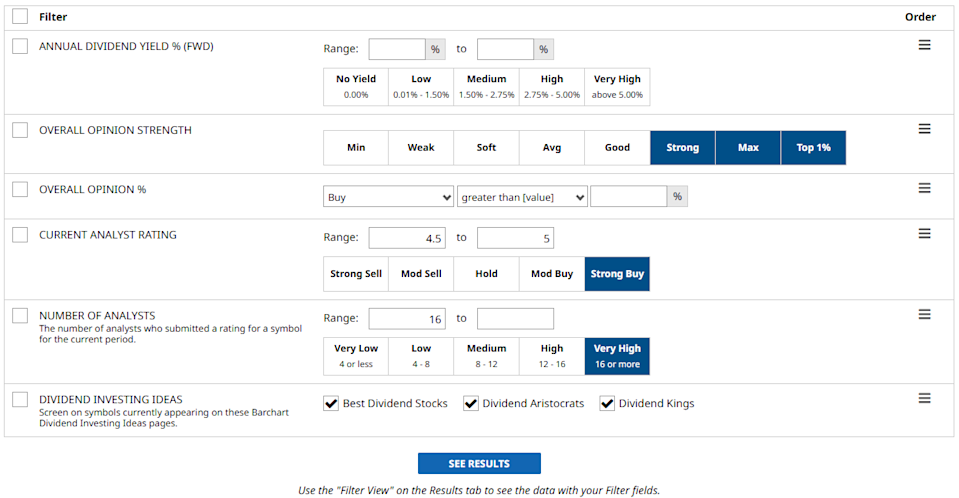

These three dividend stocks offer a blend of income, growth potential, and positive momentum

BlackRock bitcoin ETF options errupt in crash: Hedge fund blowup or just market madness?

Bitcoin Sentiment Worst Since 2022 Bear As Price Crash Continues