Trump pushes for lower rates and ban on investor home purchases in bid to make homes more affordable

President Donald Trump 's plans for bringing homeownership within reach of more Americans involve pushing for lower interest rates on home loans and credit cards, and banning large institutional investors from buying single-family homes.

In his address Wednesday at the World Economic Forum in Davos, Switzerland, Trump outlined four policies his administration is pursuing in a bid to make homeownership more affordable. Each had been previously mentioned by him or his administration in recent weeks, part of a broader push to address affordability generally, a hot-button issue with voters heading into the midterms.

The U.S. housing market has been in a sales slump dating back to 2022, when mortgage rates began to climb from pandemic-era lows. The combination of higher mortgage rates, years of skyrocketing home prices and a chronic shortage of homes nationally following more than a decade of below-average home construction have left many aspiring homeowners priced out of the market. Sales of previously occupied U.S. homes remained stuck last year at 30-year lows.

In his remarks, Trump stressed the need to lower interest rates on home loans and credit cards in order to give aspiring homebuyers more financial flexibility to save up for a down payment on a home and more purchasing power when it comes time to buy.

“We can drop interest rates to a level, and that’s one thing we do want to do,” said Trump. “That’s natural. That’s good for everybody. You know, the dropping of the interest rate, we should be paying a much lower interest than we are.”

Trump noted that he has directed the federal government to buy $200 billion in mortgage bonds, a move he said would help reduce mortgage rates. Trump said earlier this month that Fannie Mae and Freddie Mac have $200 billion in cash that would be used to buy mortgage bonds. However, some economists have said such a move would likely have only a minimal impact on mortgage rates.

Trump, who spent much of last year demanding that the Federal Reserve lower interest rates, also reiterated that he will be announcing a new Fed chair soon to replace Jerome Powell, whose term as chair is due to end in May.

"I think they’ll do a very good job,” he said.

Still, Fed rate cuts don’t always translate into lower mortgage rates. That’s what happened in the fall of 2024 after the central bank cut its main rate for the first time in more than four years. Instead of falling, mortgage rates marched higher, eventually cresting above 7% in January this year. At that time, the 10-year Treasury yield was climbing toward 5%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

meme Coin Whale Enters Top Address, Buys $2600 Worth, Now Up Almost 400x

Bitcoin Supply In Profit Stalls At 71%: Still Not Enough For A Sustainable Recovery

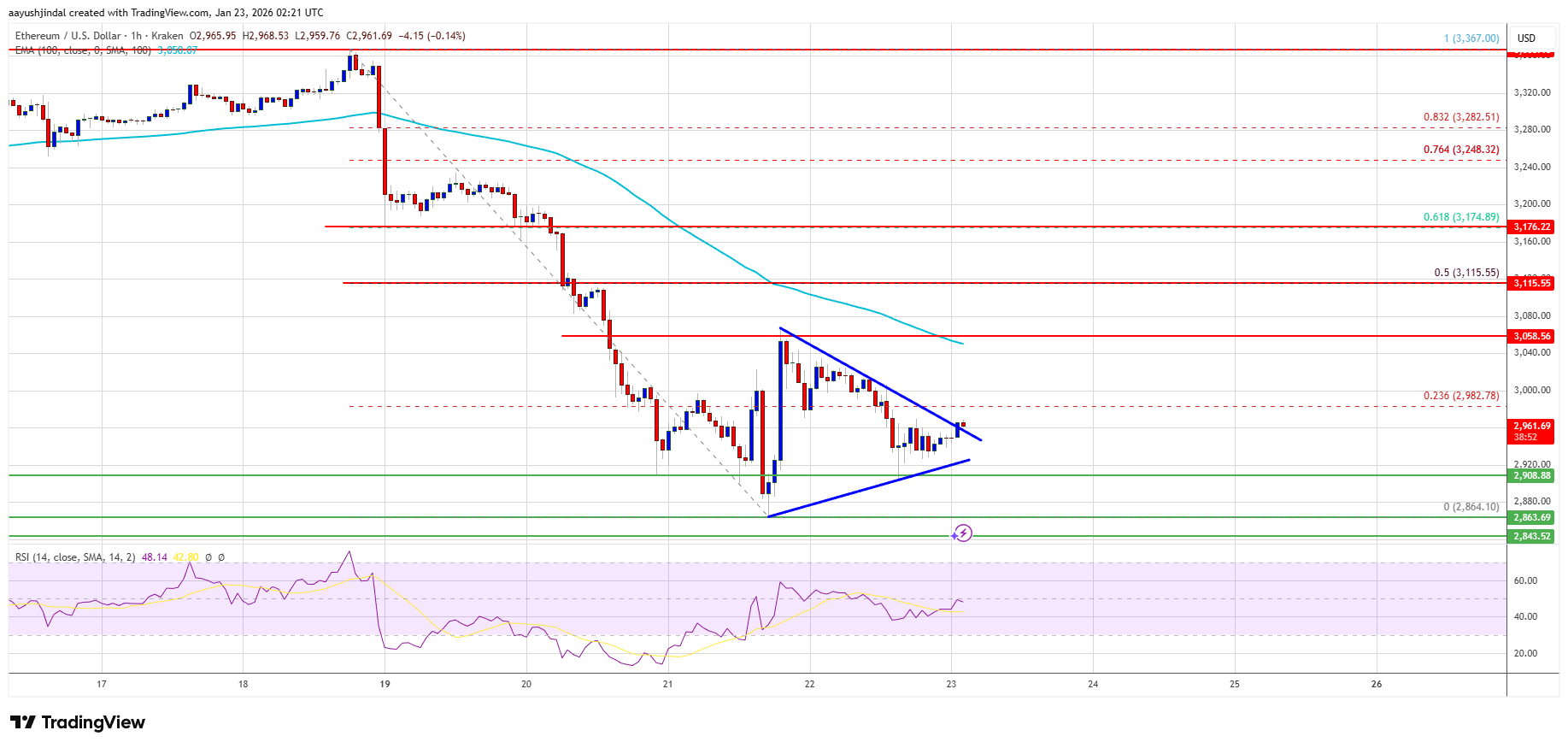

Ethereum Bulls Must Conquer $3,050 Or Momentum Quickly Fades

Crypto Social Discussions Surge Despite BTC Drop