India has updated its regulations regarding deep tech startups

India Extends Support for Deep Tech Startups

Startups specializing in advanced fields like space exploration, semiconductors, and biotechnology typically require much longer to reach maturity compared to traditional startups. Recognizing this, India is revising its startup regulations and channeling public funds to help more of these companies progress from research to market-ready products.

This week, the Indian government announced updates to its startup policies, extending the period during which deep tech firms are classified as startups to 20 years—twice the previous duration. Additionally, the revenue cap for accessing startup-specific tax breaks, grants, and regulatory incentives has been increased to ₹3 billion (approximately $33.12 million), up from ₹1 billion (about $11.04 million). These adjustments are intended to better match the lengthy development timelines typical of science-driven enterprises.

These reforms are part of a broader initiative by the Indian government to nurture a robust deep tech ecosystem, combining regulatory changes with substantial public investment. A key element is the ₹1 trillion (roughly $11 billion) Research, Development and Innovation Fund (RDI), launched last year to provide patient capital for companies focused on scientific research and development. Building on this, a coalition of U.S. and Indian venture capital firms recently formed the India Deep Tech Alliance, a $1 billion-plus investment group that includes Accel, Blume Ventures, Celesta Capital, Premji Invest, Ideaspring Capital, Qualcomm Ventures, and Kalaari Capital, with Nvidia serving as an advisor.

Addressing Startup Lifecycle Challenges

For many founders, these policy changes address a longstanding issue. Previously, startups risked losing their official status before reaching commercialization, which could send misleading signals about their progress. Vishesh Rajaram, founding partner at Speciale Invest, noted that this often resulted in science-based startups being evaluated by arbitrary timelines rather than actual technological milestones.

“By officially distinguishing deep tech ventures, the new policy streamlines fundraising, follow-on investment, and government engagement, which has a tangible impact on founders’ day-to-day operations,” Rajaram told TechCrunch.

However, investors point out that securing capital remains a significant hurdle, especially beyond the initial stages. “The most significant funding gap has traditionally been at Series A and later rounds, particularly for deep tech startups that require substantial investment,” Rajaram explained. The government’s RDI fund is designed to help bridge this gap.

Arun Kumar, managing partner at Celesta Capital, emphasized that the RDI initiative aims to boost funding for deep tech startups at both early and growth phases. By channeling public money through venture funds with timelines similar to private capital, the fund seeks to address persistent shortfalls in follow-on financing while maintaining commercial investment standards.

Building a Sustainable Deep Tech Ecosystem

Siddarth Pai, co-founder of 3one4 Capital and co-chair of regulatory affairs at the Indian Venture and Alternate Capital Association, highlighted that India’s new framework avoids the “graduation cliff” that previously cut off support as startups scaled up.

Pai added that these reforms coincide with the RDI fund’s operational rollout, as the first group of fund managers has been selected and the process of choosing venture and private equity managers is underway.

While private investment in Indian deep tech—especially in biotech—already exists, Pai told TechCrunch that the RDI Fund is meant to serve as a catalyst for greater capital formation. Unlike traditional fund-of-funds, this vehicle can also make direct investments and offer credit and grants to deep tech startups.

Growth in India’s Deep Tech Funding

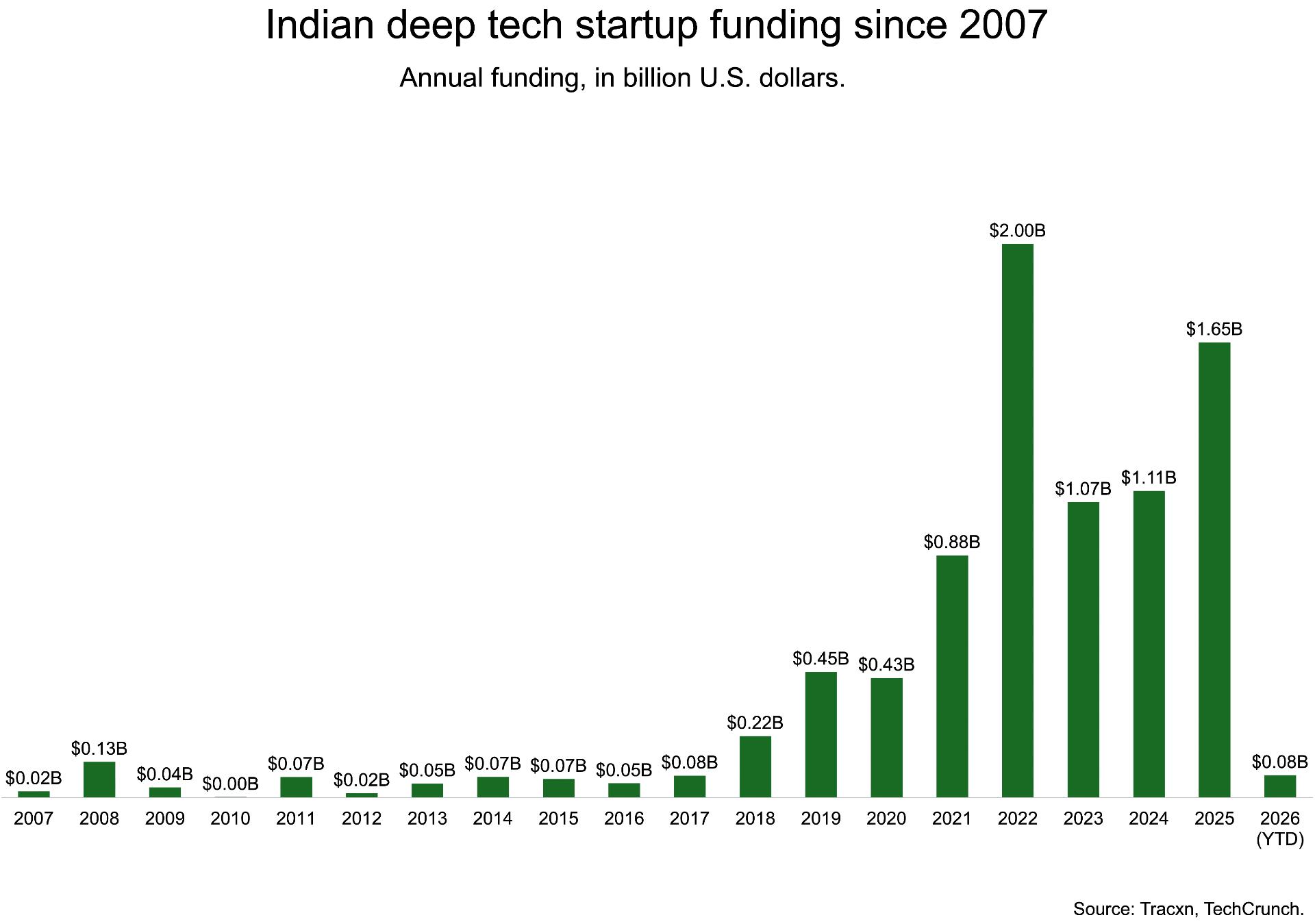

India is still emerging as a deep tech hub, with total funding for Indian deep tech startups reaching $8.54 billion to date. Recent figures, however, indicate renewed momentum: in 2025, Indian deep tech startups attracted $1.65 billion, a notable increase from $1.1 billion in each of the previous two years, though still below the 2022 peak of $2 billion, according to Tracxn. This rebound reflects rising investor interest, particularly in sectors aligned with national priorities such as advanced manufacturing, defense, climate technology, and semiconductors.

Neha Singh, co-founder of Tracxn, observed, “The uptick in funding points to a gradual shift toward longer-term investment strategies.”

Despite this progress, the scale of India’s deep tech funding remains modest compared to global leaders. In 2025, U.S. deep tech startups raised about $147 billion—over 80 times India’s total for the year—while Chinese startups secured around $81 billion, according to Tracxn data.

This stark contrast underscores the challenges India faces in building capital-intensive technologies, even with its strong engineering talent pool. The hope is that recent policy changes will encourage more investors to participate in the sector over time.

Image Credits: Jagmeet Singh / TechCrunch

Signaling Long-Term Commitment

For international investors, India’s policy overhaul is seen as a sign of sustained government commitment to deep tech, rather than an immediate catalyst for reallocating funds. Pratik Agarwal, a partner at Accel, explained that deep tech companies typically operate on timelines of seven to twelve years, so regulatory certainty over such periods gives investors greater assurance that the policy environment will remain stable.

“India is taking cues from the U.S. and Europe in developing patient, forward-looking frameworks for frontier technologies,” Agarwal told TechCrunch.

It remains to be seen whether these changes will discourage Indian startups from relocating their headquarters abroad as they expand. Agarwal noted that the extended support period strengthens the case for building and remaining in India, though access to capital and customers remains crucial. Over the past five years, India’s public markets have shown increasing interest in venture-backed tech firms, making domestic listings more attractive. This could reduce the pressure on deep tech founders to incorporate overseas, even though access to procurement and late-stage funding will continue to influence where companies scale.

Ultimately, the success of these reforms will be measured by India’s ability to produce globally competitive deep tech companies. Arun Kumar of Celesta Capital stated that the true indicator of progress would be the emergence of a significant number of Indian deep tech firms achieving sustained international success.

“Seeing ten Indian deep tech companies thrive on the global stage over the next decade would be a clear sign that the ecosystem is maturing,” Kumar said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana’s quiet takeover – Can SOL profit from the FUD around Ethereum?

COTI Earn Brings More Yield to $ADA and $USDT Holders via Carbon DeFi

Market Loaded with Shorts as Long Bets Decline

PMI Breaks Above 50 — 4 Altcoins that Could Be Gearing Up for a Massive Rally