Bitwise's 'Debasement' ETF Combines Bitcoin and Gold to Protect Against the Declining Value of the Dollar

Bitwise Launches ETF Focused on Crypto and Precious Metals

Bitwise, a leading crypto asset management firm, has introduced a new exchange-traded fund (ETF) that provides investors with access to both digital currencies and precious metals. This innovative product is marketed as a hedge against the declining value of traditional currencies, such as the U.S. dollar.

The Bitwise Proficio Currency Debasement ETF, trading under the symbol BPRO on the NYSE, was developed in collaboration with Proficio Capital Partners, an investment advisory company based in Boston that oversees approximately $5 billion in assets, according to a press release.

This actively managed ETF dynamically adjusts its holdings based on market trends. It maintains a minimum allocation of 25% to gold at all times, while also investing in silver, platinum, palladium, mining stocks, and Bitcoin.

The launch of this fund coincides with significant gains in precious metals: over the past year, gold and silver prices have surged by 79% and 207% respectively, reaching record highs, as reported by Yahoo Finance. In contrast, Bitcoin, the largest cryptocurrency by market value, has dropped 15% over the same period, despite reaching a new all-time high above $126,000 in October, according to CoinGecko.

The so-called debasement trade has gained traction recently, fueled by concerns that governments—especially the U.S.—may resort to printing more money to address budget deficits. This approach is often associated with inflation and the rapid erosion of wealth, according to Matt Hougan, Bitwise’s Chief Investment Officer.

“In my opinion, the greatest threat to the long-term financial stability of affluent families is currency debasement,” Hougan shared with Decrypt. “While I’m not claiming the dollar is headed in that direction, it has lost considerable value over the past 15 years, and that decline is accelerating.”

Hougan explained that the ETF is particularly suited for financial advisors whose clients may lack exposure to assets that protect against wealth erosion. He also mentioned that his son owns a $10 trillion Zimbabwean dollar note as a reminder of the country’s hyperinflation crisis in 2008.

BPRO carries an expense ratio of 0.96%, making it pricier than Bitwise’s $3.5 billion spot Bitcoin ETF, which charges 0.2%. The latter ranks as the fifth-largest spot Bitcoin ETF in the U.S. by assets under management.

Ray Dalio, the billionaire founder of a major hedge fund, has recommended for at least a year that investors allocate at least 15% of their portfolios to gold and Bitcoin, warning of a potential debt crisis among leading economies. Nevertheless, he has expressed a clear preference for gold, doubting that Bitcoin will be widely adopted by central banks.

Market Forces and Investor Sentiment

According to Hougan, a surge in gold buying by central banks, which began in earnest in 2022, was a major driver behind gold’s recent price spike. “That wave of demand eventually absorbed all available supply, resulting in a dramatic price increase,” he noted.

Trump Makes Good on Threat, Sues JPMorgan for $5 Billion Over Debanking

Last year, BlackRock CEO Larry Fink referred to Bitcoin and gold as “assets of fear” amid concerns about rising debt. However, analysts have recently observed that Bitcoin has been behaving more like a risk asset, as noted in recent reports. Fink also suggested that worries about financial and physical security could push investors toward these assets.

While central banks have not been purchasing Bitcoin, Hougan pointed out that institutional demand for spot Bitcoin ETFs has been robust. Since their introduction in early 2024, these funds have collectively acquired more than the total daily mined supply of Bitcoin.

“If ETF investors continue to buy more than the daily supply of Bitcoin, I believe we’ll eventually see a price surge similar to what happened with gold,” Hougan predicted. “It’s a matter of supply and demand—gold benefits from central bank demand, which Bitcoin currently lacks.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

meme Coin Whale Enters Top Address, Buys $2600 Worth, Now Up Almost 400x

Bitcoin Supply In Profit Stalls At 71%: Still Not Enough For A Sustainable Recovery

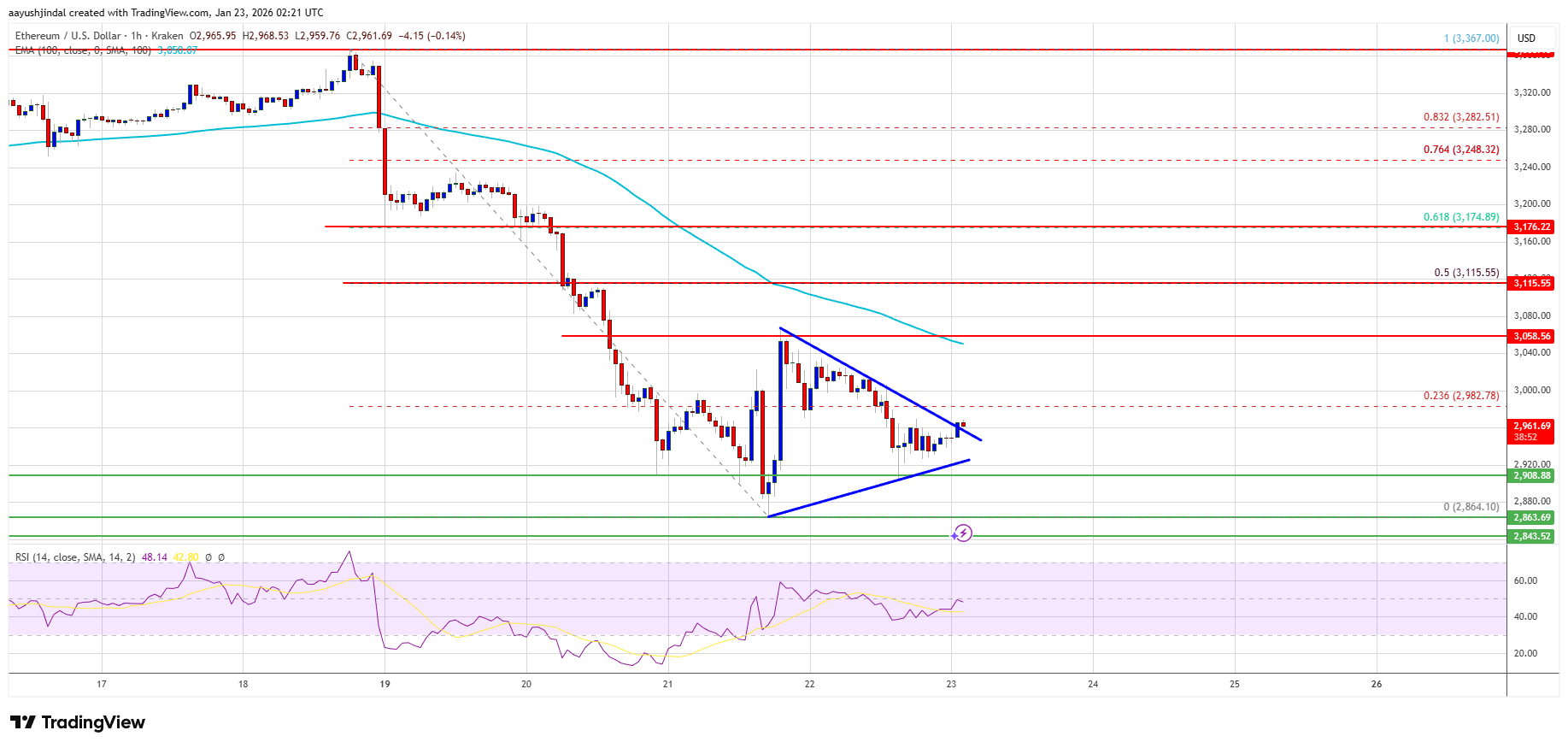

Ethereum Bulls Must Conquer $3,050 Or Momentum Quickly Fades

Crypto Social Discussions Surge Despite BTC Drop