Trump is a fan of low gas prices—but if military tensions escalate with Iran, you could see what you pay at the pump almost double.

U.S. Military Escalation and Its Impact on Oil Prices

The United States is undertaking its most significant military buildup since the 2003 Iraq war, this time focusing on Iran. According to geopolitical and energy experts interviewed by Fortune, the outcome of this standoff could dramatically affect gasoline prices in the U.S.—potentially dropping to $2.50 per gallon or soaring to $5 if conflict erupts.

The Strategic Importance of the Strait of Hormuz

The Strait of Hormuz, a narrow 104-mile waterway off Iran’s coast, is a critical passage for global oil shipments. Nearly 20 million barrels of oil flow through this chokepoint daily, connecting the Persian Gulf to the Indian Ocean and international markets. Most oil exports from Saudi Arabia, Iraq, Iran, Kuwait, and the United Arab Emirates transit this strait.

High Stakes and Potential Risks

Dan Pickering, founder of Pickering Energy Partners, emphasized the gravity of the situation: “The risks are enormous. The greatest threat of disruption would come from Iran if it feels cornered and has nothing left to lose.”

Pickering noted that, historically, Middle Eastern conflicts have avoided targeting oil infrastructure. Even during the Twelve-Day War between Israel and Iran last June, which ended with U.S. airstrikes on Iranian nuclear facilities, oil assets were largely spared.

However, if Iran becomes desperate, it could mine or attack the strait, effectively blocking it. The country might also strike neighboring nations, particularly Saudi Arabia and the UAE. Matt Reed, vice president at Foreign Reports, warned, “If Iran’s leadership believes the regime’s survival is at stake, all options are on the table.”

Rising Tensions and Diplomatic Challenges

Reed described the current situation as even more concerning than last summer, citing the lack of progress on a new nuclear agreement and ongoing domestic unrest in Iran. “Iran is far more desperate now. Facing a potential existential crisis, it may act aggressively to increase the cost of U.S. intervention,” he told Fortune. “With its back against the wall, Tehran could target oil-rich Arab neighbors, triggering a global oil price shock.”

He added, “The likelihood of a diplomatic breakthrough is diminishing every day. Both sides are repeating the same arguments as before.”

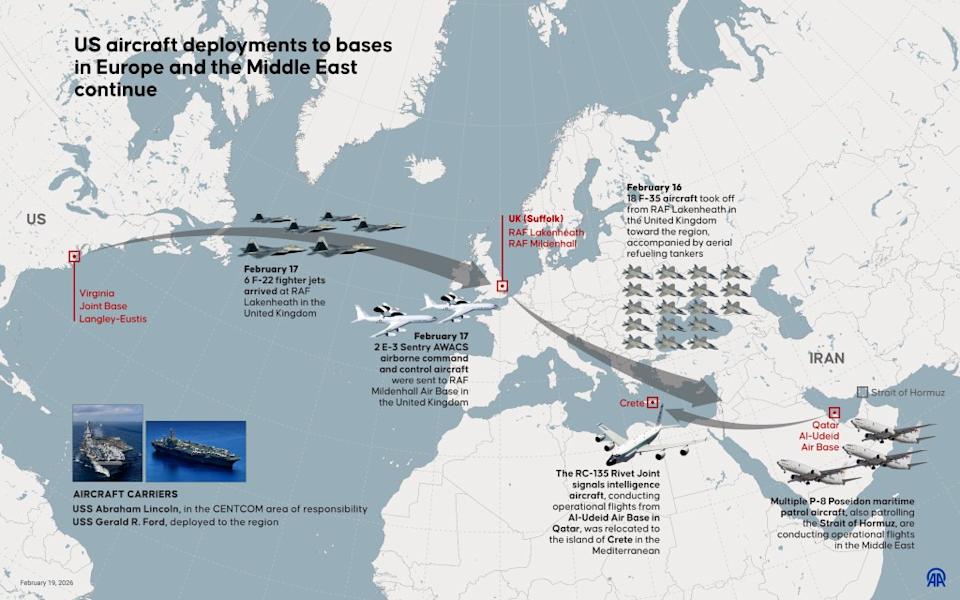

U.S. military aircraft continue to be deployed to bases across Europe and the Middle East.

Economic Implications of a Potential Conflict

As of February 20, the U.S. oil benchmark was trading above $66 per barrel, nearly $10 higher due to rising tensions with Iran. Pickering explained that this premium reflects the market’s assessment of about a 25% chance of a major conflict in the region.

Possible Scenarios for Oil and Gas Prices

Despite the risks, the probability still leans toward a peaceful resolution or a limited military engagement that could prompt renewed negotiations. With the U.S. midterm elections approaching, President Trump is focused on keeping energy prices low, aiming for oil to drop to $50 per barrel—a level below what most producers require for profitability. Achieving this could bring average gasoline prices down to around $2.50 per gallon, compared to the current national average of $2.93, according to AAA.

Pickering suggested that these figures indicate Trump’s interest in reaching an agreement with Iran. Meanwhile, OPEC, led by Saudi Arabia and the UAE, is considering increasing production, which could help cushion the impact of a limited conflict.

However, Claudio Galimberti, chief economist at Rystad Energy, cautioned that a prolonged closure of the Strait of Hormuz would be unsustainable for global energy markets. “No measure could compensate for a blockade of the strait,” he said.

Galimberti estimated that a contained conflict with Iran could push oil prices up by $15 to $20 per barrel, exceeding $80. Any disruption to the strait could send prices above $100 per barrel, with gasoline potentially nearing $5 per gallon.

Conversely, a diplomatic breakthrough could lower the U.S. oil benchmark below $60 per barrel. Removing sanctions and allowing Iranian oil to reach more markets could drive prices even lower, possibly to Trump’s target of $50 per barrel, especially given the current global oversupply.

“A diplomatic solution and a new nuclear deal are still possible, though it seems unlikely at the moment,” Galimberti told Fortune.

Ultimately, “everyone wants to avoid a closure of the Strait of Hormuz,” he said. Yet, a desperate move by Iran or an accidental strike could alter the situation dramatically.

Pickering concluded, “Iran has significant capacity to cause chaos if it chooses. But taking that step would provoke a major response.”

“Even during last June’s bombings, Iran refrained from escalating to that level.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uzbekistan issues first crypto mining permit, joins Central Asian mining race

Plug Power (PLUG) Confronts Legal Challenge Amid Hydrogen Expansion Plans

Crypto Market Holds Steady as Extreme Fear Persists

Stablecoin Evolution 2026: Why Next-Generation Stablecoins Could Become the Smartest Infrastructure Investment of the Year