Consumers were concerned about a surge in inflation due to Trump’s tariffs. Has it happened?

Tariffs and Inflation: What Has Really Happened?

Many Americans have been anticipating a sharp jump in consumer prices as a result of President Donald Trump’s tariff policies, fearing that inflation would soar to dangerous levels.

However, those expectations have yet to materialize.

By December, the yearly inflation rate remained steady at 2.7%, concluding a year where inflation fluctuated between 2% and 3%.

While prices have indeed increased, the dramatic inflation surge many predicted due to tariffs has not occurred.

“It’s encouraging that the economic fallout from tariffs has been less severe than initially feared,” commented Bill Adams, chief economist at Comerica Bank, in a December interview with USA TODAY.

President Trump launched an assertive tariff strategy in 2025.

Initial Fears: Tariffs and the Threat of Soaring Inflation

In May, a University of Michigan survey found that consumers expected prices to climb by 6.6% over the following year.

Similarly, businesses polled by the Federal Reserve Bank of Philadelphia in the third quarter of 2025 anticipated a 4.7% increase in prices for the coming year.

These alarming forecasts were largely attributed to tariffs, which function as taxes that companies often partially pass on to shoppers.

When the administration introduced broad tariffs in April, many business leaders braced for a significant inflationary shock.

“The speed and scale of these price increases is almost without precedent,” said John David Rainey, Walmart’s chief financial officer, in a May interview with The Wall Street Journal.

Consumers were deeply concerned that tariffs on imports would drive inflation sharply higher.

The Real Cost of Tariffs for Americans

Nearly a year after implementation, tariffs have imposed notable financial burdens on U.S. households.

According to a February 6 report from the nonpartisan Tax Foundation, the tariffs amounted to an extra $1,000 in taxes per household in 2025, with an additional $1,300 expected in 2026.

This represents the largest tax hike since 1993, based on the Tax Foundation’s analysis.

Despite these added costs, the feared inflation crisis has not come to pass—and may never do so.

At a December 10 news conference, Federal Reserve Chair Jerome Powell indicated that the U.S. faces minimal risk of significant tariff-driven inflation in the near future.

Powell predicted that any inflation caused by tariffs would likely reach its peak in early 2026, and the overall effect would be minor—just a few tenths of a percentage point, or possibly even less.

In summary, the Fed expects tariffs to have little impact on consumer prices in 2026.

Although a 3% inflation rate is above the Federal Reserve’s 2% target, it is not considered especially problematic. Economists typically reserve the term “inflation crisis” for annual rates of 5% to 10% or more.

Key Questions About Tariffs and Inflation

Is an inflation crisis still a possibility? How much have tariffs already contributed to price increases? Will tariffs drive further inflation in 2026? And why didn’t inflation spike more in 2025?

Let’s address these questions one by one.

Consumer prices could still rise in 2026 as a result of ongoing tariffs.

Is a Major Inflation Crisis Still Likely?

While anything is possible, most experts now believe a dramatic surge in consumer prices in 2026 is unlikely.

Shoppers have become less anxious about runaway inflation. According to a January survey by the New York Fed, the average consumer now expects prices to rise by 3.1% over the next year.

Economists forecast that inflation will ease to around 2.6% in 2026, based on a November poll by the National Association for Business Economics.

Most economists never anticipated a true inflation crisis. Even during the height of the tariff disputes in April, the same NABE survey projected inflation would reach a relatively moderate 3.4% by the end of 2025.

Current forecasts are even lower.

“Recent data suggests inflation has already peaked,” said Michael Pearce, chief U.S. economist at Oxford Economics, in January.

How Much Have Tariffs Increased Prices?

Research published by the National Bureau of Economic Research in November found that tariffs added about 0.7 percentage points to the U.S. inflation rate by late 2025.

Without these tariffs, inflation rates at the end of 2025 would have been closer to 2% rather than 3%.

“That’s a significant difference,” noted Alex Jacquez, chief of policy and advocacy at the Groundwork Collaborative, in a December interview with USA TODAY.

Will Tariffs Lead to More Inflation in 2026?

Many projections indicate that tariffs will continue to exert some upward pressure on prices in early 2026, but the effect is expected to be limited.

Fed Chair Powell told reporters in December that he expects tariff-driven inflation to peak in the first quarter of 2026, with little additional impact thereafter.

Other economists share this outlook.

“Tariff-related inflation is still filtering through the supply chain,” said Adams of Comerica Bank. “That process should finish reaching consumers in the first half of 2026.”

Adams expects the inflation rate to remain steady at around 3% during this period.

However, some analysts caution that the effects of tariffs may not be fully realized yet.

“Many companies are still absorbing most of the increased costs from imports,” said Chris Rupkey, chief economist at FwdBonds, in December. “But 2026 could present new challenges.”

Why Didn’t Tariffs Cause a Larger Inflation Spike?

Many dire forecasts assumed that American consumers would bear the full brunt of tariff-related costs.

In reality, only about 20% of the costs from Trump’s tariffs were passed on to consumers, according to the National Bureau of Economic Research.

As imported goods moved from their origin to U.S. retailers and finally to shoppers, the impact of tariffs was reduced at each stage.

Exporters often accepted lower prices for goods sold to American buyers, and China’s weakening economy contributed to lower prices for Chinese exports.

U.S. retailers, meanwhile, were often unable or unwilling to pass the full cost of tariffs to customers, partly out of concern for losing business. Some companies also sourced products from countries with lower tariffs.

Additionally, some of the tariffs were rolled back, lessening their effect on consumers.

According to Politico, due to carve-outs, trade agreements, and other exemptions, about half of all U.S. imports now enter the country without tariffs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Amuay, la mayor refinería de Venezuela, reiniciando operaciones básicas tras apagón eléctrico: fuentes

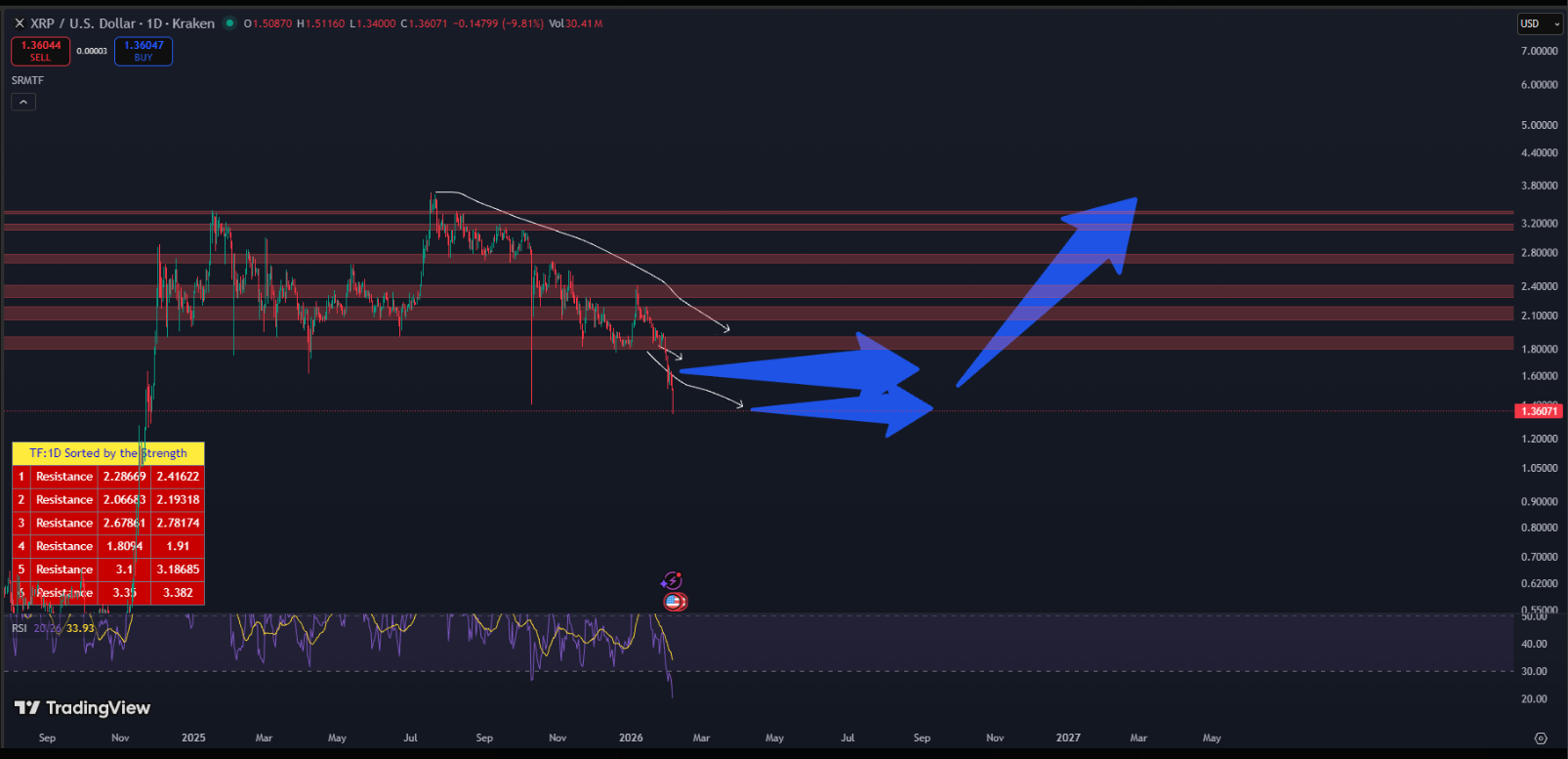

XRP Just Hit A Level That Previously Sparked 15%–40% Surges: Analyst