2 Lucrative Stocks Worth Holding for Years and 1 Encountering Difficulties

Profitable Companies: Which Ones Are Built for the Future?

While some businesses report strong earnings, not all are positioned for long-term success. Companies that depend on outdated strategies or fleeting advantages may not be able to sustain their performance. Just because a company is profitable now doesn’t guarantee it will continue to excel in the future.

Although generating profits is important, it’s not the only factor that matters. At StockStory, our mission is to help you spot companies with lasting potential. With that in mind, let’s look at two businesses that consistently deliver solid profits while still growing, and one that may face challenges ahead.

Stock to Consider Selling

Donaldson (DCI)

Latest 12-Month GAAP Operating Margin: 13.8%

Donaldson (NYSE:DCI) is known for producing filtration systems used across multiple industries, and even contributed to the Apollo 11 mission.

Why Might DCI Be at Risk?

- Revenue has only increased by 4.2% annually over the past two years, lagging behind other industrial companies.

- The company’s main business has underperformed, with disappointing organic revenue growth, suggesting it may need to rely on acquisitions to boost results.

- Projected sales growth for the next year stands at just 3.8%, indicating softer demand ahead.

Currently, Donaldson is priced at $109.05 per share, with a forward price-to-sales ratio of 3.3.

Stocks Worth Buying

Wingstop (WING)

Latest 12-Month GAAP Operating Margin: 25.5%

Wingstop (NASDAQ:WING), founded by two chicken wing enthusiasts in Texas, has become a favorite fast-food chain, celebrated for its crispy wings and wide selection of sauces.

What Makes WING Attractive?

- Same-store sales have grown by an average of 11.9% over the last two years, showing strong customer appeal.

- The company’s robust 25.7% operating margin demonstrates an efficient business model.

- Strong free cash flow allows for continued investment and the ability to return value to shareholders through buybacks or dividends.

Wingstop’s shares are trading at $264.55, with a forward P/E of 60.2. Wondering if it’s the right time to invest?

Morningstar (MORN)

Latest 12-Month GAAP Operating Margin: 22.3%

Morningstar (NASDAQ:MORN), established in 1984 by Joe Mansueto with an initial investment of $80,000, delivers independent investment research and analytics to help investors and institutions make informed decisions.

Why Are We Positive on MORN?

- Annual revenue has climbed 12.3% on average over the past five years, reflecting the value of its solutions.

- Share repurchases have propelled annual earnings per share up by 131% over the last two years, outpacing revenue growth.

- A return on equity of 15.6% highlights management’s ability to generate strong returns from investments.

Morningstar is currently valued at $171.70 per share, with a forward P/E of 16.5. Interested in whether now is a good entry point?

Resilient Stocks for Any Market

Relying on just a handful of stocks can leave your portfolio exposed. Now is the time to secure high-quality investments before opportunities become scarce.

Don’t wait for the next bout of market turbulence. Discover our Top 5 Growth Stocks for this month—a handpicked selection of leading companies that have delivered a 244% return over the past five years (as of June 30, 2025).

Our 2020 picks included well-known names like Nvidia, which soared by 1,326% from June 2020 to June 2025, as well as lesser-known firms such as Exlservice, which achieved a 354% five-year return. Start your search for the next standout stock with StockStory today.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Dollar Remains Elevated Compared to the Yen

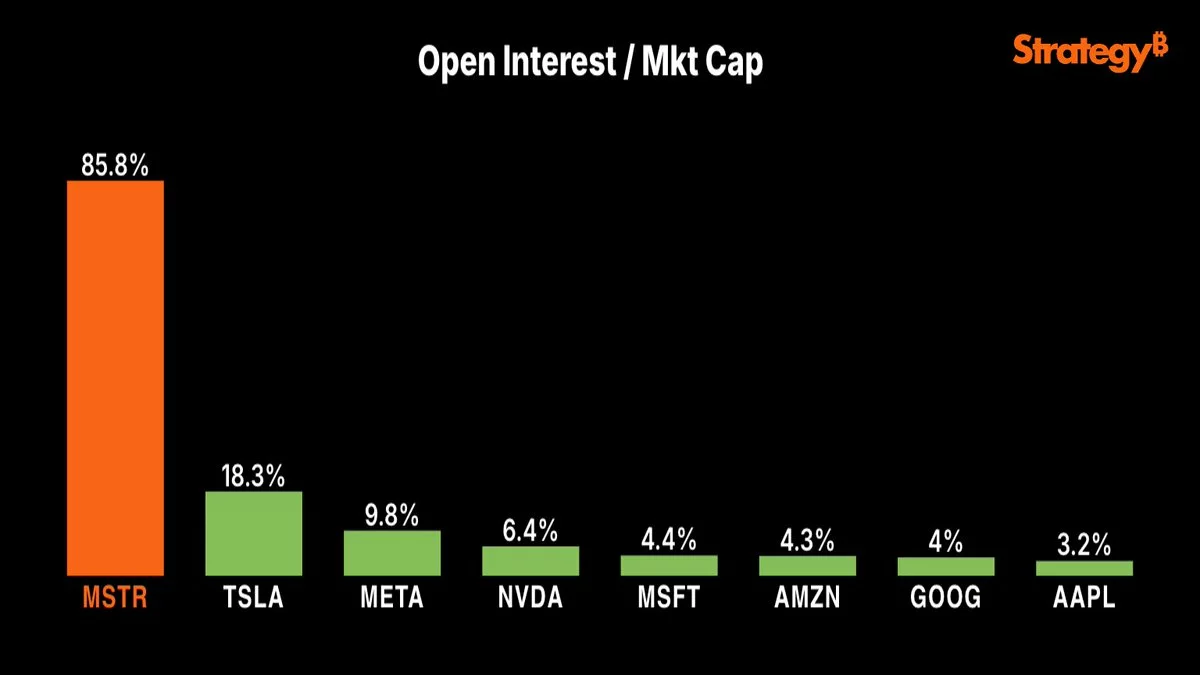

MSTR stock outlook: Traders watch key resistance after Friday rebound

Grayscale-Backed Altcoin Makes Big Announcement! “Delayed for 6 Months!”