1 Cash-Rich Stock We Recommend and 2 We’re Passing On

Financially Resilient Companies: Not All Are Worth Investing In

While businesses holding more cash than debt often appear financially robust, this alone doesn't guarantee strong investment potential. Some firms lack leverage simply because they face challenges in expanding or maintaining steady profits, making them less appealing to lenders.

Although having financial flexibility is advantageous, it’s not the sole factor to consider. At StockStory, we focus on identifying companies that are not only built to endure but also have the potential to outperform the market. With that perspective, let’s look at one company with a healthy net cash position that shows promise for sustainable growth, and two others that may be better avoided.

Stocks to Consider Selling

Supernus Pharmaceuticals (SUPN)

Net Cash Position: $217.8 million (7.4% of Market Cap)

Supernus Pharmaceuticals (NASDAQ:SUPN) specializes in developing and marketing eight FDA-approved medications for neurological disorders, including epilepsy, ADHD, Parkinson’s disease, and migraines.

Reasons for Caution with SUPN:

- Over the past five years, the company’s annual revenue increased by just 5.9%, falling short of typical healthcare sector benchmarks.

- With annual sales of $681.5 million, Supernus operates on a smaller scale than its major competitors, limiting its distribution reach.

- Returns on capital have declined from an already low base, highlighting ineffective investment decisions by management.

Currently, Supernus Pharmaceuticals trades at $51.67 per share, representing a forward P/E of 26.7.

Frost Bank (CFR)

Net Cash Position: $3.32 billion (35.8% of Market Cap)

Founded in 1868, Cullen/Frost Bankers (NYSE:CFR) operates Frost Bank, a Texas-based institution offering commercial and consumer banking, wealth management, and insurance services.

Why We’re Hesitant on CFR:

- Revenue growth averaged just 6.1% annually over the past two years, lagging behind industry peers.

- Earnings per share increased by only 2.2% annually in the same period, indicating that additional sales have not translated into strong profitability.

- Tangible book value per share is expected to drop by 3.6% over the coming year, reflecting weaker capital generation.

Frost Bank is priced at $146.70 per share, or 1.9 times forward price-to-book.

A Stock to Watch: Napco (NSSC)

Napco Security Technologies (NSSC)

Net Cash Position: $110.1 million (7.1% of Market Cap)

Since 1969, Napco Security Technologies (NASDAQ:NSSC) has been a leader in manufacturing electronic security products, access control solutions, and communication services for intrusion and fire alarm systems, serving clients from schools to government agencies.

Why Napco Stands Out

- Napco achieved impressive annual revenue growth of 14% over the last five years, signaling strong market share gains.

- A robust free cash flow margin of 19.3% allows the company to consistently reinvest or return capital, with expanding cash flow providing even greater flexibility.

- Returns on capital are on the rise as management effectively seizes new market opportunities.

Napco shares trade at $43.56, equating to a forward P/E of 28.6. Considering an investment?

Top-Quality Stocks for Any Market Environment

This year’s market rally has been driven by just four stocks, which together account for half of the S&P 500’s total gains. Such concentration can make investors uneasy. While many flock to popular names, savvy investors are seeking out high-quality companies that are overlooked and undervalued. Discover our curated selection in the Top 5 Growth Stocks for this month. These standout stocks have delivered a remarkable 244% return over the past five years (as of June 30, 2025).

Our 2020 picks included now-household names like Nvidia, which soared 1,326% from June 2020 to June 2025, as well as lesser-known companies such as Kadant, which achieved a 351% five-year return. Start your search for the next breakout stock with StockStory today.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Dollar Remains Elevated Compared to the Yen

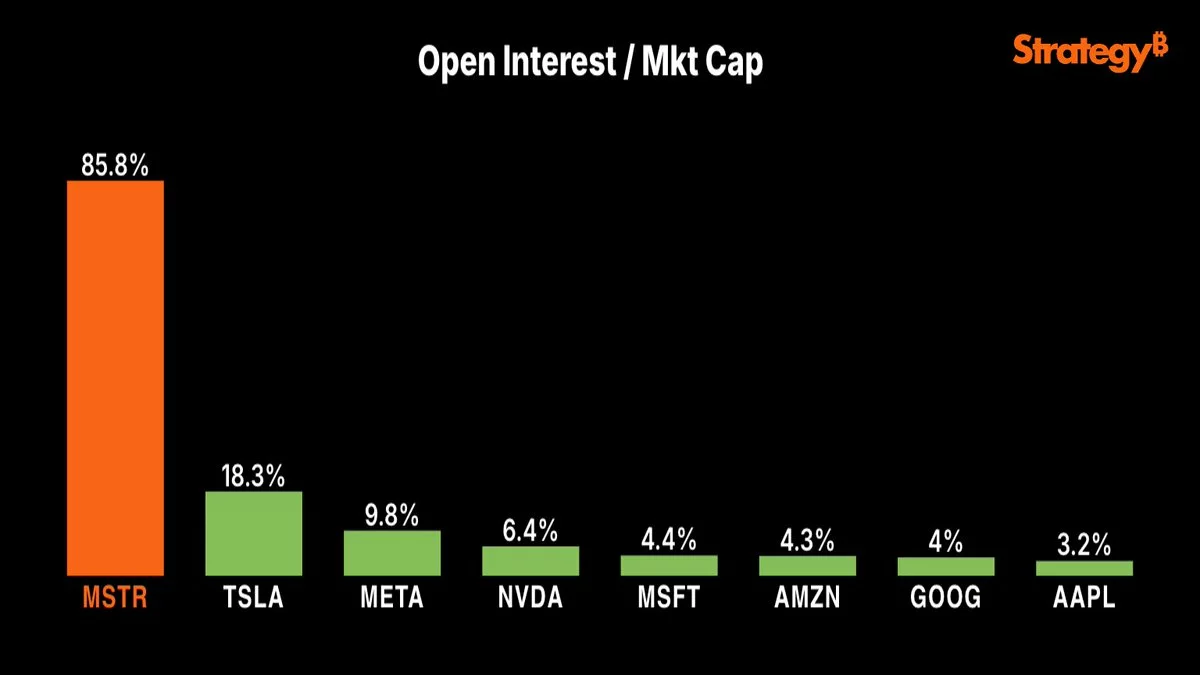

MSTR stock outlook: Traders watch key resistance after Friday rebound

Grayscale-Backed Altcoin Makes Big Announcement! “Delayed for 6 Months!”