News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 11)|Trump Announces 100% Tariffs on China, Triggering Market Turmoil; Crypto Industry Liquidations Exceed $19.1 Billion in 24 Hours, Setting New Record.2Bitcoin slump may rebound up to 21% in 7 days if history repeats: Economist3US–China Tariff Fears Hit Bitcoin Treasury Stocks

Ergo (ERG) Bounces Off Key Support – Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/10/12 16:21

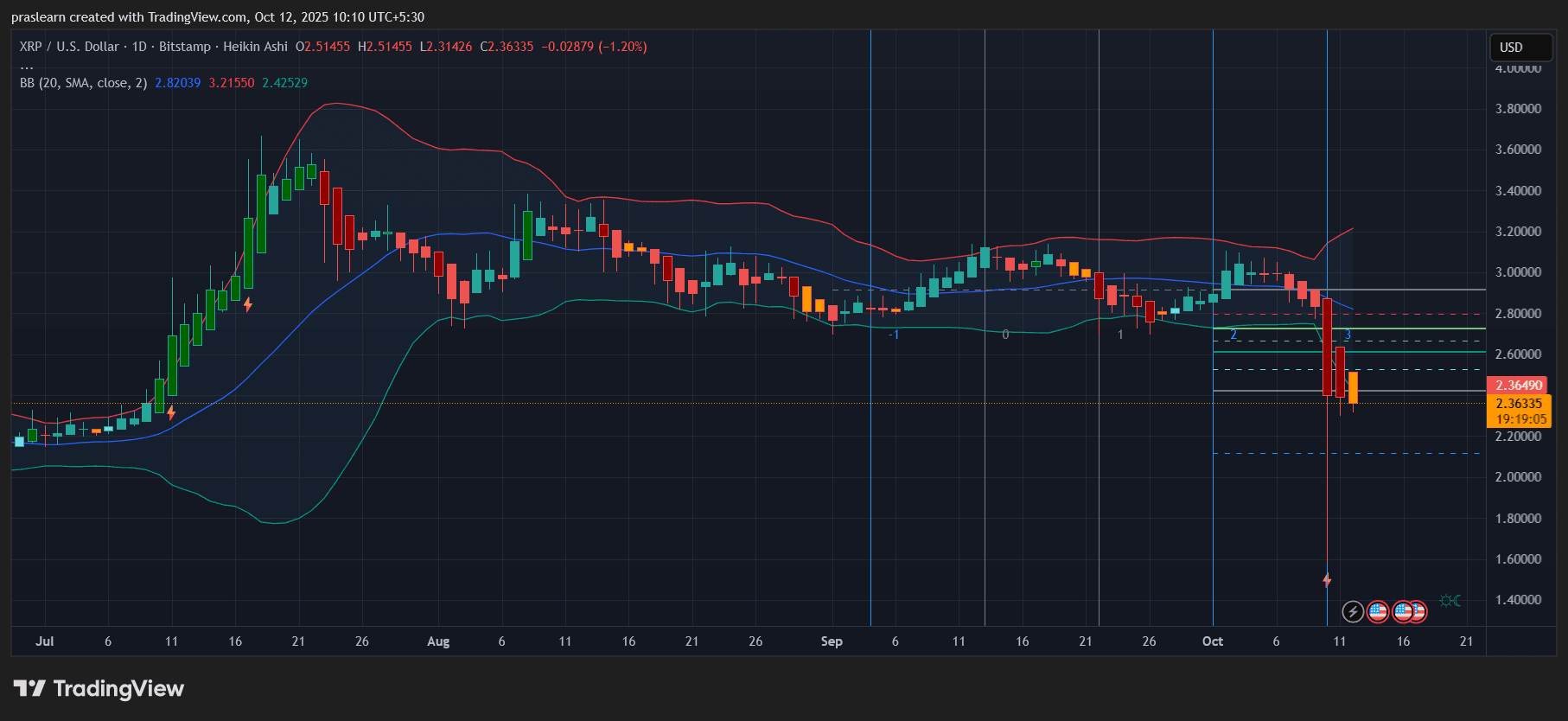

Will XRP Price Crash to $0.60 as Trade Tensions and Inflation Delays Rattle Markets?

Cryptoticker·2025/10/12 16:03

Sam Altman in conversation with a16z co-founder: Will make aggressive bets on infrastructure, sora is an important strategic tool

OpenAI is transforming from a research lab into a vertically integrated "AI empire."

深潮·2025/10/12 15:45

Hyperliquid Suffers Major Wallet Compromise, $21M Stolen

Coinlineup·2025/10/12 15:24

The Decline of Crypto’s Fair Launch Model in 2025

Coinlineup·2025/10/12 15:24

Crypto Market Crashes Following Trump’s Tariff Announcement

Coinlineup·2025/10/12 15:24

Crypto Whale Initiates $900M Bitcoin, Ethereum Shorts

Coinlineup·2025/10/12 15:24

SEC Confirms Review Acceleration for XRP, ADA, and SOL ETF Filings Amid Regulatory Softening

Quick Take Summary is AI generated, newsroom reviewed. SEC fast-tracks XRP, ADA, and SOL ETF reviews after Grayscale GDLC precedent. Review covers filings from Grayscale, VanEck, Bitwise, and Franklin Templeton. XRP benefits from legal clarity post-SEC settlement. ADA and SOL ETFs remain under consideration with minor procedural delays.References X Post Reference

coinfomania·2025/10/12 13:57

Bitcoin eyes $114K liquidity grab as traders bet on BTC price rebound

Cointelegraph·2025/10/12 12:33

Flash

- 16:13Data: A certain whale went long on 770 BTC on Hyperliquid, with an entry price of $111,749.According to ChainCatcher, on-chain analyst Yu Jin monitored that whale 0x4044...794c went long on 770 BTC (85.96 million USD) on Hyperliquid today after the market crash, with an opening price of 111,749 USD. His take-profit orders: starting from 120,000 USD, he set a reduction of 7.7 BTC every 200 USD, all the way up to 140,000 USD. If all his orders are filled as expected, he could make a profit of 14.05 million USD.

- 16:12Data: A certain whale/institution has transferred over 15,000 ETH to exchanges in the past two daysAccording to ChainCatcher, on-chain analyst @ai_9684xtpa has monitored that whale/institution 0x395...45500 appears to be selling off large amounts. In the past two days, 15,010 ETH (57.31 million USD) have been transferred to exchanges, and if sold, would yield a profit of 11.87 million USD. This address accumulated 86,000 ETH at an average price of 3,027 USD between June and August 2025, and just 10 minutes ago deposited 3,000 ETH, worth 12.15 million USD, to an exchange. Currently, it still holds 55,981 ETH, approximately 226 million USD.

- 16:12Data: A certain whale used 25x leverage to go long on 18,900 ETH today, currently with an unrealized profit of $5.75 million.ChainCatcher reported that, according to on-chain analyst @ai_9684xtpa, address 0xb9f...6d365 deposited 9.5 million USDC as margin to Hyperliquid today, and subsequently opened a 25x leveraged long position of 18,960.93 ETH, valued at 70.76 million USD, with an entry price of 3,717.76 USD and a liquidation price of 3,282.87 USD. The current unrealized profit is 5.75 million USD.