Is the US stock market reliving last year's nightmare?

Clouds of War + Government Shutdown

As US troops amass in the Middle East, will gold soar past 5100 and the US dollar collapse to a four-year low?

According to multiple media outlets and investment bank reports, the US Central Command has officially announced that the 9th Air Force will conduct several days of air readiness exercises in the Middle East. Previously, the USS Lincoln carrier strike group had already entered Middle Eastern waters. Sources reveal that the US has informed Israel of its preparations for military action against Iran, claiming that relevant work is expected to be completed within two weeks, with a possible window for action in the coming months, and that there is a possibility that Trump may order a preemptive strike.

In response to US moves, Iranian President Pezeshkian urgently spoke by phone with the Saudi Crown Prince, accusing the US of attempting to undermine regional security. The escalating geopolitical tension directly triggered a surge in market risk aversion.

Driven by this, international oil prices rose by more than 3% intraday, with WTI crude at $62.46 per barrel. Spot gold prices even forcefully broke through the historical barrier of $5,120.

In the foreign exchange market, the US dollar experienced structural selling pressure. The ICE Dollar Index fell below the 96 level, hitting its lowest point since February 2022. Despite facing multiple blows—including questions over the Fed’s independence, an out-of-control fiscal deficit, and geopolitical uncertainty—Trump remained unfazed. In an interview today, he responded that he is not worried about the dollar’s decline, even comparing it to the normal ups and downs of a yo-yo, and implied that he hopes the dollar finds a reasonable level to benefit trade.

In the spot market, traders did not reverse course due to Trump’s remarks. The market continues to bet on coordinated intervention by the US and Japanese governments in the currency market, with the yen rebounding strongly by more than 3% in three days, marking its largest recent gain.

Meanwhile, data from the derivatives market tells a similar story. Fears of a possible US government shutdown and sudden policy shifts from Trump are causing investors to panic-buy protection, willing to pay record-high premiums for short-term options. This suggests that the market is not only selling the dollar, but also preemptively hedging against potentially extreme volatility in the coming days.

Jason believes that in finance, risk is a known unknown—for example, if you’re worried about stocks falling, you can manage risk by buying put options. But uncertainty is an unknown unknown; it cannot be quantified or managed. So, when facing an uncontrollable opponent—war or volatile policies—the simplest strategy for capital is to exit, shifting into tangible assets that are visible and touchable. This trade direction could well become one of the year’s hottest trends.

Let’s also recall, last October we experienced a government shutdown, Sino-US trade disputes, mediocre tech earnings, and an AI backlash all at once. Three months later, it seems history is repeating itself: we’re still worried about a government shutdown and conflicts in the US, Europe, and the Middle East. If technology stocks crash next, will US equities face another double whammy of valuation and sentiment? Perhaps it’s this kind of anxiety that is making physical assets the path of least resistance and the most conservative choice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether accelerates global gold market influence, buying up to 2 tons weekly

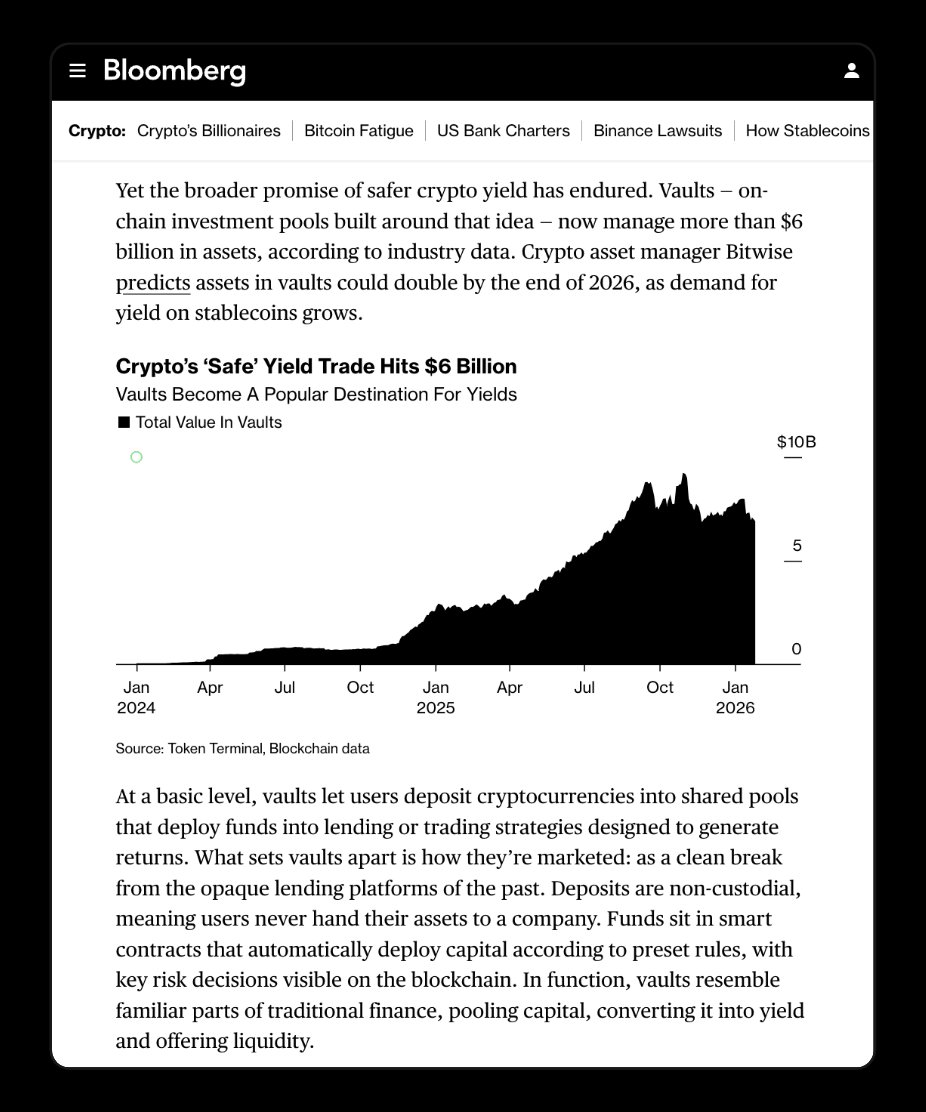

Crypto today: Safe-yield vaults hit $6B as traders chase gold and silver

Why the euro's rise to $1.20 is a big deal

Hayes: Bitcoin Moves Driven by Central Banks, Not Hype