News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | U.S. Shutdown Crisis Averted; Iran Tensions Boost Oil; Gold Rebounds Amid Microsoft Earnings Split (January 30, 2026)2Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power3 Crypto Market Today Turns Red But LTH Data Signals Structural Stability

Franklin Resources: Overview of Fiscal First Quarter Earnings

101 finance·2026/01/30 13:45

Inflation Challenges Persist for Cryptocurrency Markets

Cointurk·2026/01/30 13:42

First Hawaiian: Fourth Quarter Financial Overview

101 finance·2026/01/30 13:30

Exclusive-Australian laser maker EOS heads for Europe as defence demand soars

101 finance·2026/01/30 13:18

Verizon Reports Significant Growth in Subscribers with New CEO at the Helm

101 finance·2026/01/30 13:18

Autoliv (NYSE:ALV) Reports Higher Than Expected Q4 2025 Sales, Yet Shares Decline

101 finance·2026/01/30 13:06

WisdomTree (NYSE:WT) exceeded sales expectations in the fourth quarter of fiscal year 2025

101 finance·2026/01/30 13:06

Flagstar Financial (NYSE:FLG) Q4 CY2025: Robust Revenue Performance

101 finance·2026/01/30 13:06

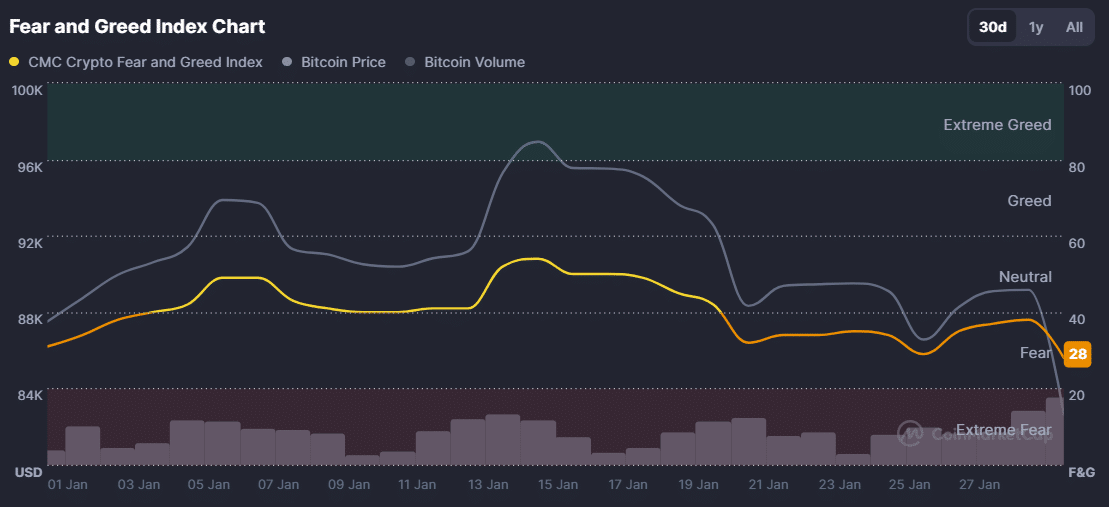

Bitcoin price dips – Is BTC’s $80K bottom too early to call?

AMBCrypto·2026/01/30 13:03

CN: Fourth Quarter Financial Overview

101 finance·2026/01/30 13:03

Flash

15:31

Whale Spends $6.77 Million to Buy the Dip in BTC and HYPECoinWorld News: According to a tweet from Ai Yi, a certain address deposited 6 million USDC into Hyperliquid and placed two buy orders, planning to purchase 73.46 bitcoin when the price drops to the $60,555 to $75,555 range, and to buy 100,000 HYPE when the price falls to the $15 to $20.38 range.

15:26

A whale has placed a buy order above $60,000 to prepare for a market bottom, with an order size of $5 million.BlockBeats News, January 31st, according to on-chain analyst Ai Auntie (@ai_9684xtpa) monitoring, Whale Address 0xd90…2D975 deposited 6 million USDC into Hyperliquid half an hour ago, and then placed a buy order in preparation for buying the dip:

The plan is to buy 73.46 BTC for about $5 million in the $60,555 - $75,555 range.Also planning to buy 100,000 HYPE for about $1.77 million in the $15 - $20.38 range.

15:25

An ETH whale urgently deposited 2 million USDC to Hyperliquid to avoid liquidation.According to Odaily, monitored by Lookonchain, an ETH whale urgently deposited 2 million USDC into Hyperliquid to avoid liquidation. This whale currently holds a position of 20,000 ETH, valued at 50.82 million USD, with a liquidation price of 1,994.24 USD.

News