Anthropic Has Another New Model-Software Stocks Are Going To Hate It

Anthropic is leading the charge in user development of autonomous agentic systems, and its Tuesday debut of Claude Sonnet 4.6 delivered another blow to software companies.

Anthropic's Sonnet 4.6 followed hot on the heels of the Claude Opus 4.6 release, creating a one-two punch that has left traditional software stocks reeling.

- MSFT stock is moving.

Software investors fear cannibalization: the concern that advanced AI agents, like Anthropic’s latest models, are rendering traditional user interfaces and subscription-based models obsolete.

Anthropic spoke to those exact fears in a blog post announcing the latest release on Tuesday.

"Almost every organization has software it can't easily automate: specialized systems and tools built before modern interfaces like APIs existed. To have AI use such software, users would previously have had to build bespoke connectors. But a model that can use a computer the way a person does changes that equation," Anthropic said.

Software Stocks Under Pressure

Traditional "office" software stocks like Salesforce, Inc. (NYSE:CRM) and Intuit, Inc. (NASDAQ:INTU) have plunged following recent model releases and the latest from Anthropic could add more pain.

"Performance that would have previously required reaching for an Opus-class model—including on real world, economically valuable office tasks—is now available with Sonnet 4.6," the AI startup said on Tuesday.

The cybersecurity sector has not been spared. Okta, Inc. (NASDAQ:OKTA) and CrowdStrike Holdings (NASDAQ:CRWD) face a shift where AI-native threat detection could potentially be superior to traditional endpoint software.

Even Microsoft Corp. (NASDAQ:MSFT), despite its massive investment in AI and Anthropic itself, is caught in the crossfire with shares down 18% in 2026.

Some industry leaders, such as Nvidia Corp. (NASDAQ:NVDA) CEO Jensen Huang, argue that AI will “feed” rather than “eat” software. However, the $830 billion rout in the software and services index suggests that Wall Street is betting on a future where the AI model is the software.

Image: Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bakkt Announces Partnership with Nexo

Bitcoin: Corporations rush to secure BTC – So why is price still falling?

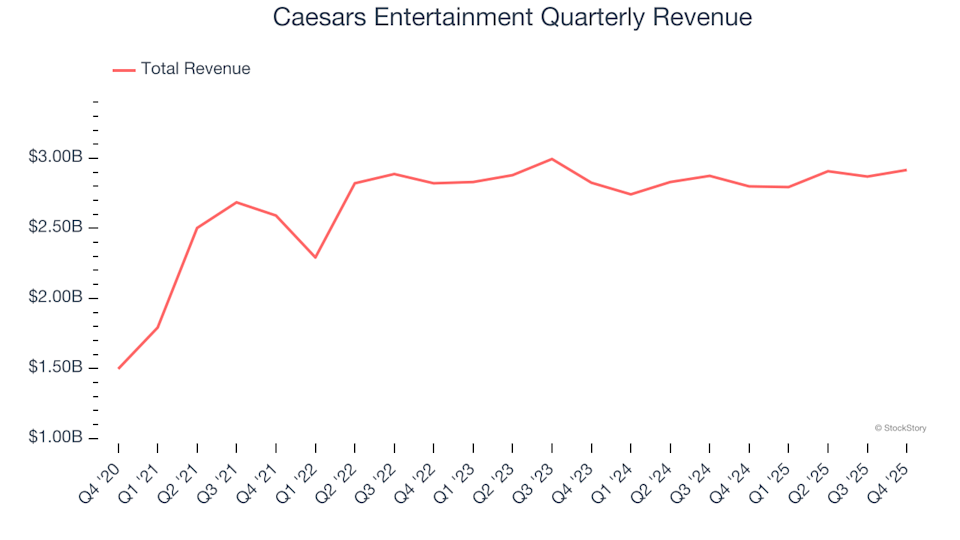

Caesars Entertainment (NASDAQ:CZR) Exceeds Q4 2025 Sales Expectations

US, Nippon Steel to reline Gary Works blast furnace this year