Stocks rebound after a dramatic week sparked by ongoing AI uncertainty

The S&P 500 on Friday rose 1.97%, recording its best day since May, as it rebounded from a week of dramatic selling triggered yet again by the AI boom and what it will mean for the economy, companies and the labor market.

The Nasdaq Composite also surged 2.18% on Friday. But the rebound masked a sell-off in many tech names.

Shares of Amazon, the fifth largest public company in the world, sank 5.58% after it said Thursday that it planned to spend $200 billion in the coming year.

That money is primarily expected to be spent on the Amazon Web Services division, the largest cloud provider in the world.

Since Monday, Amazon's stock has plunged 12% and shed more than $310 billion in market value.

Two other tech giants, Microsoft and Meta, have met similar fates this week. Both companies also announced hundreds of billions of dollars in planned spending on AI this year.

Collectively, Amazon, Microsoft, Meta and Alphabet plan to shell out around $650 billion this year to expand their data center and AI capabilities.

Taken together, the four companies shed nearly $1 trillion in market value over the last five days.

The S&P 500 and Nasdaq Composite also finished the week in the red. But there were definite bright spots.

Industrial stocks such as Caterpillar and a handful of energy firms soared on the expectation that their services would be in high demand for data centers.

The industrial and energy sectors of the S&P 500 were two of the best performers on Friday. Tech was as well, boosted by chipmakers.

Shares of Nvidia also boomed, rising nearly 8%. The AI chip maker is now worth more than $4.5 trillion.

After saying earlier this week that the sell-off was "the most illogical thing in the world," Nvidia CEO went on CNBC to back the sector again on Friday. Huang said the stunning levels of spending was appropriate given the "incredibly high" demand for AI applications.

Likewise, Apple jumped 7% this week. The iPhone maker has been largely spared from recent AI-induced sell-offs because the company buys most of its cloud computing capacity from other firms, rather than build its own data centers.

The turmoil started on Tuesday, after AI developer Anthropic announced that AI agents could do advanced tasks such as data analytics.

This triggered a panic among investors in the software companies and firms that provide data analysis for industries as varied as real estate, human resources and banking.

Fear that AI agents could eat into their businesses prompted heavy selling this week in the sector.

Private credit firms, which own many of the big software and data companies, also plummeted this week. These firms play a growing role in helping to raise the extraordinary amount of money that AI and tech giants are seeking to expand.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock bitcoin ETF options errupt in crash: Hedge fund blowup or just market madness?

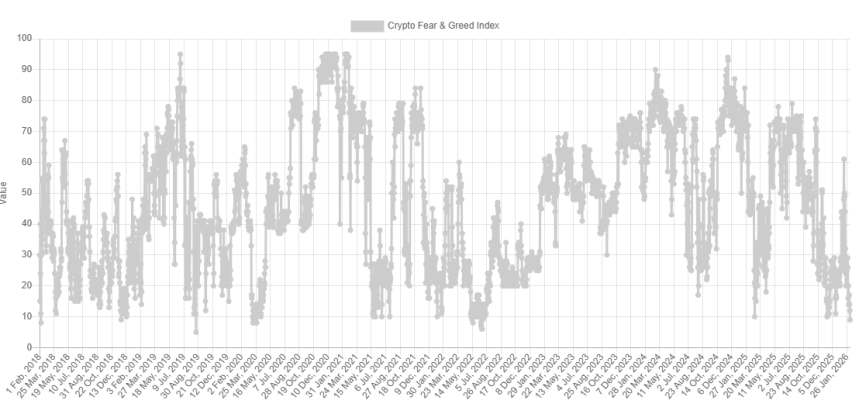

Bitcoin Sentiment Worst Since 2022 Bear As Price Crash Continues

Corn Slips as the Weekend Approaches

Wheat Ends Lower on Friday