Somnigroup (NYSE:SGI) Misses Q4 CY2025 Sales Expectations

Bedding manufacturer Somnigroup (NYSE:SGI)

Is now the time to buy Somnigroup?

Somnigroup (SGI) Q4 CY2025 Highlights:

- Revenue: $1.87 billion vs analyst estimates of $1.93 billion (54.7% year-on-year growth, 3.2% miss)

- Adjusted EPS: $0.72 vs analyst estimates of $0.72 (in line)

- Adjusted EBITDA: $348.5 million vs analyst estimates of $351.6 million (18.7% margin, 0.9% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $3.20 at the midpoint, missing analyst estimates by 3.9%

- Operating Margin: 13.2%, up from 10.6% in the same quarter last year

- Free Cash Flow Margin: 2.2%, down from 9% in the same quarter last year

- Market Capitalization: $20.16 billion

Company Chairman and CEO Scott Thompson commented, "We are pleased to report record fourth quarter net sales and adjusted EBITDA, along with a 20% increase in adjusted EPS. These results mark a continuation of the strength we displayed throughout the year, as we enhanced our competitive position and executed a successful combination with Mattress Firm.

Company Overview

Established through the merger of Tempur-Pedic and Sealy in 2012, Somnigroup (NYSE:SGI) is a bedding manufacturer known for its innovative memory foam mattresses and sleep products

Revenue Growth

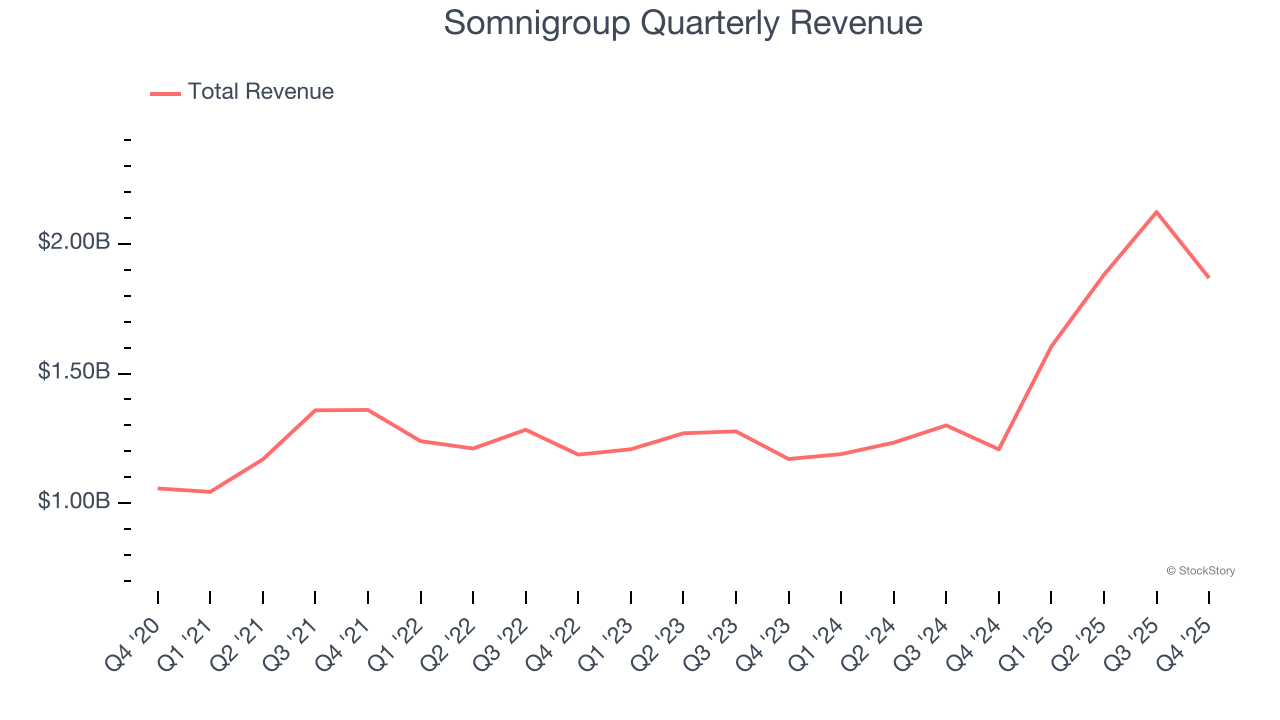

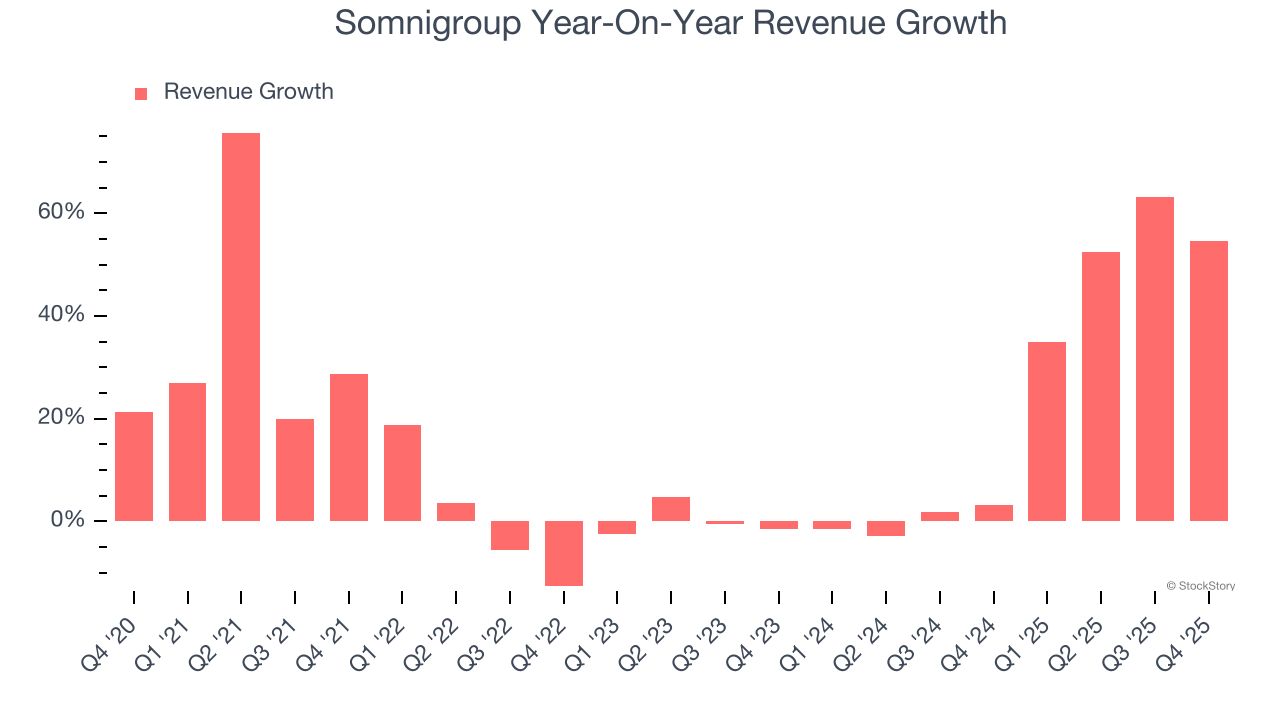

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Somnigroup grew its sales at a 15.3% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Somnigroup’s annualized revenue growth of 23.2% over the last two years is above its five-year trend, which is encouraging.

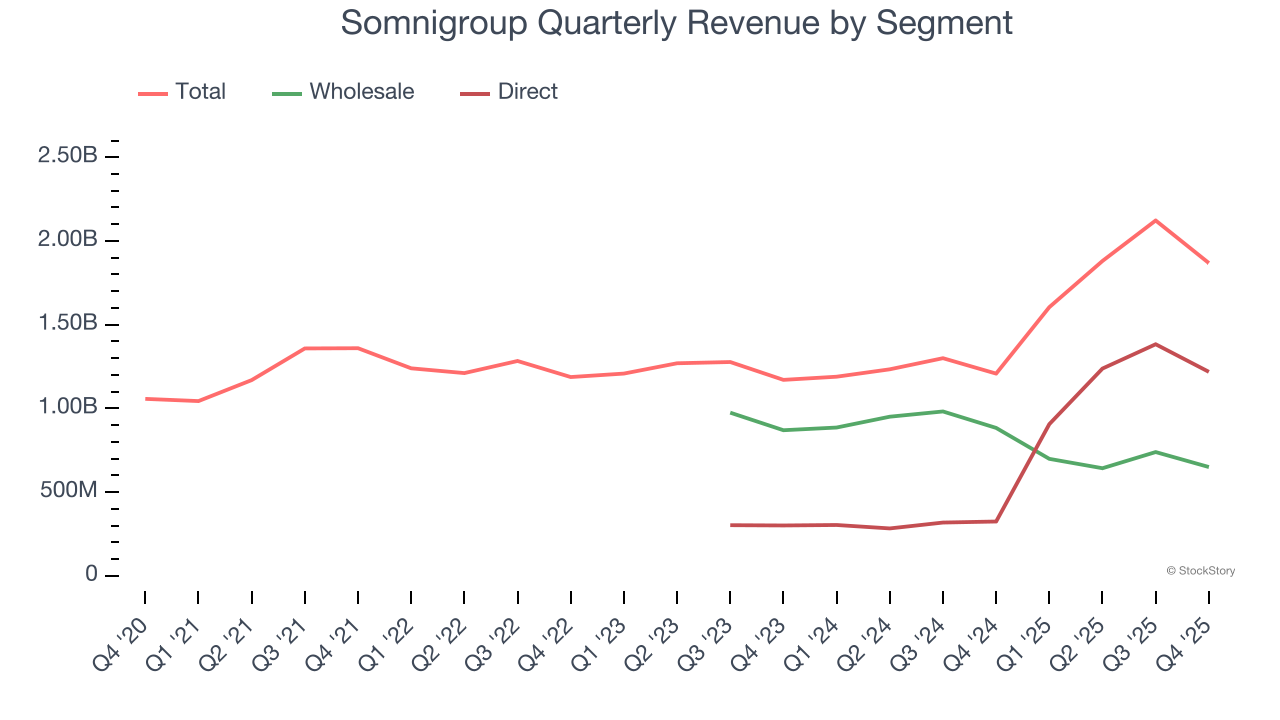

We can better understand the company’s revenue dynamics by analyzing its most important segments, Wholesale and Direct, which are 34.8% and 65.2% of revenue. Over the last two years, Somnigroup’s Wholesale revenue (sales to retailers) averaged 17.1% year-on-year declines. On the other hand, its Direct revenue (sales made directly to consumers) averaged 193% growth.

This quarter, Somnigroup achieved a magnificent 54.7% year-on-year revenue growth rate, but its $1.87 billion of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without.

Operating Margin

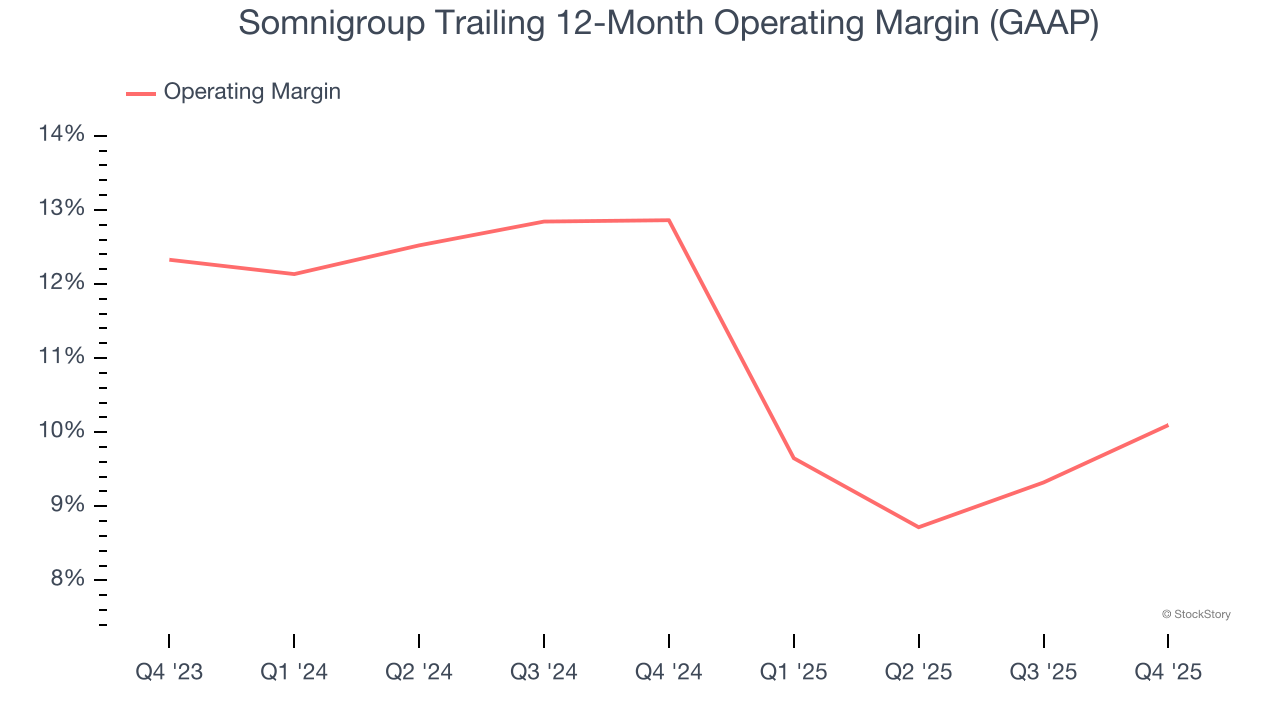

Somnigroup’s operating margin has shrunk over the last 12 months and averaged 11.2% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q4, Somnigroup generated an operating margin profit margin of 13.2%, up 2.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

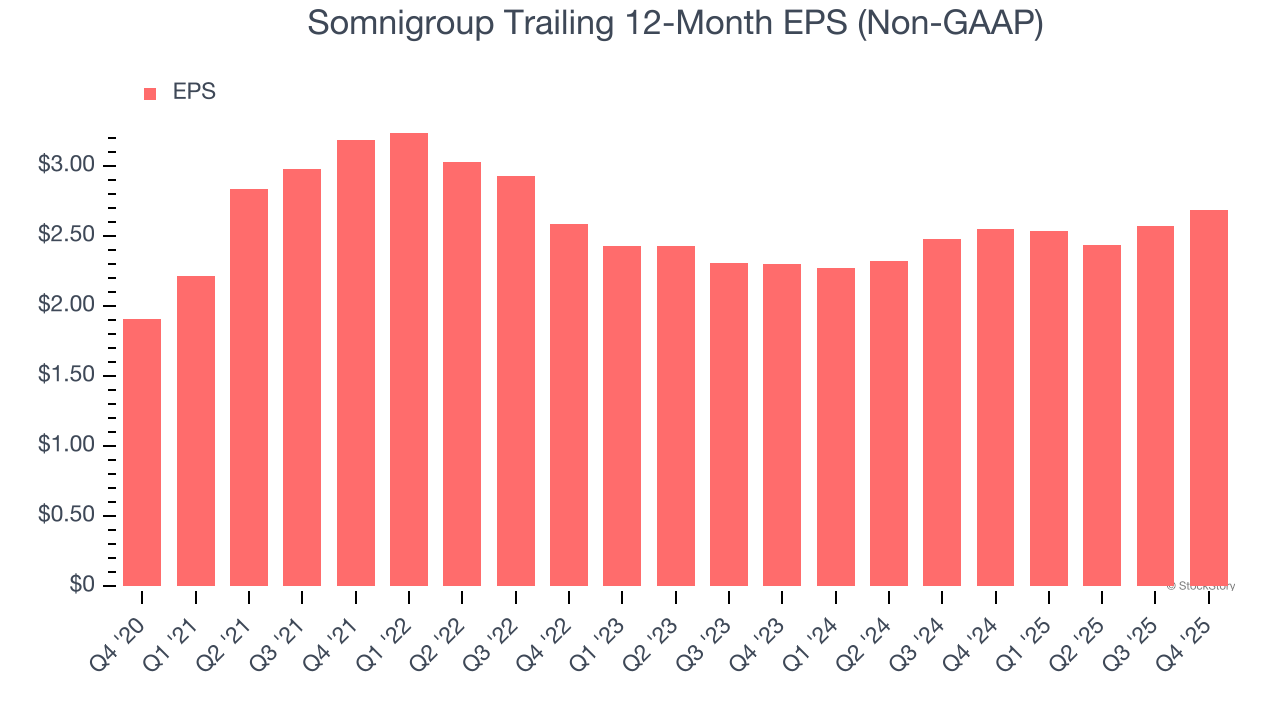

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Somnigroup’s EPS grew at a weak 7.1% compounded annual growth rate over the last five years, lower than its 15.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

In Q4, Somnigroup reported adjusted EPS of $0.72, up from $0.60 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Somnigroup’s full-year EPS of $2.69 to grow 23%.

Key Takeaways from Somnigroup’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $95.74 immediately following the results.

Somnigroup didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Darknet Markets Shift to Monero in 2025

Paychex (PAYX) Directors Buy 2,000 Shares in February Insider Trades

Kinder Morgan (KMI) Director Buys 3,000 Shares in Insider Transaction

Evercore Raises Price Target on Molson Coors (TAP), Maintains Outperform Rating