Crypto investors are curious about when Bitcoin will enter the 'value zone' with its price.

Main Points

- Despite positive developments such as a pro-crypto nominee for Federal Reserve Chair and progress on the Clarity Act, optimism around bitcoin remains subdued.

- Bitcoin's value has dropped roughly 20% over the past year.

What could spark a revival for bitcoin?

This is the question many in the crypto trading community are asking. The leading cryptocurrency has seen its price decline since the start of the year, dashing hopes for a recovery that emerged in January. This week, bitcoin slipped below $85,000 and is nearing price levels last seen in April. Even with some encouraging news, the coin is currently trading around $83,000, showing little sign of recovery.

Large-scale purchases by major bitcoin holders and recent legislative progress in the crypto sector have not managed to reignite bullish sentiment. Investors seeking safe havens are currently favoring gold. Additionally, President Donald Trump's selection of Kevin Warsh, a known bitcoin advocate, as the next Federal Reserve Chair, has not significantly impacted bitcoin's performance.

Some analysts believe that investors are waiting for bitcoin to reach a price they consider attractive enough to re-enter the market. Many supporters remain optimistic about bitcoin's prospects for the rest of the year and beyond.

Expert Perspective

Bitcoin seems to have lost its appeal both as a hedge and as a momentum-driven asset, leading some observers to wonder what price point will entice investors to return.

Recent activity in bitcoin exchange-traded funds (ETFs) suggests that investors are not yet convinced. Over the past three days, bitcoin ETFs have experienced net outflows totaling about $985 million, according to Farside Investors. Meanwhile, MicroStrategy (MSTR), a major institutional buyer, has continued to accumulate bitcoin, adding 40,147 coins this month at a cost of approximately $3.7 billion.

The Senate Agriculture Committee recently advanced its version of the Clarity Act—a significant piece of crypto regulation—through a party-line vote. While this is a positive step, the Senate Banking Committee's draft has stalled, and the partisan nature of the vote indicates that passing the legislation will remain challenging.

Kevin Warsh has previously described bitcoin as a "significant asset." On social media, MicroStrategy's Michael Saylor predicted that Warsh could become the first openly pro-bitcoin Federal Reserve Chair. However, Warsh's appointment still requires Senate approval, and his nomination has not yet had a notable effect on bitcoin's price.

If neither regulatory progress nor a supportive Fed Chair can trigger a bitcoin rally, price levels may be the deciding factor. Sean Farrell, head of digital asset strategy at Fundstrat, noted this morning that with "no obvious catalysts in the near term," a quick rebound seems unlikely.

According to Farrell, "It is becoming more likely that we enter a 'value zone' in the coming days or weeks," suggesting that support may be found in the mid-$70,000 range—a potential further decline of about 10% from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anatomy of bitcoin's plunge this week: The dollar's bottom was BTC's top

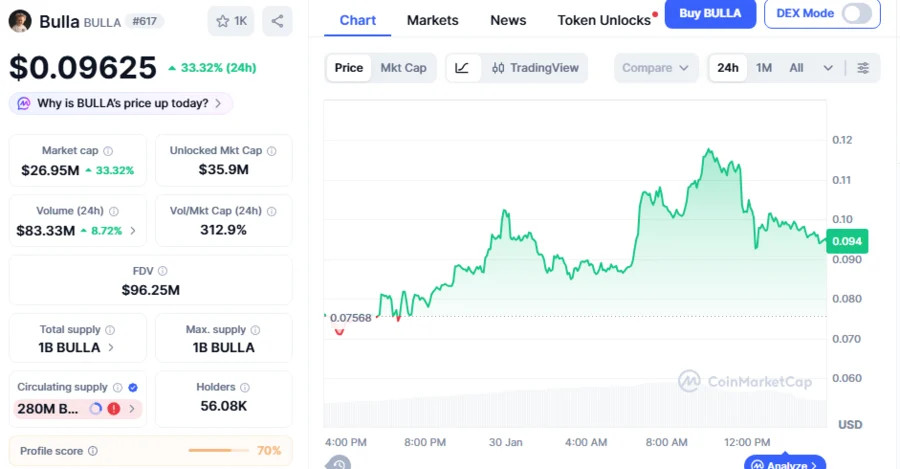

BULLA Price Climbs 315% This Week, Falling Wedge Breakout Primes to Push Price To $0.125 Target: Analyst

Dear Western Digital Shareholders, Save the Date: February 3