Are Wall Street analysts optimistic about Exelon's shares?

Overview of Exelon Corporation

Established in 1999 and headquartered in Chicago, Illinois, Exelon Corporation (EXC) operates as a holding company within the utility sector, focusing on energy distribution and transmission. With a market capitalization of $45.2 billion, Exelon is engaged in the regulated retail sale and purchase of electricity and natural gas, as well as the transmission and distribution of electricity and the distribution of natural gas to its customers.

Stock Performance Highlights

Over the past year, Exelon's stock performance has trailed the broader market, though it has shown modest gains in 2026. EXC shares have climbed 12.2% in the last 52 weeks and are up 1.9% year-to-date. In comparison, the S&P 500 Index ($SPX) has delivered a 15.4% return over the same period and increased 1.8% so far this year.

Related News from Barchart

Comparative Sector Performance

When compared to the State Street Utilities Select Sector SPDR ETF (XLU), which gained 12.9% over the past year, Exelon underperformed. However, EXC slightly outpaced XLU's 1.5% increase so far this year.

Recent Earnings and Market Sentiment

On November 4, Exelon shares saw a modest uptick after the company reported third-quarter 2025 results that exceeded expectations. Operating earnings grew by 9% year-over-year to $6.7 billion, surpassing analyst forecasts. Adjusted earnings per share for the quarter reached $0.86, beating consensus estimates by 13.2%.

Despite these positive results, investor sentiment toward EXC has remained subdued. The stock has been weighed down by sluggish organic growth, inconsistent cash flow, and limited shareholder returns since 2019, making it less appealing to some investors.

Analyst Expectations and Ratings

For the fiscal year ending December 2025, analysts project that Exelon will achieve an 8% year-over-year increase in adjusted EPS, reaching $2.70. The company has a strong track record of surpassing earnings expectations, having outperformed consensus estimates for the past four quarters.

Currently, Exelon holds a consensus rating of “Moderate Buy.” Among the 20 analysts covering the stock, there are seven “Strong Buy” recommendations, eleven “Hold” ratings, and two “Strong Sell” opinions.

Shifts in Analyst Sentiment

Analyst sentiment has become slightly less optimistic recently, with the number of “Strong Buy” ratings dropping from eight to seven over the past month.

On January 26, Jefferies analyst Julien Dumoulin-Smith reaffirmed a “Buy” rating for Exelon, but lowered the price target from $57 to $55.

Price Targets and Disclosure

The average price target for EXC stands at $48.88, representing a potential 10.1% premium over current trading levels. The highest target among analysts is $57, suggesting a possible upside of 28.3% from present prices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anatomy of bitcoin's plunge this week: The dollar's bottom was BTC's top

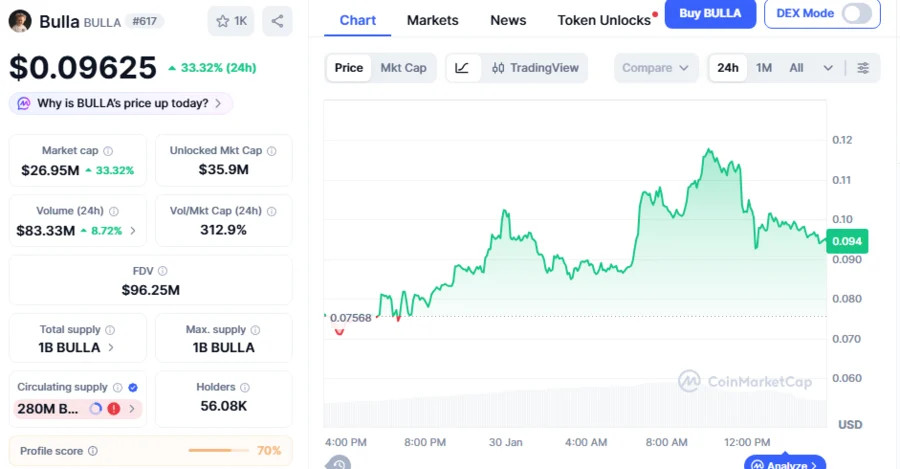

BULLA Price Climbs 315% This Week, Falling Wedge Breakout Primes to Push Price To $0.125 Target: Analyst

Dear Western Digital Shareholders, Save the Date: February 3