Bitwise and Proficio Capital Partners ETF focuses on gold, metals, and bitcoin as substitutes for traditional currencies

Bitwise and Proficio Introduce ETF Focused on Currency Alternatives

By Suzanne McGee

On January 22, Reuters reported that, amid escalating global tensions and increasing government debt, Bitwise—a digital asset investment firm—and Proficio Capital Partners, part of a Florida-based multi-family office, have launched a new exchange-traded fund (ETF). This fund is designed to invest in assets that serve as alternatives to traditional currencies, including gold and bitcoin.

The newly introduced Bitwise Proficio Currency Debasement ETF, which debuted on Thursday, provides investors with a diversified portfolio of such alternatives. At least a quarter of the fund’s holdings will be allocated to gold, a commodity that has reached unprecedented prices this year. However, the creators emphasize that the fund’s purpose extends beyond capitalizing on gold’s recent surge; it aims to identify assets that are independent of any single nation’s currency or monetary policies.

Bob Haber, Proficio’s chief investment officer and co-founder, explained, “These assets should be considered a separate class, distinct from equities or bonds that are valued in government-issued currencies. When the returns on government bonds or assets tied to the dollar, euro, or other fiat currencies fail to justify their risks, it becomes prudent to seek out alternatives.”

Beyond gold and bitcoin, the ETF also grants exposure to silver, platinum, palladium, and shares of mining companies involved in extracting these and other precious metals.

Haber noted that, even if the upward momentum in gold and silver prices slows, he anticipates a rising interest among investors in what he calls “hard currencies.”

“We are witnessing a fundamental, long-term transformation in the market,” he added.

Reporting by Suzanne McGee in Providence, Rhode Island. Edited by Chris Reese.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

meme Coin Whale Enters Top Address, Buys $2600 Worth, Now Up Almost 400x

Bitcoin Supply In Profit Stalls At 71%: Still Not Enough For A Sustainable Recovery

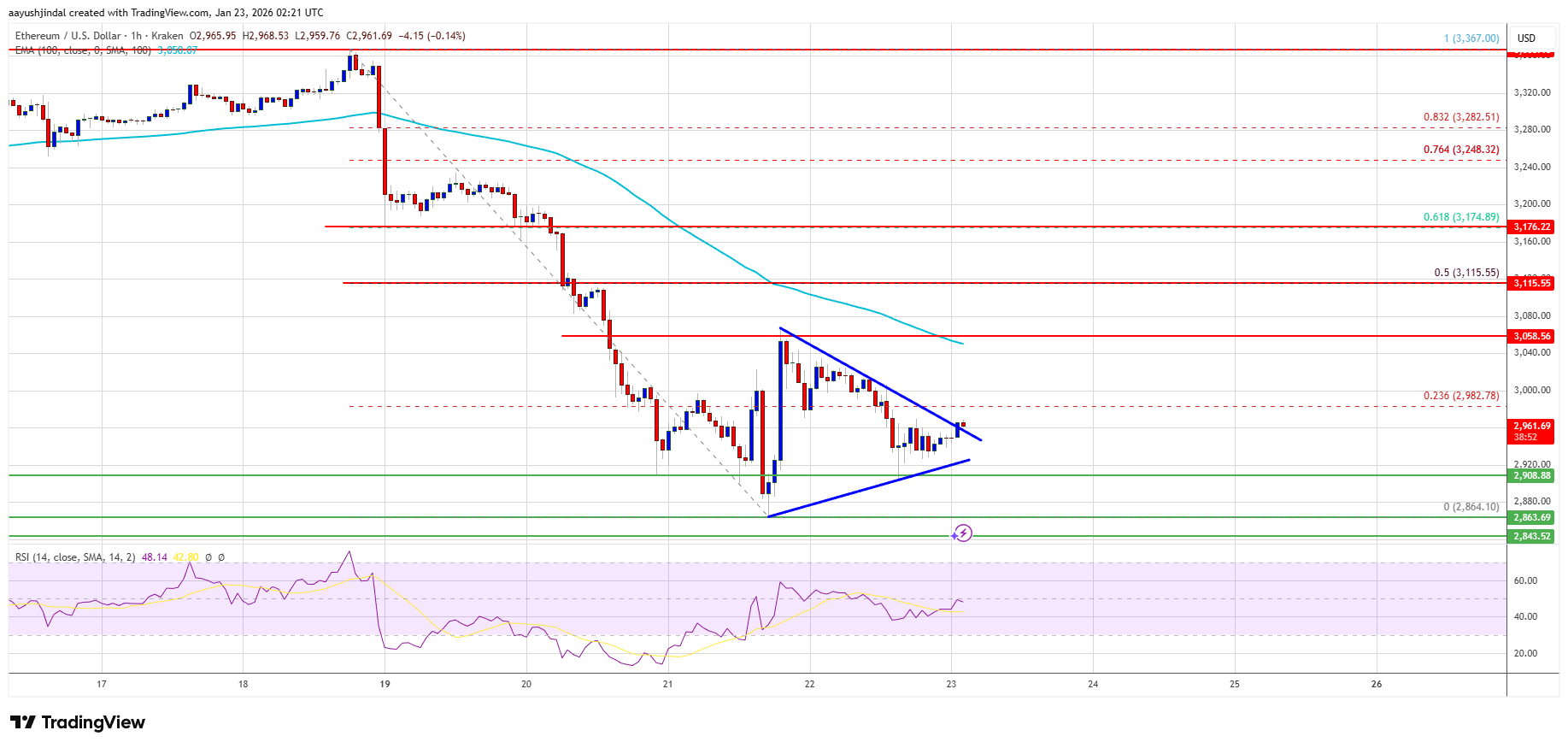

Ethereum Bulls Must Conquer $3,050 Or Momentum Quickly Fades

Crypto Social Discussions Surge Despite BTC Drop