Crypto’s TradFi Moment: Institutions Are In, but on Their Terms

By:BeInCrypto

Inside Consensus Hong Kong 2026 This series covers the key debates and trends that emerged from Consensus Hong Kong 2026, drawing on main stage sessions, side events, and on-the-ground interviews during the second week of February. The RWA War: Stablecoins, Speed, and Control Cryptos AI Pivot: Hype, Infrastructure, and a Two-Year Countdown Cryptos TradFi Moment: Institutions Are In, but on Their Terms The numbers keep getting cited at crypto conferences, but at Consensus Hong Kong 2026, they came from a different kind of speaker not a protocol founder or exchange CEO, but a BlackRock executive doing math on a stage. The conference surfaced a central tension: institutional capital is enormous, interested, and still mostly watching. The $2 Trillion Thought Experiment Nicholas Peach, head of APAC iShares at BlackRock, framed the opportunity in simple math. With roughly $108 trillion in household wealth across Asia, even a 1% allocation to crypto would translate into nearly $2 trillion in inflows, equivalent to about 60% of the current market. BlackRocks IBIT, the US-listed spot Bitcoin ETF launched in January 2024, has grown to roughly $53 billion in assets, the fastest-growing ETF in history, with Asian investors accounting for a significant share of flows. Asia Is Already Building the On-Ramps If institutions want familiar structures, someone has to build them. That race is well underway and Asia is leading. Laurent Poirot, Head of Product Strategy and Development for Derivatives at SGX Group, told BeInCrypto in an interview that the exchanges crypto perpetual futures launched in late November reached $2 billion in cumulative trading volume within two months, making it one of the fastest product launches for SGX. More than 60% of trading activity occurred during Asian hours, in contrast to CME, where US hours dominate. Institutional demand is concentrated in Bitcoin and Ethereum, and SGX is prioritizing options and dated futures to complete the funding curve rather than expanding into additional tokens. Notably, SGX has no plans to expand into altcoins. Institutional demand concentrates on Bitcoin and Ethereum; the next step is options and dated futures to complete the funding curve, not a longer list of tokens. In Japan, major banks are developing stablecoin solutions to create regulated rails for traditional capital, according to Fakhul Miah of GoMining Institutional, who pointed to Hong Kongs recent approval of ETFs and perpetuals as another major liquidity driver. Wendy Sun of Matrixport noted that while stablecoin settlement and RWA tokenization dominate industry conversation, internal treasury adoption of stablecoins still awaits standardization. Institutional behavior, she said, is becoming rule-based and scheduled rather than opportunistic. Different Languages: When TradFi Meets On-Chain Yield At HashKey Clouds side event, the gap between what institutions want and what crypto offers became tangible. Louis Rosher of Zodia Custody backed by Standard Chartered described a fundamental trust problem. Traditional financial institutions group all crypto-native firms together and distrust them by default. A bank CEO with a 40-year career wont stake it on a single crypto-native counterparty, Rosher said. Zodias strategy is to leverage established banking brands to bridge that gap a dynamic he projected would persist for the next decade or two. The firm is building DeFi yield access through a Wallet Connect integration, but within a permissioned framework in which each DApp is vetted individually before being offered to clients. Steven Tung of Quantum Solutions, Japans largest digital asset treasury company, identified a more mundane but critical barrier: reporting format. Institutions dont want block explorers they want daily statements, audit trails, and custody proofs in formats their compliance teams already understand. Without traditional-style reporting, he argued, the vast majority of institutional capital will never arrive. Samuel Chong of Lido outlined three prerequisites for institutional-grade participation: the protocols security, ecosystem maturity, including custodian integration and slashing insurance, and regulatory alignment with traditional finance frameworks. He also flagged privacy as a hidden barrier institutions fear that on-chain position exposure invites front-running and targeted attacks. Regulation: The Variable That Controls Everything Anthony Scaramucci used his fireside chat to walk through the Clarity Act the US market structure bill working through the Senate and its three key sticking points: the level of KYC/AML requirements for DeFi, whether exchanges can pay interest on stablecoins, and restrictions on crypto investments by the Trump administration and its affiliates. Scaramucci predicted the bill would pass, driven less by conviction than by political math: young Democratic senators dont want to face crypto industry PAC money in their next elections. But he warned that Trumps personal crypto ventures including meme coins are slowing the process. He called Trump objectively better for crypto than Biden or Harris, while criticizing the self-dealing as harmful to the industry. That tension was visible on stage when Zak Folkman, co-founder of Trump-linked World Liberty Financial, teased a new forex platform called World Swap built around the projects USD1 stablecoin. The projects lending platform has already attracted hundreds of millions in deposits, but its proximity to a sitting president remains a legislative complication Scaramucci flagged directly. Meanwhile, Asia isnt waiting. Regulators in Hong Kong, Singapore, and Japan are establishing frameworks that institutions can actually use. Fakhul Miah noted that institutional onboarding now requires passing risk committees and operational governance structures infrastructure that didnt exist for on-chain products until recently. The Market Between Cycles Binance Co-CEO Richard Teng addressed the Oct. 10 crash head-on, attributing $19 billion in liquidations to macroeconomic shocks US tariffs and Chinese rare-earth controls rather than exchange-specific failures. The US equity market alone saw $150 billion of liquidation, he said. The crypto market is much smaller. But his broader reading was more revealing. Retail demand is somewhat more muted compared to the past year, but the institutional deployment, the corporate deployment is still strong, Teng said. The smart money is deploying. Vicky Wang, president of Amber Premium, put numbers to the shift. Institutional crypto transactions in Asia grew 70% year over year to reach $2.3 trillion by mid-2025, she said. But capital allocation remains conservative institutions overwhelmingly prefer market-neutral and yield strategies over directional bets. The institutional participation in Asia, I would say its real, but at the same time its very cautious, Wang said. Among industry participants at the event, the mood was more somber. Trading teams at institutional side events were significantly down from the previous year, with most running identical strategies. The consensus among fund managers was that crypto is becoming a license-driven business where compliance and traditional financial credibility matter more than crypto-native experience. Some noted that serious projects now prefer Nasdaq or HKEX IPOs over token listings a reversal unthinkable two years ago. The Endgame Is Finance Solana Foundation President Lily Liu may have delivered the conferences clearest thesis. Blockchains core value, she argued, is not digital ownership, social networks, or gaming its finance and markets. Her internet capital markets framework positions blockchain as infrastructure for making every financial asset accessible to everyone online. The end state is moving into assets that have value, can also command price, and bring more inclusivity for five and a half billion people on the internet into capital markets, Liu said. GSRs CJ Fong predicted that most tokenized real-world assets will ultimately be classified as securities, requiring crypto firms to bridge to traditional market infrastructure. That means more competition from traditional players but also the legitimacy that institutional capital demands. The $2 trillion that Peach described isnt arriving tomorrow. But the plumbing is being laid in Hong Kong, Singapore, Tokyo, and on SGXs order books by institutions that have decided crypto is worth building for, even if theyre not ready to bet on it. (Inside Consensus Hong Kong 2026) This series covers the key debates and trends that emerged from Consensus Hong Kong 2026, drawing on main stage sessions, side events, and on-the-ground interviews during the second week of February.1. The RWA War: Stablecoins, Speed, and Control2. Cryptos AI Pivot: Hype, Infrastructure, and a Two-Year Countdown3. Cryptos TradFi Moment: Institutions Are In, but on Their Terms

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Roth Raises Integra Resources Corp. (ITRG) Resources Price Target to $7, Reiterates Buy

Finviz•2026/02/17 12:54

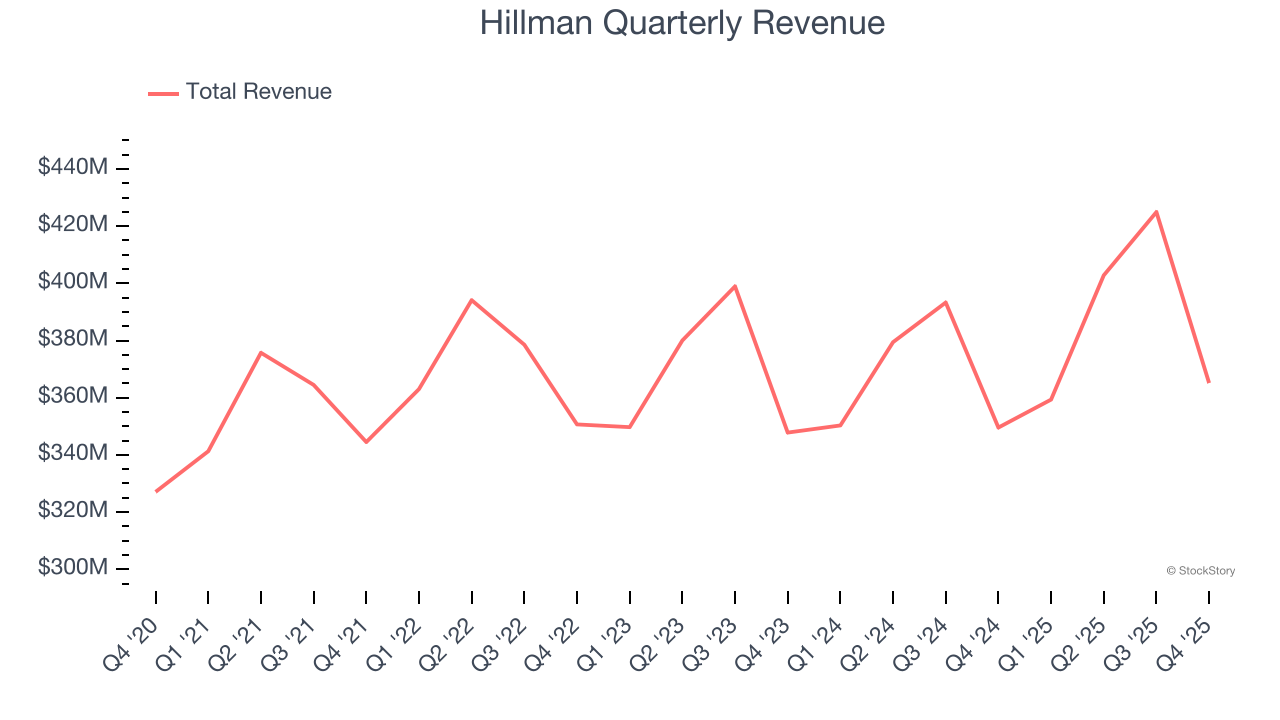

Hillman (NASDAQ:HLMN) Reports Sales Below Analyst Estimates In Q4 CY2025 Earnings

Finviz•2026/02/17 12:54

Watsco: Fourth Quarter Earnings Overview

101 finance•2026/02/17 12:51

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$68,007.48

-2.41%

Ethereum

ETH

$1,970.4

-1.64%

Tether USDt

USDT

$0.9995

+0.00%

XRP

XRP

$1.46

-3.11%

BNB

BNB

$620.27

-1.06%

USDC

USDC

$1.0000

+0.01%

Solana

SOL

$84.88

-1.50%

TRON

TRX

$0.2810

+0.06%

Dogecoin

DOGE

$0.09963

-2.83%

Bitcoin Cash

BCH

$562.51

-0.23%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now