Community Bank (CBU) Set to Announce Earnings Tomorrow: Here’s What You Should Know

Community Financial System Set to Announce Quarterly Results

Community Financial System (NYSE:CBU), a regional banking institution, is scheduled to release its latest earnings report on Tuesday morning. Here’s a summary of what investors should keep in mind.

In the previous quarter, Community Bank achieved revenue of $206.8 million, reflecting a 9.4% increase compared to the same period last year. However, the company experienced a slower pace, narrowly missing analysts’ projections for net interest income, while overall revenue matched expectations.

For the upcoming quarter, analysts anticipate Community Bank’s revenue will reach $212.2 million, representing an 8.2% year-over-year increase. This growth rate is slower than the 10.8% rise recorded in the same quarter last year. Adjusted earnings per share are forecasted at $1.13.

Community Bank Total Revenue

Over the past month, most analysts have maintained their forecasts for Community Bank, indicating stable expectations as the earnings date approaches. Notably, the company has fallen short of Wall Street’s revenue predictions four times in the last two years.

Regional Banking Sector Performance

Several of Community Bank’s competitors in the regional banking space have already released their fourth-quarter results, offering some insight into sector trends. ServisFirst Bancshares reported a 20.7% year-over-year revenue increase, surpassing analyst forecasts by 5%. Dime Community Bancshares saw its revenue climb 24.5%, beating expectations by 5.2%. Following these announcements, ServisFirst Bancshares’ stock rose 14.6%, while Dime Community Bancshares gained 12.5%.

Investor Sentiment and Stock Performance

The regional banking sector has seen a positive trend recently, with average share prices rising 2.6% over the past month. Community Bank’s stock has outperformed, climbing 5.3% in the same period. Analysts currently set an average price target of $66.60 for Community Bank, compared to its present share price of $62.

Spotlight: Share Buybacks and Value Opportunities

When a company has surplus cash, repurchasing its own shares can be a strategic move—provided the valuation is attractive. We’ve identified a promising, undervalued stock that is generating significant free cash flow and actively buying back shares.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

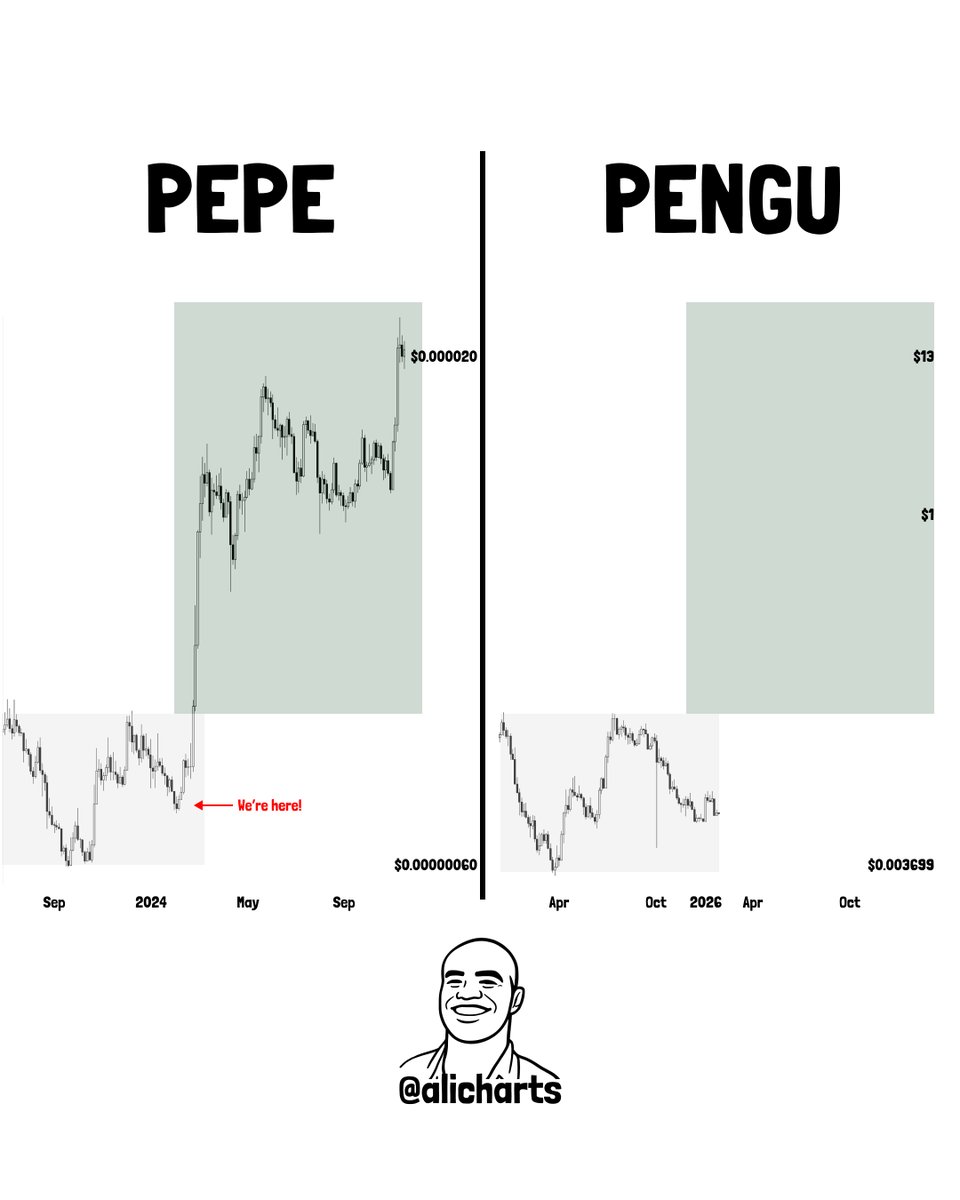

Is Pudgy Penguins (PENGU) Near a Bullish Reversal? An Emerging Fractal Suggests So!

MoonPay Taps X Games League to Merge Web3 and DeFi Features in Gaming

Weekly Market Pulse: Perhaps It's Time for Our Own Golden Chains