Fluor Ends 2025 With $25.5 Billion Backlog, Targets $1.4 Billion Stock Buyback In 2026

Fluor Corporation (NYSE:FLR) reported fourth-quarter and full-year 2025 financial results on Tuesday, outlining performance across its engineering and construction businesses. Shares were trading higher following the release of the results.

Fourth-Quarter Results

For the fourth quarter of 2025, Fluor reported a net loss attributable to the company of $1.6 billion, or ($9.87) per diluted share, compared with net earnings of $1.9 billion, or $10.57 per diluted share, in the prior-year period. The company said the quarter reflected a net $2 billion reduction in the valuation of its NuScale investment.

Adjusted EPS was 33 cents, missing the 34 cents analyst estimate. Revenue was $4.175 billion, missing the $4.249 billion estimate and down from $4.260 billion a year earlier. Consolidated segment profit totaled $120 million versus $206 million in the fourth quarter of 2024. Adjusted EBITDA was $91 million.

New awards in the quarter were $1.127 billion, down from $2.308 billion in the prior-year period.

Segment Performance

Urban Solutions generated revenue of $2.630 billion, up from $1.999 billion a year earlier. Segment profit was $44 million, compared with $81 million last year.

Energy Solutions reported revenue of $943 million, down from $1.520 billion. Segment profit was $56 million versus $63 million in the prior-year period.

Mission Solutions posted revenue of $600 million, down from $654 million a year earlier. Segment profit was $21 million versus $45 million last year.

Full-Year Results

For the year ended Dec. 31, 2025, revenue was $15.503 billion, down from $16.315 billion in 2024. Fluor reported a GAAP net loss attributable to the company of $51 million, or (31) cents per share, compared with earnings of $2.145 billion, or $12.30 per share, a year earlier.

Adjusted EPS was $2.19 versus $2.32 in 2024, and adjusted EBITDA was $504 million, compared with $530 million.

Full-year results reflected a $643 million adverse Santos ruling, which the company said drove the reversal of $643 million in previously recognized revenue associated with a judgment on the completed Santos project in Australia. Operating cash flow was ($387) million compared with $828 million in 2024, including a $642 million payment to Santos, net of insurance recoveries.

Total new awards for 2025 were $11.956 billion, down from $15.123 billion in 2024. Ending backlog was $25.536 billion compared with $28.484 billion a year earlier. Backlog was 81% reimbursable, up from 79%, while backlog outside the U.S. declined to 40% from 55%.

The company ended 2025 with $2.2 billion in cash and marketable securities and $2.135 billion in cash and cash equivalents. During the year, Fluor repurchased 18 million shares for $754 million and retired $37 million of debt, and it plans $1.4 billion of share repurchases in 2026.

NuScale Monetization and Outlook

Fluor said it received $605 million in 2025 and an additional $1.35 billion in the first quarter of 2026 from NuScale share sales. The company expects full monetization of its remaining stake by the end of the second quarter of 2026.

Looking ahead, Fluor established 2026 adjusted EBITDA guidance of $525 million to $585 million, citing the expected timing of new awards and the pace of execution on the existing backlog, and noted risks including tariffs and trade policies as well as GAAP earnings volatility tied to NuScale fair value measurements.

FLR Price Action: Fluor shares were up 6.95% at $48.64 at the time of publication on Tuesday.

Photo by Trong Nguyen via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bakkt Announces Partnership with Nexo

Bitcoin: Corporations rush to secure BTC – So why is price still falling?

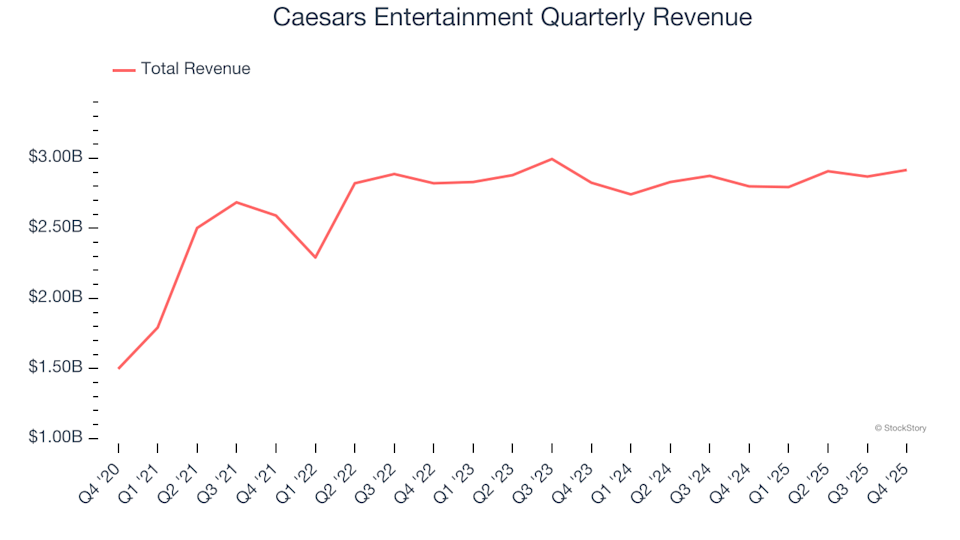

Caesars Entertainment (NASDAQ:CZR) Exceeds Q4 2025 Sales Expectations

US, Nippon Steel to reline Gary Works blast furnace this year