Tesla Focuses on ‘Incredible Abundance’ Moving Forward. How Will This Impact TSLA Shares?

Elon Musk Shapes Tesla’s Future Amid Revenue Challenges

Elon Musk continues to steer the conversation around Tesla, even as the company faces its first annual revenue drop in 2025 and a second straight year of declining automotive sales. Discussions on Wall Street have largely centered on Musk’s bold visions for “Amazing Abundance,” humanoid robots, and advancements in full self-driving technology.

In a significant shift, Musk revealed that Tesla will discontinue the Model S and Model X—vehicles that originally established the brand’s reputation. The Fremont plant, previously dedicated to these models, will now focus on producing Optimus humanoid robots.

Latest Updates from Barchart

Looking ahead, Tesla plans to invest approximately $20 billion in capital expenditures for 2026, a substantial increase from the previous year’s $8.5 billion. This investment aims to transform Tesla from a conventional car manufacturer into a leader in physical AI and robotics.

While these ambitious plans make headlines, Tesla’s immediate financial situation remains under pressure. The stock has only gained 8% over the past year, and the heavy spending could further squeeze already thin margins. For those who believe in Tesla’s long-term vision or see the stock as undervalued, is this period of uncertainty an opportunity to invest? Let’s explore further.

Financial Performance: Signs of Strain with Some Positives

Historically, Tesla’s strong brand and product quality fueled impressive compound annual growth rates in both revenue (24.63%) and earnings (34.50%). However, returning to such rapid growth now appears unlikely.

Despite surpassing expectations for both revenue and earnings in the fourth quarter, both metrics declined year-over-year. Quarterly revenue fell 3% to $24.9 billion, with automotive revenue dropping 11% to $17.7 billion. Earnings per share decreased by 17% to $0.50, slightly above analyst forecasts but flat compared to the previous quarter. Over the last nine quarters, Tesla has only exceeded earnings estimates three times.

Profit margins also narrowed, falling to 5.7% from 6.2% a year earlier. Operating cash flow dropped 21% to $3.8 billion in Q4 2025. Nevertheless, Tesla ended the quarter with $44.1 billion in cash, comfortably exceeding its short-term debt of $31.7 billion.

Production and deliveries continued to slide following the expiration of federal EV tax credits. Vehicle production declined 5% year-over-year to 434,358 units, while deliveries dropped 16% to 418,227 vehicles.

There were bright spots as well. Active subscriptions for full self-driving surged 38% year-over-year to 1.1 million. Tesla’s energy business also gained momentum, with revenue climbing 27% to $12.8 billion. The number of Supercharger stations and connectors grew by 17% and 19%, reaching 8,182 and 77,682, respectively.

From a valuation perspective, Tesla remains unique among mega-cap companies, trading at a forward price-to-earnings ratio of 198.35—far above the sector median of 17.88. Its forward price-to-sales and price-to-cash-flow ratios are also well above industry averages. Still, many on Wall Street continue to value Tesla primarily as an automaker, even as its focus shifts toward AI and robotics.

Ambitious Plans for AI and Robotics

Musk’s recent statements suggest that full self-driving and the Optimus robot are central to his strategy, including his pursuit of a $1 trillion compensation package. However, the infrastructure needed to support these initiatives has received less attention.

During the latest earnings call, Musk discussed plans to build a “Terafab”—a fabrication facility designed to support Tesla’s AI ambitions. This facility, targeted for completion in three to four years, would handle logic, memory, and packaging, reducing reliance on external chip suppliers like Nvidia, TSMC, and Micron.

Tesla’s current AI4 chip, while not as powerful as Nvidia’s Drive Thor, is optimized for the company’s autonomous vehicles. It uses GDDR6 memory to achieve 384 GB/s bandwidth, surpassing the base configuration of Nvidia Thor and enabling efficient processing of high-resolution video data.

Development is also underway on the AI5 chip, which Musk considers a top priority. The AI5 will mark a significant leap, utilizing advanced 3nm and 2nm nodes for greater transistor density and targeting performance of 1,500–4,000 TOPS—a 10 to 40-fold improvement over AI4. Despite this, production costs are expected to rise by only 250%, making it a cost-effective upgrade.

The Optimus Gen 3 robot has entered mass production, with a goal of producing 50,000 units in 2026 and scaling up to an annual rate of 1 million units by year-end. While initial deployment will focus on Tesla’s own factories, external sales are planned for late 2026, with broader consumer availability expected in 2027. The Gen 3 robot offers enhanced dexterity, reduced weight, increased speed, and longer battery life, all at a lower cost compared to its predecessor.

While these innovations fuel excitement about Tesla’s future, the company must also address the ongoing decline in its core automotive business. Stabilizing this segment will be crucial for supporting its broader ambitions in AI, robotics, and semiconductor manufacturing.

Analyst Perspectives on Tesla Stock

Analysts currently rate Tesla as a “Hold,” with the average target price already surpassed by the stock. The highest target price of $600 suggests a potential 38% upside from current levels. Among 41 analysts, 14 recommend a “Strong Buy,” one suggests a “Moderate Buy,” 17 advise holding, and nine recommend a “Strong Sell.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anatomy of bitcoin's plunge this week: The dollar's bottom was BTC's top

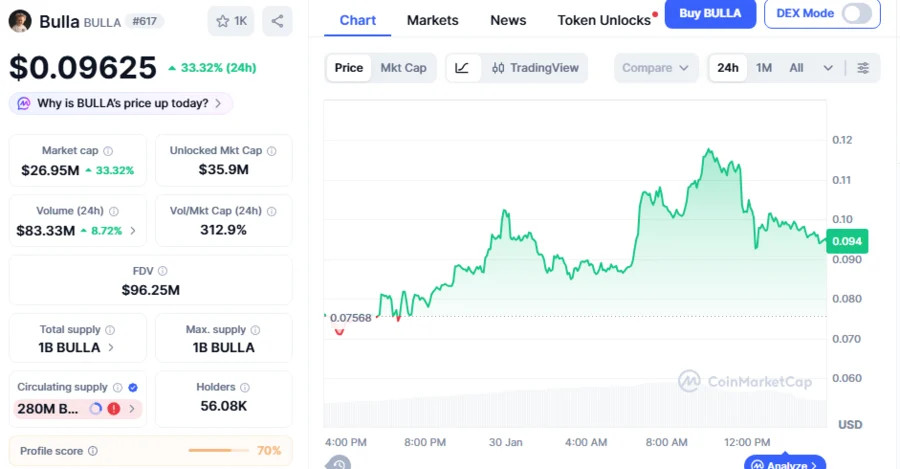

BULLA Price Climbs 315% This Week, Falling Wedge Breakout Primes to Push Price To $0.125 Target: Analyst

Dear Western Digital Shareholders, Save the Date: February 3