In early 2026, the discourse around an “altcoin season” resurges in the cryptocurrency market. This time, the expectations are substantiated more by blockchain data and market dynamics rather than social media narratives. Synchronized movements in high market cap assets like Ethereum, XRP, Solana, and BNB signify a shift in interest from Bitcoin to other areas. The critical question for the market is when this process will gain momentum and what signals will be decisive.

Altcoins Thrive as Cryptocurrency Dynamics Shift

What Early Data from Major Altcoins Reveals

In the altcoin market, the most noticeable trend is the structural strengthening of high-volume projects. On the Ethereum front, the number of active addresses remains close to cycle peaks despite prices remaining flat. This scenario indicates a persistent demand based on network usage rather than short-term trading, hinting at an underlying vibrancy in the market.

For XRP, large-scale wallet movements are prominent. Blockchain data shows that high-balance investors are maintaining their positions instead of moving assets to exchanges. In past cycles, similar behaviors have preceded broader price movements. This setup strengthens expectations of a possible directional change.

Solana and BNB show a quieter yet stable picture. Solana’s network is experiencing a gradual increase in retail investor interest, likening this early growth stage to the beginning phases of major rallies seen in previous cycles. For BNB, transaction volumes and network activities suggest a pattern of regular use, steering clear of speculative leaps. These concurrent behaviors in the four assets present a robust framework suggesting the market is gearing up for an altcoin-focused phase.

Debating Bitcoin’s Market Share and Cyclical Timing

Another factor supporting altcoin expectations is Bitcoin’s market share chart. Bitcoin maintains a 59% market share, while the total crypto market value approaches 3.2 trillion dollars. The dominance rate testing a strong resistance region within an ascending channel on weekly charts grabs analysts’ attention, establishing parallels with past cycles. Historically, failed attempts at these levels led to sharp movements as capital shifted to altcoins.

One of the market’s closely followed analysts, Dr. Whale, argues that altcoins have broken their long-term downtrend in market share. According to the analyst, this technical breakout aligns with structures that in the past correlated with extensive scale rises of 40 to 50 times. Some altcoins outperforming Bitcoin in recent weeks also serve as tangible examples supporting this view.

On the timing side, cyclical analyses become prominent. Another market commentator, Moustache, compares the 2016–2017 and 2020–2021 periods, highlighting a similar breakout-retracement model. According to the analysis, 2025 serves as a transition phase similar to previous cycles. If historical patterns are maintained, significant altcoin movements are anticipated to gain true momentum in 2026. The altcoin season index at 57 indicates Bitcoin’s still dominant stance while suggesting a rapidly approaching balance point.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

French consumer spending on goods fell in November 2025 (-0.3% following a +0.5% increase)

PENGU price tests descending trendline as SEC pushes back on Canary ETF decision

In November 2025, manufacturing output in France is expected to increase once more, showing a growth of 0.3%.

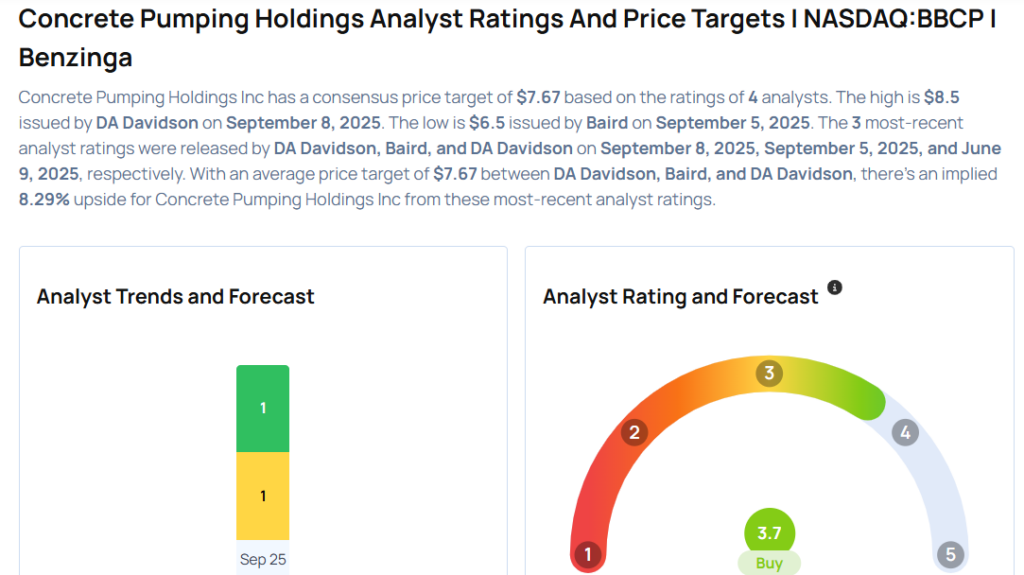

Top Wall Street Analysts Adjust Concrete Pumping Projections Prior to Q4 Earnings