Gold and Silver Values Drop Sharply After Reaching All-Time Highs—Key Information for Investors

Main Highlights

-

On Friday, investors took profits following a rapid surge in precious metals, after President Trump selected former Federal Reserve Governor Kevin Warsh as his nominee to head the central bank.

-

Gold experienced a sharp 10% decline from its previous record, while silver dropped over 25%, falling below $85 per ounce.

-

Ongoing geopolitical tensions, worries about the Federal Reserve’s autonomy, and a weakening U.S. dollar have contributed to gold and silver becoming standout performers over the last year.

Gold and silver prices saw significant declines on Friday as investors cashed in gains after President Trump announced Kevin Warsh as his choice for Federal Reserve Chair. This move eased some concerns on Wall Street regarding the president’s influence over the independent central bank.

Recently, spot gold dropped 10% to around $4,850 per troy ounce after reaching a record $5,600 on Thursday. Silver, which had climbed above $120, tumbled 28% to trade below $84 per ounce. Exchange-traded funds such as iShares Silver Trust (SLV) and SPDR Gold Shares (GLD) mirrored these losses.

Over the past year, gold and silver prices have surged, fueled by global uncertainty and a declining U.S. dollar. In the 12 months leading up to Friday, gold had nearly doubled, while silver soared by approximately 250%.

Significance of These Developments

Gold and silver had soared over the past year as investors sought safety from turbulent markets. The sharp drop on Friday suggests that investors anticipate greater stability with Kevin Warsh expected to lead the Federal Reserve.

President Trump’s decision to nominate Kevin Warsh, a former Fed Governor, to succeed Jerome Powell (whose term ends in May), was met with relief by investors. Warsh was regarded as one of the more mainstream candidates among those considered by Trump, who has spent the past year urging the Fed to cut rates despite high inflation and trade uncertainties. Warsh’s nomination reassured markets that the central bank’s independence would remain intact, preserving the credibility of U.S. monetary policy.

This sense of relief was evident across financial markets on Friday. The 10-year Treasury yield rose to 4.25%, signaling that investors expect monetary policy under Warsh to be less accommodative than President Trump might prefer.

The U.S. dollar index, which hit a four-year low earlier in the week, recently rebounded by about 0.7%. The dollar’s decline since Trump’s return to office—over 10% in the past year—has made metals priced in dollars more attractive to foreign buyers, fueling the rally in gold and silver.

Additional Insights

Investors also took profits in other precious metals. Palladium had doubled in value over the past year but fell roughly 15% in recent trading. Platinum, after nearly tripling, dropped 20%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anatomy of bitcoin's plunge this week: The dollar's bottom was BTC's top

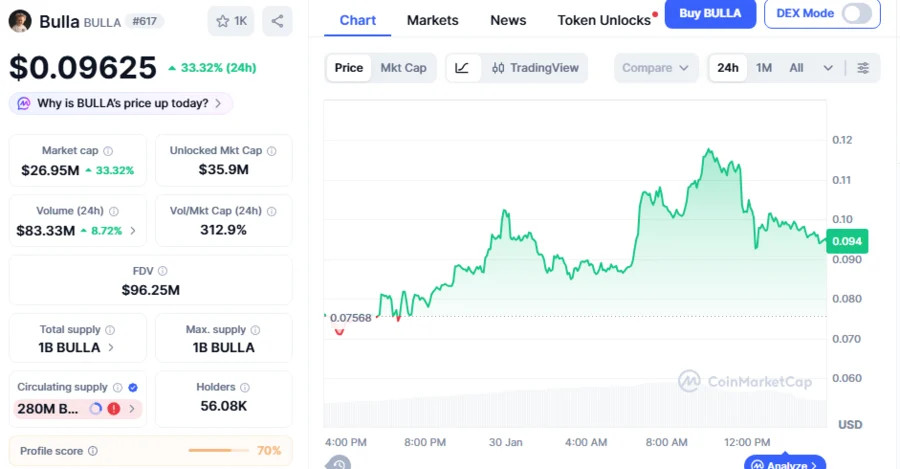

BULLA Price Climbs 315% This Week, Falling Wedge Breakout Primes to Push Price To $0.125 Target: Analyst

Dear Western Digital Shareholders, Save the Date: February 3