News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Federal Reserve Rate Cut in September: Which Three Cryptocurrencies Could Surge?2Is XRP about to break through $3?3Bitcoin Cash Breakout Eyes $776, $960, and $1,157 as Key Resistance Levels

Ethereum Could Break Out After Triple Bottom With $4,540 Resistance in Focus Toward $5,000

Coinotag·2025/09/08 02:00

Top Altcoin Movers: Mythos Rallies 9%, Immutable Holds $0.51, Cardano Pushes Toward $0.85

Cryptonewsland·2025/09/08 01:35

5 Best Layer 1s to HODL — Breaking Down Real Trade-Offs in 2025

Cryptonewsland·2025/09/08 01:35

Solana Trades at $202 as Rising Wedge Targets $160 Breakdown Level

Cryptonewsland·2025/09/08 01:35

SUI vs AVAX: Which Altcoin Wins 2025? Analysts Also Back MAGACOIN FINANCE

SUI and AVAX lead the altcoin race, but MAGACOIN FINANCE is gaining strong momentum, making investors rethink the next big move in crypto.

Coinomedia·2025/09/08 01:30

Trump family's wealth grew by $1.3B following ABTC and WLFI debuts: Report

CryptoNewsNet·2025/09/08 01:20

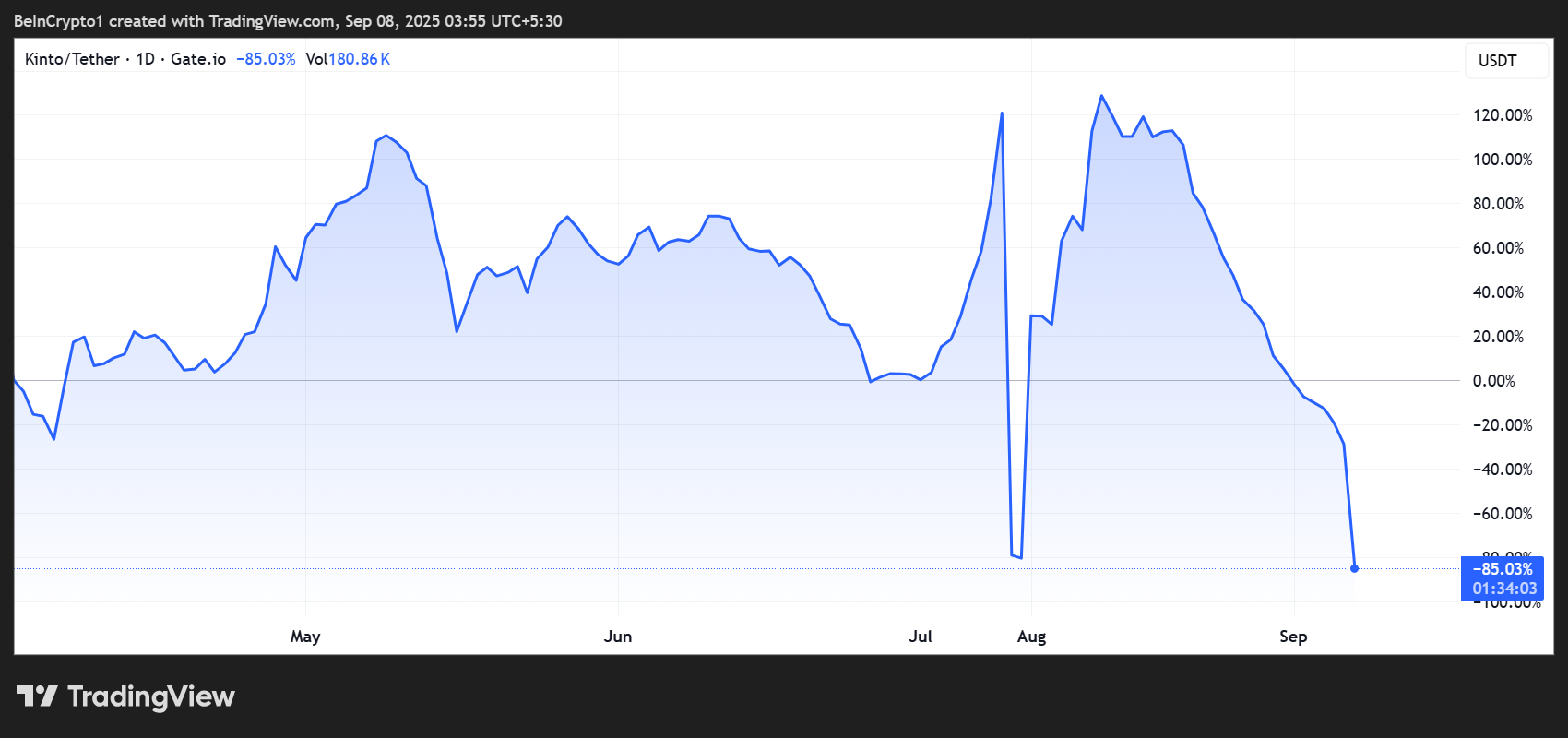

Why Kinto’s K Token Collapsed Before Unlocking

CryptoNewsNet·2025/09/08 01:20

Sell Everything: A Crypto Market Crash Is Coming

Cointribune·2025/09/08 01:10

Goldman and T. Rowe sign $1 billion partnership as Wall Street targets retirement cash

Share link:In this post: Goldman Sachs is buying a $1 billion, 3.5% stake in T. Rowe Price to push private assets into retirement accounts. The partnership will launch target-date funds, co-branded portfolios, and advice services by mid-2025. Citigroup also announced a deal giving BlackRock $80 billion in client assets to manage starting in Q4.

Cryptopolitan·2025/09/07 23:50

Flash

- 02:03Barclays: The Federal Reserve will cut rates consecutively this year, while the European Central Bank will keep rates unchanged this week.According to ChainCatcher, citing Jinse Finance, Barclays economists expect the Federal Reserve to cut interest rates consecutively in September, October, and December, even though upcoming data may show an acceleration in consumer inflation. They believe the likelihood of a 50 basis point rate cut is very small and that the market has already priced this in. The economists predict two more rate cuts in March and June 2026, ultimately bringing the interest rate down to 3% - 3.25%. In contrast, Barclays expects the European Central Bank to keep rates unchanged this week.

- 02:03Barclays: Expects the Federal Reserve to Cut Rates Consecutively This Year, While the European Central Bank Will Hold Steady This WeekJinse Finance reported that as the U.S. employment report indicates increasing downside risks in the labor market, Barclays economists expect the Federal Reserve to cut interest rates consecutively in September, October, and December, even though upcoming data may show an acceleration in consumer inflation. However, they ruled out the possibility of a significant rate cut by the Fed. The report stated: "We believe the likelihood of a 50 basis point rate cut is very low, and the market is indeed pricing it that way. The upcoming CPI and the Quarterly Census of Employment and Wages (QCEW) will have limited impact on this expectation." Economists still predict two more rate cuts in March and June 2026, bringing the final rate down to 3.00%-3.25%. In contrast, Barclays expects the European Central Bank to remain unchanged this week, while fiscal pressures will persist, especially in France and the UK. (Golden Ten Data)

- 02:03ICBC Asia and HSBC have expressed their intention to apply for a stablecoin license to the Hong Kong Monetary Authority.According to a report by Jinse Finance, The Hong Kong Economic Journal has released market news stating that ICBC Asia and a certain exchange have expressed their intention to apply for a stablecoin license to the Hong Kong Monetary Authority. It is still unclear whether the exchange will officially submit the application before the end of this month.