Nick, an XRP-focused market analyst, is arguing that the token is already slipping out of reach for many small investors — long before any eye-watering three-figure price targets. In a recent video, the host frames $1.43 XRP not as cheap, but as a level where “a large portion of retail” can no longer afford meaningful exposure.

The core claim is blunt: while anyone may still buy a few tokens, ownership of large stacks — 10,000 XRP or more — is becoming unrealistic for the average person and is likely to get further out of reach as institutional infrastructure around the XRP Ledger (XRPL) comes online.

Key Crypto Wallet Data: Millions Of Accounts, Very Little XRP

The host leans heavily on XRP rich list data to argue that current adoption is both early and skewed toward small holders. Out of roughly 7.59 million activated XRP accounts, more than 5 million hold between 0 and 500 XRP. About 6.46 million accounts hold 1,000 XRP or less.

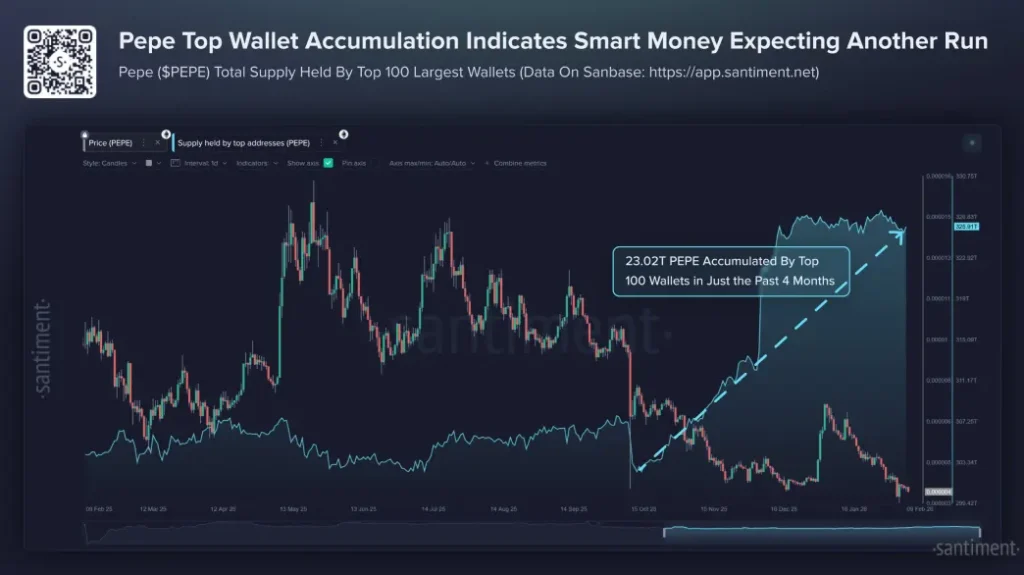

Sponsored

By contrast, only 514,237 wallets hold more than 5,000 XRP, and just 330,189 wallets hold 10,000 XRP or more — a position that now costs nearly $15,000 at current prices, NCash notes.

“Most of the population doesn’t have $15,000 in disposable income” to put into a single crypto asset, they say, arguing that for many retail investors, the window for building a “large” XRP position is already closing.

Updated figures cited from early 2026 show total accounts rising from about 6.1 million a year earlier to over 7.6 million, yet “most of the accounts are holding less than 1,000 XRP,” reinforcing the concentration argument.

Institutional Tooling, Not ETFs, Are Seen As Real Supply Shock

On the upside case, the analyst is clear: they expect XRP at $6, $10, $20, even $100 over time, but not primarily because of exchange-traded funds. XRP ETFs are described as “very successful” so far, with over $1.1 billion in assets and almost 800 million XRP locked up, but the host does not see them alone triggering a major supply squeeze.

Instead, they point to a confluence: more retail adoption, ETF accumulation, growth of XRP-based DeFi, and, crucially, banks and large institutions using XRPL for real-world flows such as FX swaps, cross-border payments, payroll, and corporate treasury.

The host cites a Ripple employee’s account of a boardroom session with more than 20 bank executives, where the “conversation has officially shifted from why to how” on digital asset payments and tokenization.

He also references comments from former Ripple CTO David Schwartz, who said institutions have preferred using digital assets off-chain and that even Ripple “can’t use the XRP Ledger DEX for payments yet” due to compliance concerns, but that new features like permissioned domains could change this.

According to the video, permissioned domains are now live, and a permissioned DEX is roughly “9–10 days” from activation. These are framed as “big key enablers” for institutional use of XRPL, including tokenized fiat and real-world assets, which in turn require XRP as gas.

The host links this to a broader tokenization trend, arguing that if trillions in assets move on-chain over time, demand for efficient settlement networks like XRPL — and their native tokens — could rise sharply. In that scenario, he said, retail investors may still afford 1 XRP, but not the 1,000–10,000-unit positions many now target.

Why This Matters

For investors, the message cuts two ways. On one hand, XRP at roughly $1.43 is presented as early in the adoption curve: only about 1.13 million accounts hold more than 1,000 XRP, a small number in global terms.

On the other, the analyst suggests the long-term value drivers are shifting decisively from speculative retail activity to regulated, institutional flows enabled by new XRPL features.

If that thesis proves correct, XRP’s pricing dynamics could begin to resemble those of infrastructure assets rather than purely speculative coins — with deeper liquidity, but also a higher baseline cost for meaningful exposure.

The timing of institutional adoption, and how quickly new XRPL tooling is actually used at scale, remains uncertain, but it is increasingly central to the XRP investment debate.

Delve into DailyCoin’s top crypto news now:

Prediction Markets Soar, But Major Risks Still Loom

Bitcoin Is No Longer Just About Halvings

People Also Ask:

According to the data cited in the video, about 330,189 wallets hold more than 10,000 XRP.

No. They view ETFs as contributory but argue that real supply pressure will come from institutional use of XRPL for payments, FX, and tokenization.

The host points to permissioned domains & an upcoming permissioned DEX as key tools to make on-chain XRP usage compliant for large institutions.

No. They argue retail will be priced out of “large” holdings over time, not of owning any XRP at all.