News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

Ether fights to hold $4.3K as corporate ETH treasury growth, DApp activity provide hope

Cointelegraph·2025/09/03 01:50

![[Long English Thread] From Sony to Toyota, why are they all building their own blockchains?](/news-static/client/media/cover-placeholder.101bcc72032a7c4f0a397f15f3252c92.svg)

[Long English Thread] From Sony to Toyota, why are they all building their own blockchains?

ChainFeeds·2025/09/03 01:32

Understanding New Crypto Trends from WLFI's Sky-High Opening Price

ChainFeeds·2025/09/03 01:32

Crypto treasuries surge as IPO filings accelerate

Billions in bitcoin, ether and token buys collide with major Nasdaq listings

Blockworks·2025/09/03 00:55

3 Altcoins Poised to Benefit from Investor Interest in World Liberty Financial (WLFI)

As WLFI adoption grows, BNB, Chainlink, and Bonk are positioned to capture liquidity, interoperability, and ecosystem growth opportunities.

BeInCrypto·2025/09/03 00:43

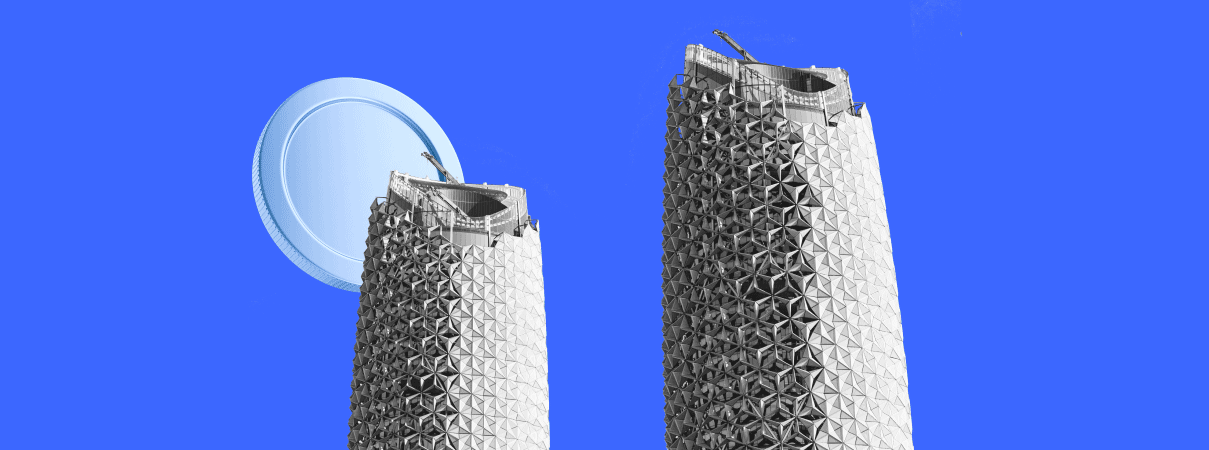

Options to Purchase Real Estate With Crypto Expand in UAE

Coinspaidmedia·2025/09/02 23:20

Wall Street Giants Poised to Offer Spot Bitcoin and Ethereum Trading

A joint SEC-CFTC statement paves the way for Wall Street giants like NYSE and Nasdaq to host spot Bitcoin and Ethereum trading, signaling a new era for US crypto.

BeInCrypto·2025/09/02 23:03

Blue Fox Notes: Understanding dappOS's Intent-Centric Infrastructure

dappOS is a fundamental infrastructure based on a task execution network, enabling the creation of diverse user-centric intent products to enhance the user experience in the crypto space.

蓝狐笔记·2025/09/02 23:02

Flash

- 13:11Glassnode: After bitcoin stabilized, investor panic subsided and funds began flowing into call optionsChainCatcher reports that the latest weekly report from Glassnode points out that the current market conditions are similar to the early stages of the 2022 bear market (also known as the crypto winter). ETF demand continues to weaken, with IBIT experiencing outflows for the sixth consecutive week, marking the longest streak of negative flows since its launch in January 2024. The total redemptions over the past five weeks have exceeded 2.7 billions USD. Derivatives data further confirms the decline in risk appetite. Open interest continues to decrease, indicating a reduced willingness to take on market risk, especially after the flash crash and liquidation event on October 10. Perpetual contract funding rates have remained largely neutral, only briefly turning negative, while the funding premium has also dropped significantly. This suggests a more balanced market environment with reduced speculation. Sentiment in the options market remains cautious, with investors preferring to sell rather than chase upside potential. Earlier this week, as the bitcoin price approached 80,000 USD, put option buying dominated. However, as the price later stabilized, investor panic subsided and capital flowed into call options.

- 12:51Total USDT supply surpasses 190 billions, market capitalization exceeds $185 billions, reaching a new all-time highAccording to a report by Jinse Finance, the latest data from Coingecko shows that the total supply of the US dollar stablecoin USDT, issued by Tether, has surpassed 190 billions, currently reaching 191,099,037,578 tokens (with a circulating supply of 185,632,100,913 tokens), and a market capitalization of $185,680,551,074, setting a new all-time high.

- 12:35Analysis: Ethereum at the $1,800 price range is one of the best accumulation zonesAccording to a report by Jinse Finance, analyst @ali_charts, based on the Ethereum cost basis heatmap analysis, the $1,800 price range for Ethereum appears to be one of the best accumulation zones before the bull market surges toward $10,000.

News