Stock market update: Dow, S&P 500, and Nasdaq futures dip as investors await a week shaped by Trump's Fed nominee and employment figures

Wall Street Prepares for a New Month Amid Market Turbulence

US stock futures dropped late Sunday as investors braced for the start of a new trading month, following a sharp decline in stocks, precious metals, and cryptocurrencies.

Dow Jones Industrial Average futures slipped by 0.2%, S&P 500 futures were down 0.3%, and Nasdaq 100 futures fell 0.5%.

Last Friday, markets ended in the red after Donald Trump named Kevin Warsh as his choice for the next Federal Reserve chair. This announcement has sparked new debates about the direction of interest rates in the coming months, although most market participants still anticipate two rate cuts before year-end.

Over the weekend, bitcoin dropped below $80,000 for the first time since April, deepening losses after a volatile close to last week. Precious metals, which have been at the center of 2026’s dramatic rally, continued to see wild swings. Silver rebounded late Sunday after suffering its largest single-day drop on record—nearly 30%—while gold edged higher following its own recent decline.

Investors are also weighing fresh uncertainty surrounding Nvidia and the broader artificial intelligence sector. Major technology firms have been driving market activity so far in 2026, with earnings results pushing companies in divergent directions.

Key Events to Watch This Week

- Over 100 S&P 500 companies are scheduled to release earnings, including notable names such as Amazon, Alphabet, Disney, Palantir, and Advanced Micro Devices.

- The highly anticipated January jobs report will be released on Friday. Economists predict that 65,000 jobs were added last month, with the unemployment rate expected to remain steady at 4.4%.

Live Market Coverage Coming Soon

Stay tuned for real-time updates on the stock market for Monday, February 2, 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500’s $1 Trillion Recovery Brings Limited Comfort to Wall Street

What's in store for gold moving forward?

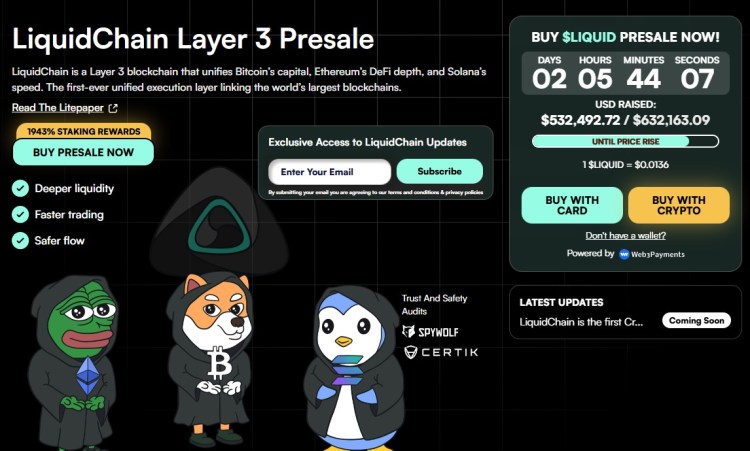

China Speeds Up De-Dollarization as LiquidChain's Presale Booms

Universal Corp.: Fiscal Third Quarter Earnings Overview